Transforming Infrastructure

Five key themes for the decarbonization of infrastructure portfolios

Strategies for decarbonizing infrastructure portfolios, emphasizing renewable energy, ESG integration, and private market investment opportunities.

Transitioning our economy to greenhouse gas neutrality represents an enormous challenge for society, companies, and investors. Massive investments in production technologies and infrastructure are required. Experts estimate that the global energy transition will need between USD 150 trillion1 and USD 275 trillion by 2050.2 By uniting investors in industry initiatives, capital is mobilized to promote decarbonization and the energy transition. According to a McKinsey Survey3, a significant portion of Limited Partners (LP) plan to increase their allocations to infrastructure strategies, with 46% indicating a desire to do so in 2026. And investors have a clear view about sustainability. 85% of the LPs asked for a report by BCG on the evolution of sustainability in private markets4 answered that they would plan to further strengthen their ESG focus in the next three years, 98% of the respondents would even quit the relationship with their GP (General Partner) if they see a lack of ESG commitment.

Infrastructure is one of the areas for investors to focus on as it comes with one of the highest decarbonization potentials whilst requiring substantial capital investment. As a result, we believe there will be opportunities for institutional investors to contribute to the transition, decarbonize their portfolios while participating in value creation and return potential.

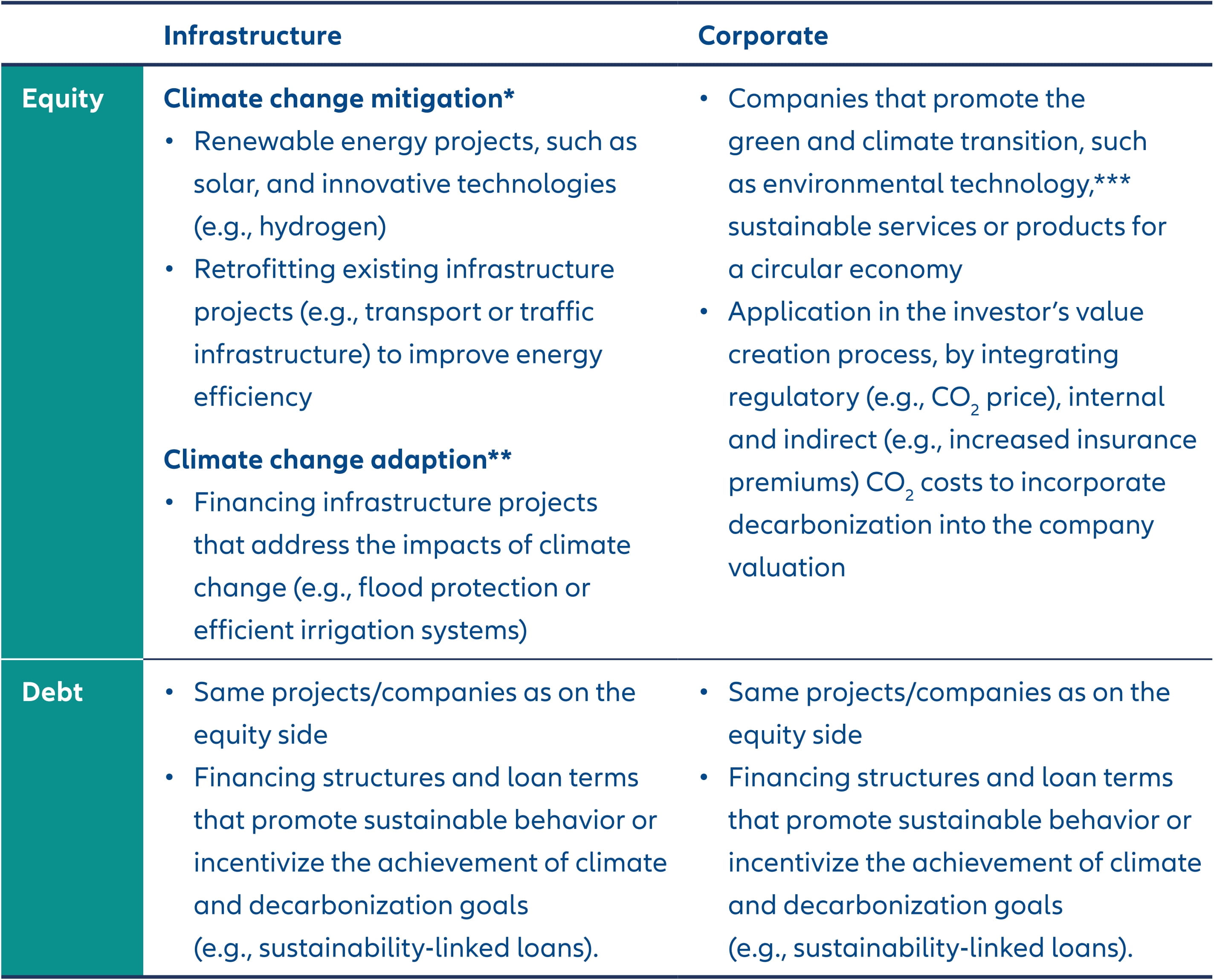

Private markets investors have various options for driving the decarbonization of the economy, providing the capital for the energy transition, and benefiting economically.

Five key questions for implementing a portfolio decarbonization strategy

To approach the topic of climate conscious and sustainable investing in private markets, investors can be guided by several key questions. Different phases, from goal setting to implementation and reporting, must be considered. Infrastructure is probably one of the asset classes with the broadest and deepest influence through its investment sectors.5 The following five questions can help infrastructure investors to find the right levers for their portfolios and help guide them in the discussions with partners:

1. Sustainability policy

How do I set priorities and achievable targets? Which (interim) targets should be achieved when and how? Which frameworks are available for decarbonizing my infrastructure portfolio? Which ones are suitable for my requirements?

