Embracing Disruption

India Equity Update

India’s equity markets have experienced significant pressure over the last year. Some has been self-inflicted in an effort to foster a sustainable long-term growth path, while other triggers have come from outside influences, especially tariffs. Though headlines of late have tended to focus on what has gone wrong for India, we see emerging signs of a favourable shift, anchored by governmental reforms, fiscal discipline, and resilient demand. As India enters the second half of FY25 with accelerating reform implementation, a sovereign rating upgrade, and valuations near 15-year relative lows, we believe the underlying story remains characterized by strength, with markets positioned to benefit from steady capex and resilient consumer demand.

GST reform – Simplification with a demand boost

External pressures, particularly US tariff actions, have added urgency to India’s reform momentum. The GST (Good and Services Tax) Council’s September decision to rationalize rates marks a structural simplification, while simultaneously providing a timely consumption boost. On 4 September, the GST Council overhauled and simplified the tax structure from four tiers to two: a 5% merit rate and an 18% standard rate, alongside a 40% demerit rate for selected categories. Effective from 22 September, this change makes over 90% of goods cheaper, just ahead of the annual festive season.

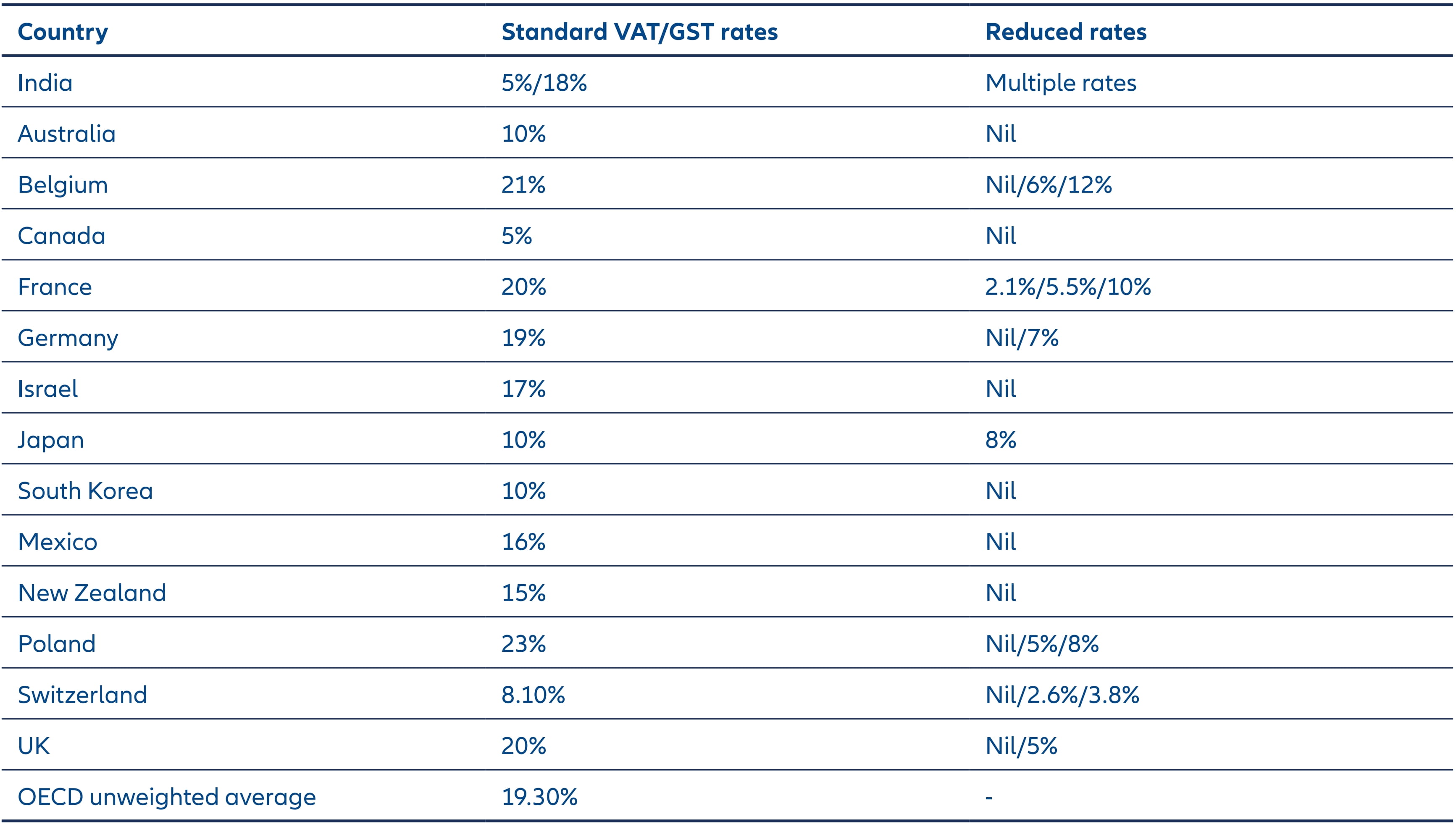

