Interpreting China

Why “Made in China” will be the new “Made in Germany”

The meaning of “Made in China” will come to mean leadership in terms of quality and innovation.

Key takeaways

- As China’s economy matures, its focus is moving towards becoming a leader in sectors that will be crucial to global development in the coming decades. We believe that the meaning of “Made in China” will come to mean leadership in terms of quality and innovation.

- China is seeking to establish itself as a tech superpower to rival the US. This will benefit domestic companies as they receive policy support and move up the value chain.

- Electric vehicles, renewable energy, information technology, and healthcare are some of the sectors that will be watched keenly.

The merchandising mark “Made in Germany” was originally introduced in Britain in the late 19th century, to denote what were then considered to be inferior goods compared to those produced domestically in the UK. Of course, Made in Germany now stands for something very different, and the trajectory taken by this designation is now being echoed by “Made in China”. Once a signifier of cheap mass production, Made in China is set to take on a new meaning as the Asian powerhouse moves beyond rapid industrialization and becomes an innovator and leader across several key sectors, inclu ding in cutting-edge tech.

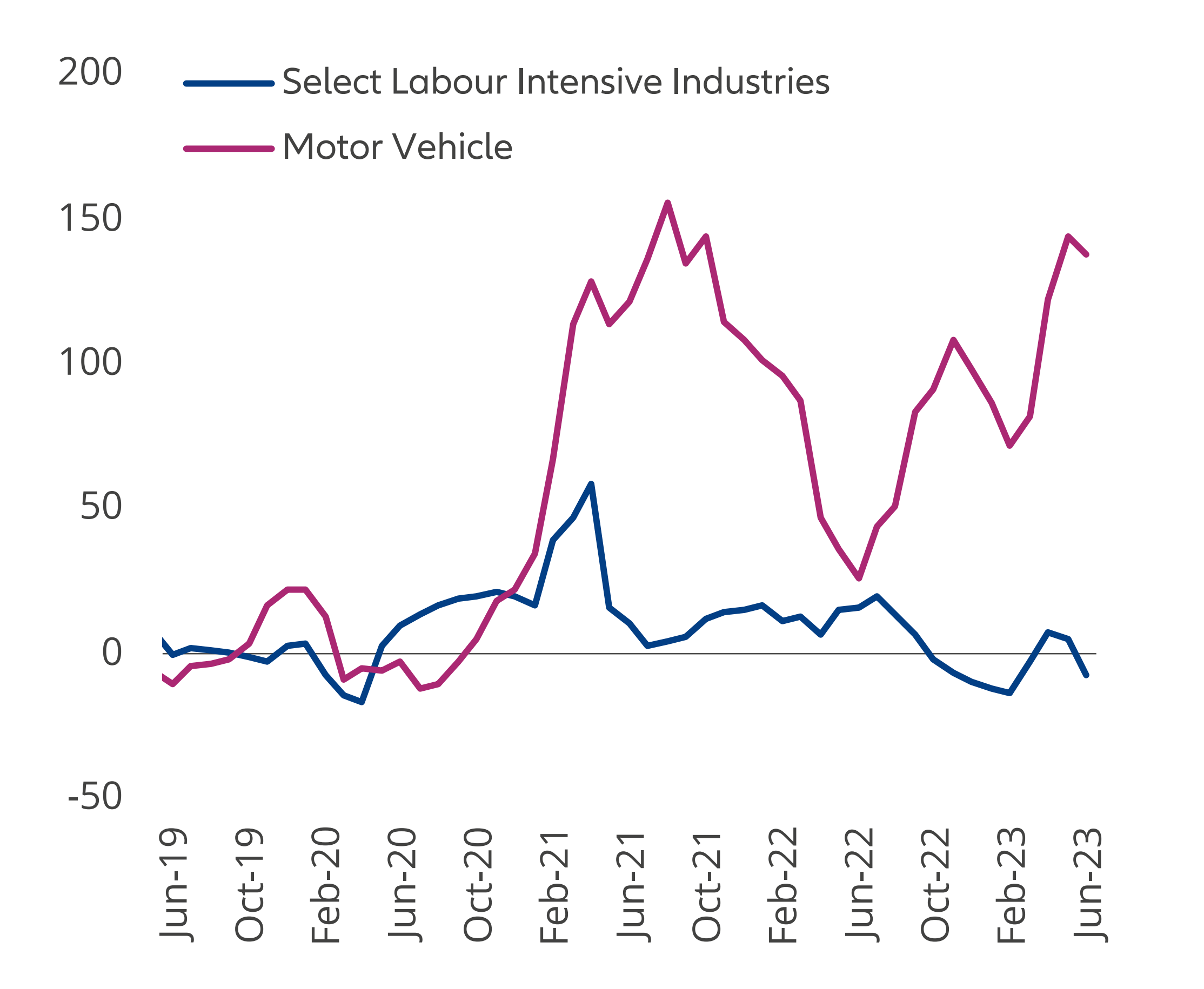

While the Chinese economy is now rebounding from the effects of its zero-covid policies, its recovery has been slower than some expected. Indeed, the 2023 growth target of 5%, set by Beijing, is modest by recent Chinese standard. Yet the headline figures do not tell the whole story; while the overall economy may be showing some sluggishness, there is still impressive growth to be found in several sectors. For instance, China recently overtook Japan as the world’s largest exporter of cars, largely thanks to its leading position in EVs (electric vehicles). And the trajectory of motor vehicle exports compared to more labour-intensive industries, as shown in the chart below, speaks of the changes the Chinese economy is currently undergoing.

