Navigating Rates

Understanding US convertibles and why they’re attractive today

Over the last 35-plus years, US convertibles have produced equity-like performance but with lower volatility. And thanks to accelerated new issuance at favourable terms, today’s opportunity set has expanded, adding to the appeal of this unique asset class.

Key takeaways

- Convertible securities have offered equity-like return potential with reduced volatility, allowing for gains during market ups and benefiting from protection when markets decline.

- Increasing new issuance at more attractive terms expands the opportunity set of total return convertibles, which offer a compelling asymmetric risk/reward profile.

- We believe active management is key to unlocking opportunities and managing risks in the evolving market environment.

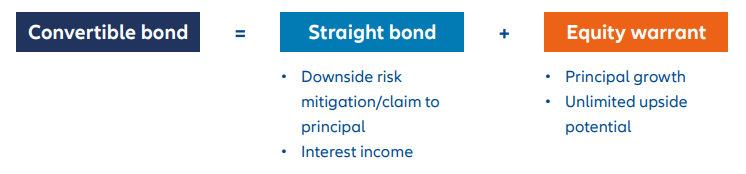

A convertible security is a traditional bond that can be converted or exchanged into a specific number of shares of the issuer’s common stock. Convertibles have characteristics of both bonds and stocks, which can help improve a portfolio’s overall risk-adjusted returns (see Exhibit 1).

The bond component provides income potential and reduced volatility, derived from the stated coupon and maturity and the claim to principal. Like other bonds, a convertible’s value can fluctuate with changes in interest rates and the credit quality of the issuing company. Convertible securities generally have a lower coupon than corporate bonds, but they usually offer a yield advantage over the common stock dividend.

The equity component provides unlimited capital appreciation potential, derived from an option (determined at issuance) that provides the right to convert into a fixed number of common shares. Because of this feature, when convertible securities mature, they can be redeemed at the market value of the underlying common shares or at their face value – whichever is higher.

Exhibit 1: A simplified structure showing the basic components of convertibles

Source: Voya IM. For illustrative purposes only.

How do convertible securities behave?

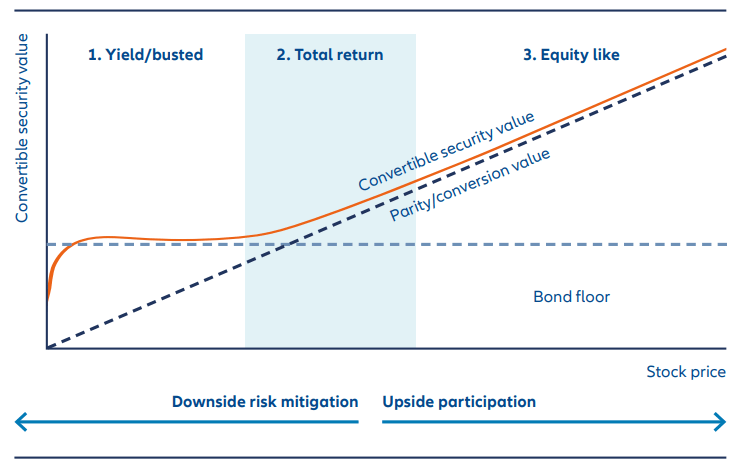

The behaviour of a convertible security may take on either stock-like or bond-like characteristics, depending upon where the underlying stock is trading in relation to the bond’s conversion price. The security tends to become more equity-like as the price of the common shares rises (see Exhibit 2), which means its participation in the stock’s upside may increase. As the underlying stock price falls, the convertible may act more bond-like, which means its participation in the stock’s downside tends to decrease. It is important to note that convertibles are subject to the same risk factors as stocks and bonds, including market, interest rate and credit risks.

Exhibit 2: Three types of convertibles

Source: Voya IM. For illustrative purposes only.

1. Yield/busted

Convertibles in this category are characterised by high yields and high conversion premiums. Given that the equity option is out of the money, these securities behave more like corporate bonds, with little regard given to the option value.

- Behave more like fixed income instruments

- Low correlation to the underlying equity

- Delta below 0.411

2. Total return

Convertibles in this category exhibit ideal qualities, characterised by moderate conversion premiums and some equity sensitivity.

- Provide an asymmetric risk/reward profile

- Capture more of the upside and less of the downside of the underlying equity

- Delta between 0.4 and 0.81

3. Equity like

Convertibles in this category behave like equity investments, characterised by lower conversion premiums and a high degree of equity sensitivity.

- Behave more like equity instruments

- High correlation to the underlying equity

- Delta greater than 0.811

Why consider investing in convertible securities?

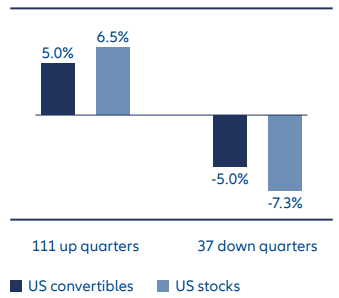

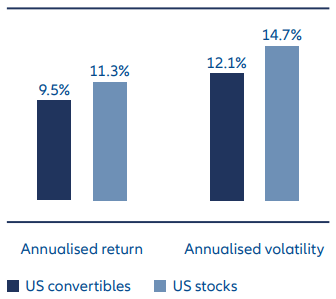

Asymmetric risk/reward

Convertible securities offer an asymmetric risk/reward profile in which the upside opportunity (reward) can exceed the downside capture (risk). Over the last 35 years, which have included multiple periods of elevated volatility, US convertibles have produced equity-like performance but with lower volatility (see Exhibits 3 and 4).