While the primary objective is simplification and modernisation of the tax system, aligned with more global tax regimes (see Table 1), the immediate effect is a consumption uplift. Autos and consumer discretionary segments could see a ~6% price reduction, with a potential multiplier effect on demand. This provides a fiscal stimulus of ~0.4% of GDP, with limited medium-term impact on government finances thanks to buoyant demand and the new rate structure being designed to be broadly revenue neutral relative to the previous tax regime.

This fiscal stimulus complements earlier income-tax reductions and liquidity measures, together representing a meaningful injection into household balance sheets and system liquidity.

Table 1: Global tax rates

Source: OECD Report; Axis Bank Research

US tariffs – A manageable headwind, pushing India to fast track reforms

Following the India–Pakistan ceasefire in May, the relationship between New Delhi and Washington has become more strained. What had been hailed as constructive geopolitical and bilateral trade talks quickly soured, with Russian oil purchases – despite being within sanctions limits and the G7/EU price-cap framework – becoming a flashpoint.

Energy Minister Hardeep Singh Puri has emphasised that India’s purchases remain compliant with sanctions and have helped stabilise global oil markets, preventing prices from spiking toward $200 per barrel. Russia now accounts for roughly 40% of India’s crude imports, while diversification has expanded supply sources from 27 to nearly 40 countries. What’s more, India has also significantly increased its crude oil imports from the US since the start of Donald Trump’s second term, with imports up more than 50% from last year’s level, not counting its growing imports of LNG and LPG products.