Exhibit 1: Export growth by product Export YoY% 3MMA

Source: General Administration of Customs, Morgan Stanley Research

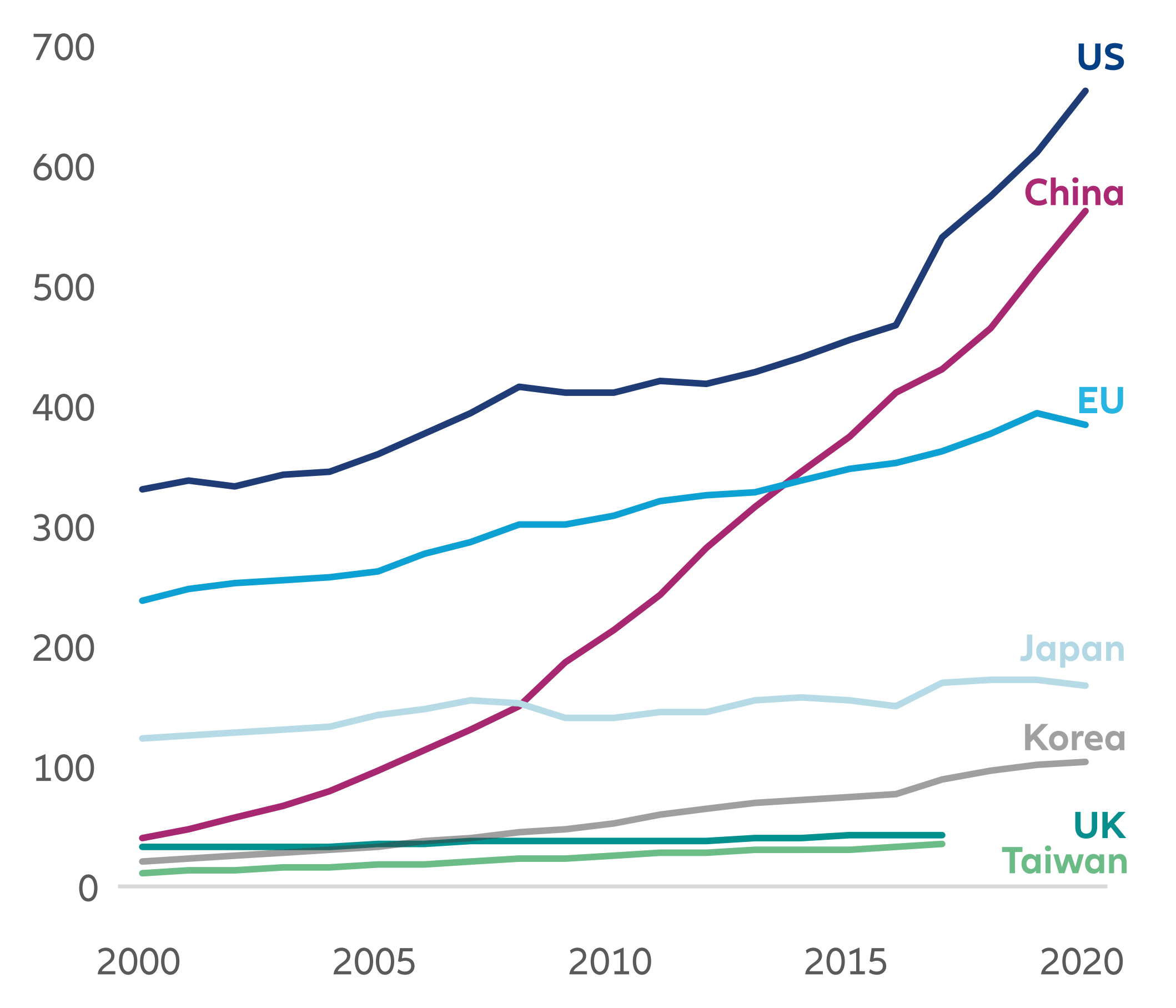

Exhibit 2: Global R&D expenditure and growth (USD thousand)

OECD Data – https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm; as of 9 April 2019.

So, despite some headwinds, there are still bright spots within the Chinese economy. Indeed, the kind of GDP (gross domestic product) growth seen during China’s rapid shift away from a predominantly agrarian economy is likely to be a thing of the past, and growth rates going forward are expected to be more in line with those we are used to from more developed market economies. However, we believe that the focus will move to those areas where China is beginning to show that it can lead in terms of innovation and developing globally marketleading products.

It is these industries that, in our view, are China’s future, and its government and regulators are moving to support this new direction for the domestic economy. For instance, the “China Standards 2035” project forms part of China’s “new formula” for taking the lead across a range of tech sectors. The goal of this project is for China to play a central role in setting global technical standards for the next generation of tech. In terms of education, China has been producing more STEM (science, technology, engineering, mathematics) doctorates than the US since the mid-2000s and is set to see nearly double the number per year by 2025.1 These developments are indicative of the country’s current ambition to move beyond a source of cheap manufacturing to setting the agenda and leading innovation across several areas that will be vital to global growth and prosperity in the coming decades.

Key sectors

Green tech

Green technology – including electric vehicles (EVs) and renewable energy – is one area where Chinese corporates are rivaling their western counterparts.

With respect to EVs, 64% of global new energy vehicle production occurred in China in 2022, while the country also accounted for 59% of global sales of these vehicles.2 And it’s not just about original equipment manufacturers – China also globally dominates large parts of the automotive supply chain. For instance, with respect to batteries – the largest cost component of an EV – China has a dominant share in the market, producing around three quarters of all lithium-ion cells, and possesses between 70 to 85% of the global production capacities for anodes and cathodes.3

Indeed, China’s impressive advancement in EVs is due to both an established competitive edge in the lithium-ion battery market and supportive government policies such as EV subsidies first introduced in 2009. Furthermore, it is China’s flexibility and supply efficiency has enabled it to quickly capitalize on developing trends such as this – for instance, it typically takes around a third of the time to build a factory in China than it does overseas.