Exhibit 3: US convertibles have captured more of the stock market’s upside than downside

As of 31/12/24. Source: FactSet, ICE Data Services, Voya IM, Morningstar. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favourable. US convertibles: ICE BofA US Convertibles Index. US stocks: S&P 500 Index. See end notes index definitions and additional disclosures.

Exhibit 4: US convertibles have delivered equity-like returns with lower volatility

As of 31/12/24. Source: FactSet, ICE Data Services, Voya IM, Morningstar. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favourable. US convertibles: ICE BofA US Convertibles Index. US stocks: S&P 500 Index. See end notes index definitions and additional disclosures.

Improving new issuance

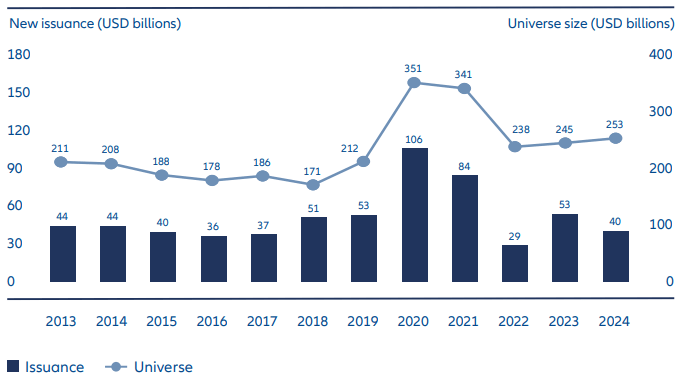

US convertible new issuance not only accelerated in 2024, but exceeded estimates as higher debt financing costs drew issuers to the convertible market for coupon savings (Exhibit 5). Looking ahead, market analysts estimate that new issuance in 2025 should remain steady due to coupon savings demand and elevated refinancing needs, despite increased market volatility.

Due to the rise in interest rates over the last few years, new issuance carries much more attractive terms for convertible security investors. Coupons rose from about 1.5% (record low) in 2021 to about 3.2% through December 2024.

In addition, average initial conversion premiums narrowed from 36% (record high) to about 33% over that same period.2

Increasing new issuance at more attractive terms expands the opportunity set of total return convertibles, which offer a compelling asymmetric risk/reward profile.

Exhibit 5: New US issuance in line with or above pre-Covid levels

As of 31/12/24. Source: Voya IM (using data from ICE Data Indices, LLC). Projections are based on assumptions with respect to future events. The actual future events may differ from the assumptions. Past performance is not indicative of future results. This statement reflects performance and characteristics for the time period shown; results over a different time period may have been more or less favourable.

Terms to know

- Conversion ratio

The number of common shares into which a convertible bond can be exchanged. - Conversion price

Equal to the face value of the bond divided by the conversion ratio. - Conversion premium

The price an investor must pay above the conversion value (number of shares represented in the conversion ratio, multi-plied by the common share price). Typically, the higher the conversion premium, the less equity sensitive the convertible security is; the lower the conversion premium, the more equity sensitive. - Delta

A measure of the convertible security’s price sensitivity to underlying stock price movements. The lower the delta, the less equity sensitive the convertible security is; the higher the delta, the more equity sensitive.

Active managers can take advantage of market opportunities

Passive investment strategies may not find it easy to adjust to changes in the convertible market’s composition, issuer fundamentals or individual issue characteristics, among other factors. In addition, these strategies may not have discretion related to new issuance.

We therefore believe that active management is critical to minimising portfolio risks – such as fundamental/ credit and concentration risks – while adjusting to changing risk/reward profiles (ie, delta, conversion premiums) of individual issues, which are driven by the movement of the underlying equity

To summarise, we think US convertibles have an attractive asymmetric return profile, providing upside participation potential when stock prices rise and downside mitigation when stock prices fall. Accelerated new issuance at favourable terms has expanded the opportunity set of convertible investments with the desired risk/ reward characteristics. We believe active management can help mitigate risks and capture opportunities arising from shifting market dynamics.

A note about risk

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. All security transactions involve substantial risk of loss.

Debt instruments: Debt instruments are subject to greater levels of credit and liquidity risk, may be speculative, and may decline in value due to changes in interest rates or an issuer’s or counterparty’s deterioration or default.

Market volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Price changes may be short or long term. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio’s manager(s) to invest the portfolio’s assets as intended.

Issuer risk: The portfolio will be affected by factors specific to the issuers of securities and other instruments in which the portfolio invests, including actual or perceived changes in the financial condition or business prospects of such issuers.

Interest rate risk: The values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced for securities with longer maturities.

Credit risk: If the issuer of a debt instrument fails to pay interest or principal in a timely manner, or negative perceptions exist in the market of the issuer’s ability to make such payments, the price of the security may decline.

1 BofA Global Research, as of 28/02/25. Deltas below 0.1 indicate distressed debt.

2 FactSet, ICE Data Services, Voya IM, Morningstar, as of 31/12/24.

4706086