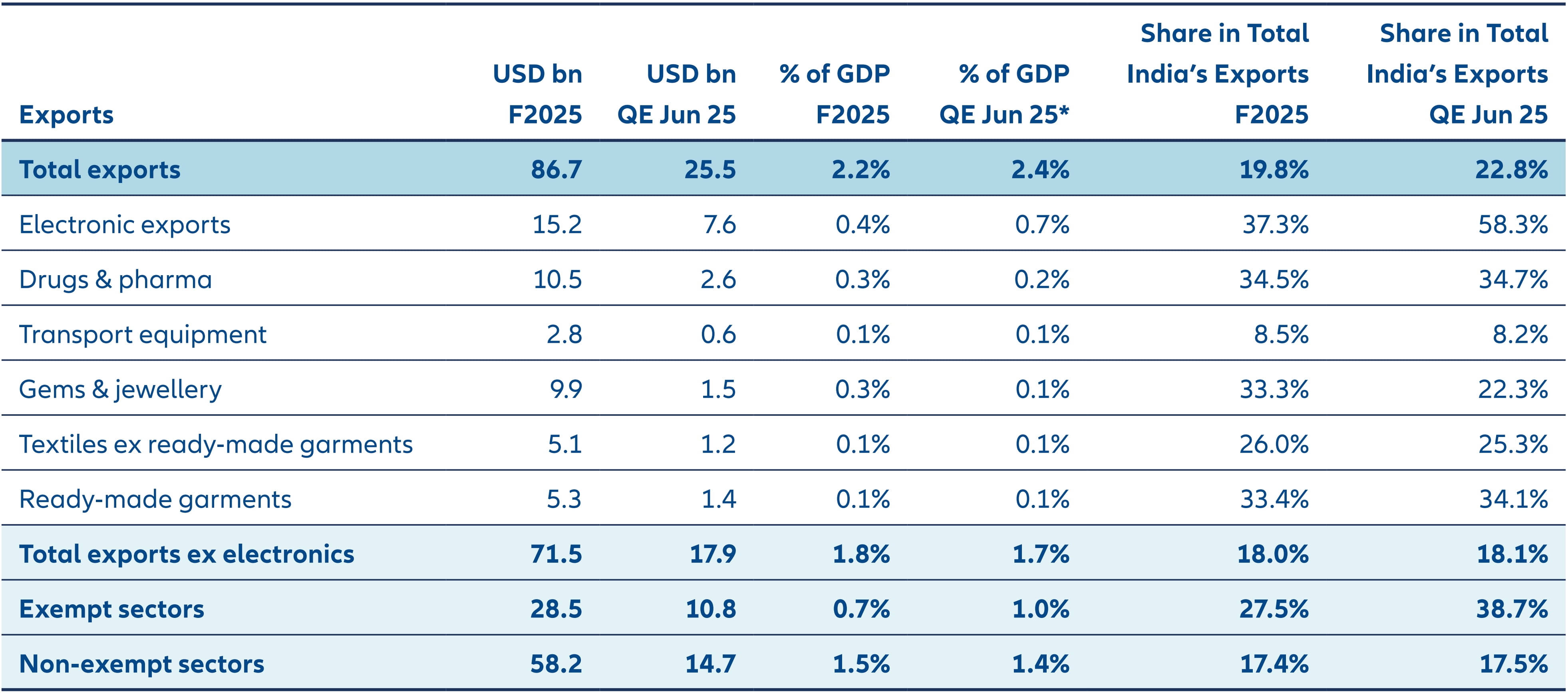

Against this backdrop, the US administration doubled tariffs on Indian exports to 50%, penalizing continued imports from Russia. The measure affects 67% of India’s exports into the US (USD 58bn, ~1.5% of GDP). Our sensitivity analysis suggests a direct growth drag of ~40bps with a similar magnitude of indirect impact. The table below shows the sectoral composition of exports. From an equity market perspective, less than 2% of MSCI India’s weight would be directly exposed to the 50% tariff.

While the risk is not insignificant, we expect the RBI to counter with further monetary easing – potentially two additional 25bps rate cuts – alongside higher government capital spending and an accelerated reform push if downside risks persist. The government has also indicated the possibility of extending credit guarantees to mitigate job losses and rising credit costs in SME sectors such as textiles and jewelry, both among the top Indian export categories to the US that may be affected. Importantly, India’s export diversification strategy and resilient domestic demand should mitigate the longer-term impact.

Table 2: India’s exports to the US

Source: CEIC, CMIE, Morgan Stanley Research. * Note: QE Jun-25 share in GDP is annualised

Further reforms pipeline

Trump-led external pressure has pushed India to fast track its reform agenda. Some of the potential measures outlined by the government include the following:

- Next-Generation Reforms Task Force: A newly announced task force is tasked with identifying structural bottlenecks and proposing reforms in areas such as defense, manufacturing, and technology, aligned with the broader “Viksit Bharat 2047” vision.

- Deregulation Commission: Proposed to review and eliminate redundant regulations, reduce state-level compliance burdens, digitize approvals, and harmonize frameworks with states.

These initiatives may lower entry barriers for businesses, enhance the ease of doing business, attract foreign investment, and accelerate private sector job creation and capital deployment. Together, they strengthen India’s case as a global manufacturing and services hub.

Credit rating upgrade – Structural endorsement

In a milestone development, S&P Global upgraded India’s sovereign rating to BBB from BBB- – its first such move in 18 years. The decision reflects fiscal consolidation discipline and policy stability. While the immediate impact on debt inflows may be limited, the upgrade should bolster investor confidence and lower India’s cost of capital over time.

In our view, the combination of fiscal prudence, improved quality of spending, and inflation being range-bound under the RBI’s flexible targeting framework has materially strengthened India’s macro stability. This rating action validates that trajectory.

GDP – Strong headline, weaker underneath

India’s 1QFY26 GDP grew 7.8% YoY, ahead of consensus. However, much of this outperformance was the result of a historically weak deflator (0.9% YoY, a 23-quarter low), which artificially boosted real growth. On a nominal basis, growth actually slowed to 8.8% from 10.8% in Mar-25.