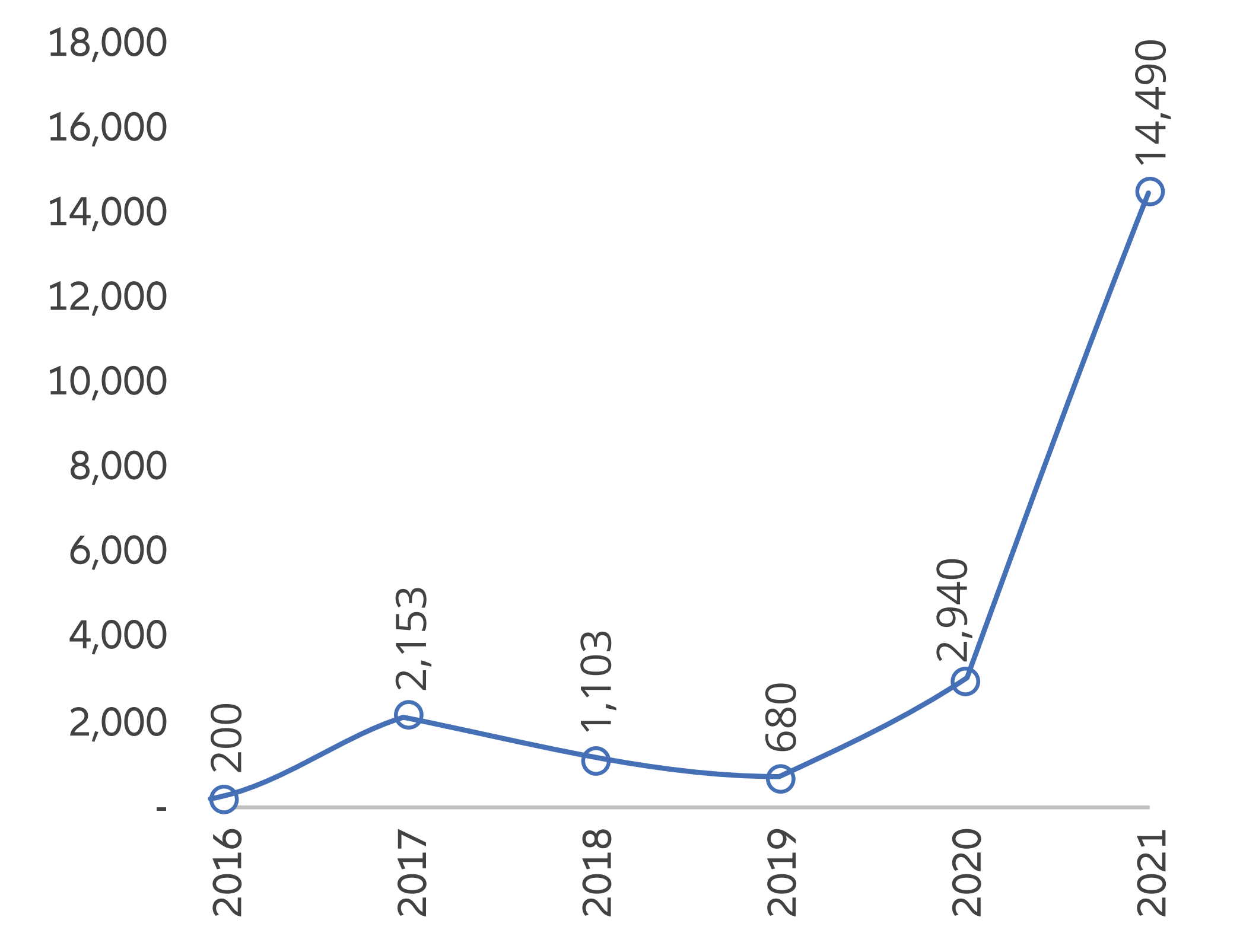

Exhibit 3: Strategic industries drive unicorn growth

Source: Bloomberg, data as of 14 March each year

It is a similar story with respect to renewable energy. China already enjoys more solar capacity than the rest of the world combined and is set to double both wind and solar output by 2025, reaching its 2030 target five years early.4 The growing installation of renewables is pushing the development of new technologies and better infrastructure. Indeed, for some time China has been upgrading and optimizing its power grid to accommodate the less stable nature of renewable energy sources. On example here is the development of what are known as “virtual power plants” (VPPs). VPPs use software and telecommunications to integrate distributed and disparate power sources, and China has already established two in Shanghai and Jiangsu provinces, while the Jiangsu example is considered the world’s largest VPP. The advantages include real time control of interruptible power loads that ensure a balance between supply and demand, meaning manufacturing corporates, and others, can operate at full capacity with peace of mind.