That said, beneath the statistical distortion there were genuine positives: manufacturing delivered its third straight quarter of improvement (7.7% YoY). Services rose 9.3% YoY, though partly inflated by the deflator issue. Government capex surged 52% YoY, and exports to the U.S. rose 22% YoY, largely front-loaded ahead of tariffs. We see the GDP surprise less as a broad-based acceleration, and more as evidence of supportive policy, capex strength, and resilient demand cushioning external risks to growth.

Valuations – Compelling entry points

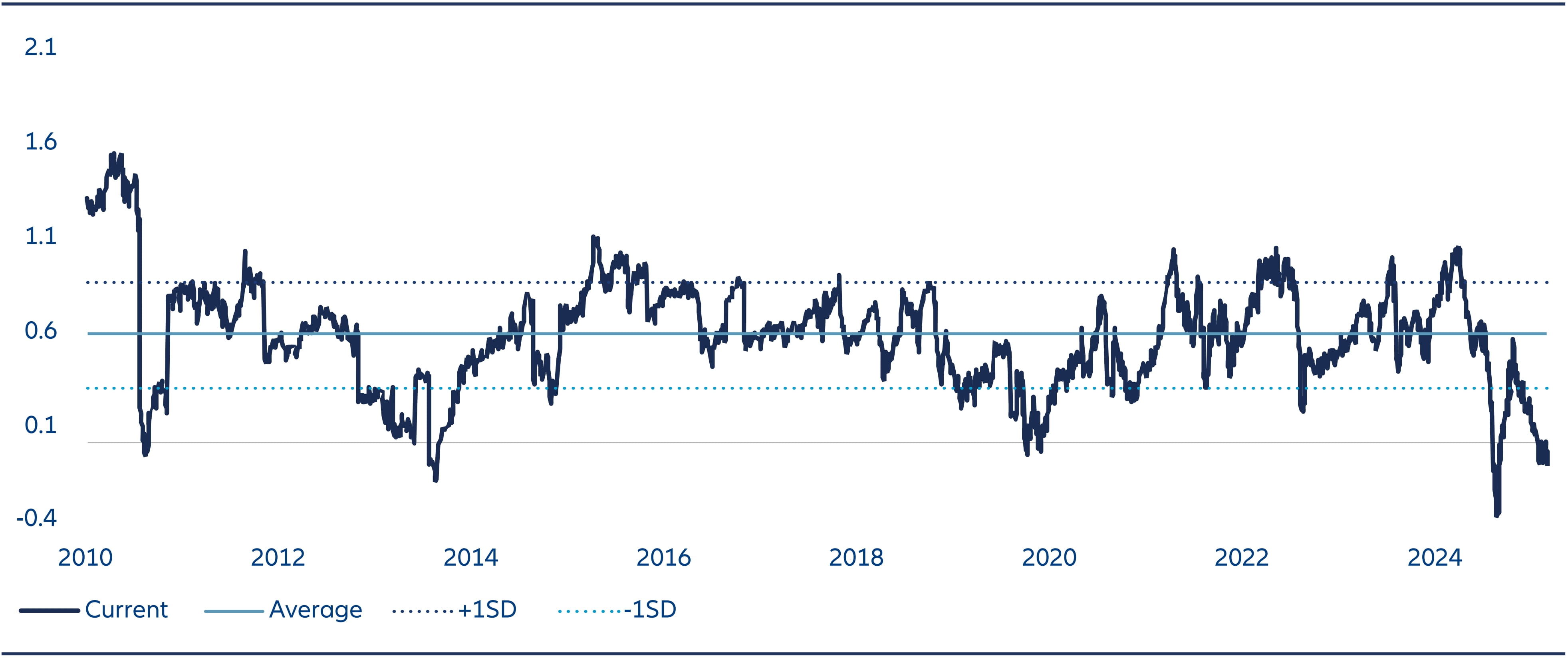

MSCI India’s price-to-book relative to MSCI ACWI is near a 15-year low, almost two standard deviations below its long-term average. After narrowing earlier this year, the gap widened again following the India-Pakistan conflict and recent U.S. tariff escalation.

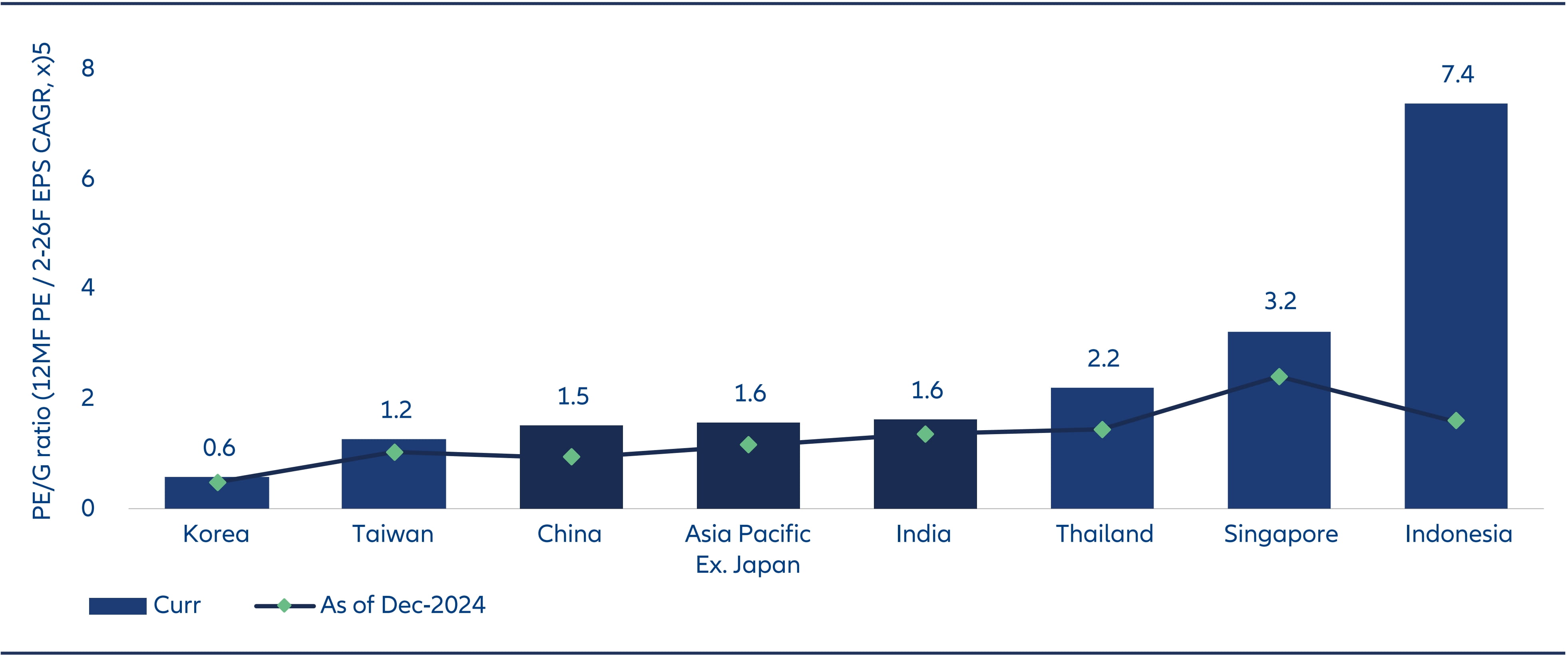

We see both as short-term dislocations. India’s longerterm earnings trajectory remains intact, underpinned by reforms, robust domestic demand, and policy stability. Another way of looking at Indian equity valuations is through the lens of Price-to-Earnings Growth (PEG ratio). India’s PEG is on par with the regional MSCI AC Asia Pacific ex Japan index and almost at the same levels as MSCI China, for comparison.

For long-term investors, this relative discount offers an attractive entry point into India’s exciting structural growth story.

Exhibit 1: MSCI India – P/B ratio relative to World P/B

Source: Bloomberg, Allianz Global Investors, as of 31 August 2025. The average valuation is calculated over the period of past 15 years, or since data became available.

Exhibit 2: MSCI Indices – India’s PE/G now close to APxJ/China

Source: Jeffries, Allianz Global Investors, as of 9 September 2025

4868919