Hardware, software and AI

Another field where China continues to make strides is in the hardware sector – an area that, of course, receives a great deal of attention due to geopolitical issues around semiconductor production. While a somewhat anecdotal measure, we can see the relative development of this area by looking at the number of “unicorns” – non-listed companies with a valuation of over one billion USD.

We can see that the tech hardware and semiconductors sector number grew over sevenfold during the same period. And as the use of AI (artificial intelligence) begins to proliferate across a growing number of non-tech industries, we believe that China’s hardware sector will benefit from the hardware and semiconductor upgrade cycle to meet the needs for higher bandwidth and faster data processing.

Much like with hardware, geopolitical and trade tension has led China to seek self-sufficiency in software – this is why we have seen domestic software companies gaining market share from foreign players in recent years. These Chinese software companies now offer leading solutions for a wide range of sectors that need to be digitalized. Examples include financial services news and data, project management and cost estimation in construction, cybersecurity and so on. China’s current spending on software is around US$40 per employee, only 2% of that in the US, indicating the growth potential of this sector.

AI is a broad theme that will impact many industries outside of what is traditionally considered tech, and China thus recognizes how crucial it is to build out its own capacities in this respect. For instance, while in 2016 only 19% of AI-related unicorns were Chinese, this figure rose to 51% in 2022 (with the US dropping from 81% to 41% during the same period). China’s nascent leadership here is also underlined by its contribution to academic research in this area: in 2021, Chinese researchers accounted for nearly 40% of all academic journal publications pertaining to AI. And China has already launched its own ChatGPT equivalent – Ernie Bot by Baidu – which, despite some limitations, is already able to outperform its western peer in several areas.5

Healthcare

China’s domestic healthcare industry is another sector that will likely continue showing impressive growth. Healthcare spending in China is currently relatively low but is growing very fast – something that is unlikely to abate due to China’s rapidly ageing population.

As a result of strong commitment to innovation, Chinese corporates are beginning to become leaders rather than a source of cheap generic products. There are a growing number of Chinese biotech companies licensing patents, not just to emerging market economies, but also to established global giants in the field. Such deals are a strong indicator of the growing quality of local products and the emerging strength of this sector in China.

Exhibit 4: China pharmaceutical companies – licensing out deal size (USD, mn)

Source: PharmaGO database as at December 2022. The information above is provided for illustrative purposes only. It should not be considered a recommendation

This brief overview of industries where China is showing nascent leadership is, of course, certainly not exhaustive, but it gives an idea of how the meaning and perception of Made in China is set to change. As with Germany, Japan, and South Korea before it, China is making the leap from a low-cost manufacturer, to one whose name symbolic of quality and technological leadership.

However, we believe the rise of China into a modern, innovation-led economy will change the landscape in a way that the development of Japan, Korea, and others, did not. China’s tech leadership and desire to establish itself as an economic power to rival the US – plus its growing role in setting global tech standards – means that we are likely to see the growth of two rival tech superpowers using different ecosystems. Learning to navigate this new and changing landscape should be a key priority for investors.

1 https://cset.georgetown.edu/publication/china-is-fast-outpacing-u-s-stem-phd-growth/

2 https://thechinaproject.com/2023/05/18/chinas-top-15-electric-vehicle-companies

3 https://www.iea.org/reports/global-supply-chains-of-ev-batteries

4 https://www.bloomberg.com/news/articles/2023-06-28/china-s-solar-wind-build-to-crush-target-global-energy-monitor

5 https://www.cnbc.com/2023/06/27/baidu-claims-its-ernie-bot-beats-openais-chatgpt-on-key-ai-tests.html

3055550