Numerous frameworks and standards guide investors in sustainability strategies. Associations like the Net Zero Asset Owner Alliance (NZAOA) and the Institutional Investors Group on Climate Change (IIGCC) provide guidelines for achieving greenhouse gas neutrality by 2050. Additionally, the IIGCC’s Net Zero Investment Framework offers specific instructions for various investments, while the EU’s Sustainable Finance Taxonomy serves as a guideline to define sustainable economic activities.

There is an abundance of frameworks and guidelines, and it is not necessary for investors to know them all in detail. Instead, they should focus on the standards and guidelines that suit them and their strategy. Portfolio managers should take into account the individual targets of each of its investments; some investments may be high GHG emitters and therefore should set higher decarbonisation targets, whereas low emitters will find it harder to decarbonise at the same rate as they may have already met targets or be operating in low emitting sectors. In cross referencing the resulting consolidated target of the portfolio, the portfolio manager can be more assured that overall targets can be met.

The focus here is on fulfilling all mandatory requirements and keeping an eye on the further development of the regulatory landscape while, ideally, actively helping to drive it forward.

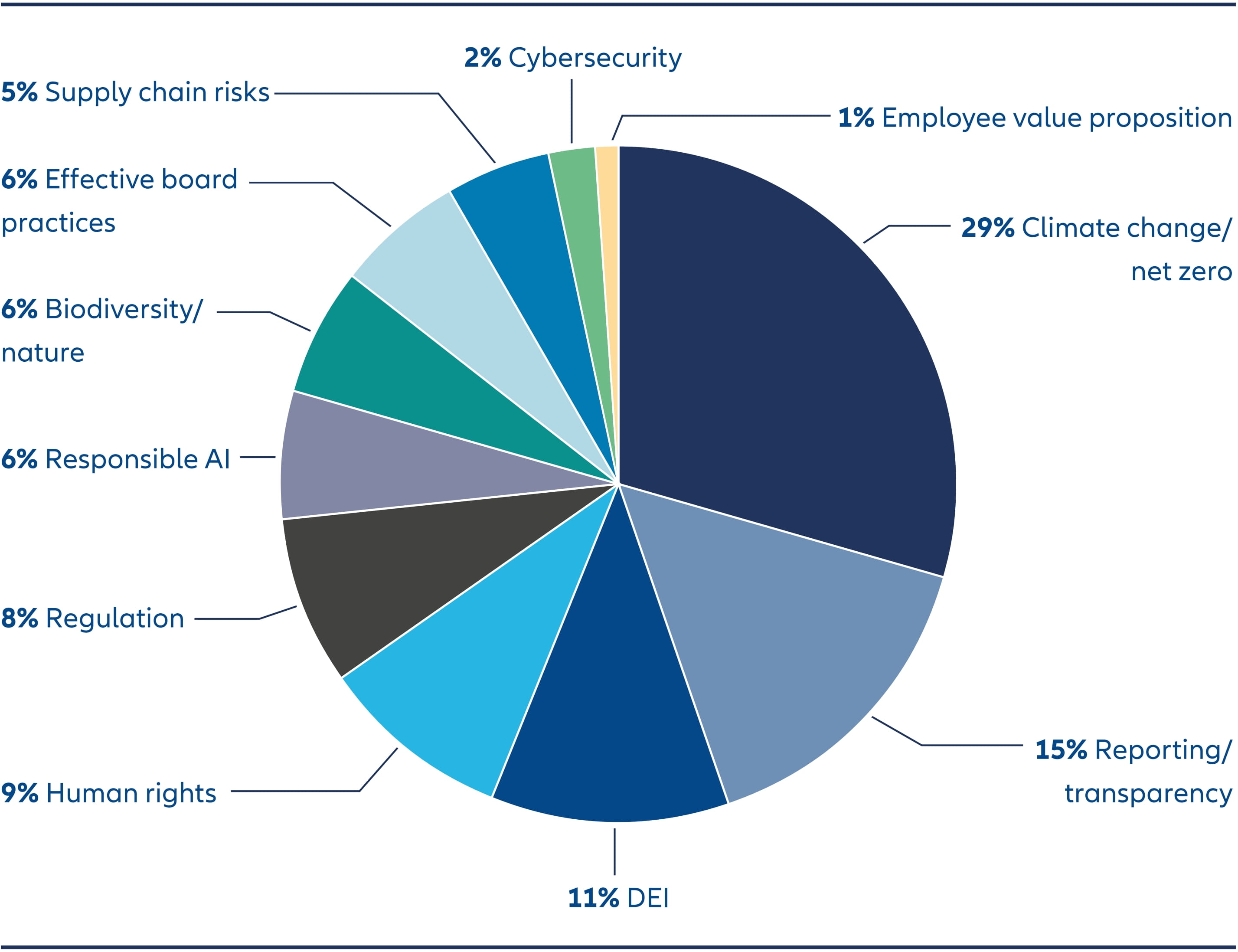

LPs see Climate Change/ Net Zero as the most prevalent topic, which gives portfolio managers the opportunity to meet this demand with the right decarbonisation or net zero investment strategies.

Figure 1: Exemplary overview of potential climate investments

* Climate change mitigation: To mitigate the effects of climate change by preventing or reducing the emission of greenhouse gases (GHG) into the atmosphere.

** Climate change adaption: To anticipate the negative impacts of climate change and to take appropriate measures to prevent or minimise the damage caused by it or to take advantage of opportunities that arise.

*** Environmental technology: The term environmental technology or “GreenTech“ refers to technologies, solutions and services that implement and promote environmental, resource and climate protection (for example, air pollution control or wastewater treatment.

Source: Allianz Global Investors, 2024

2. Integration

How can I integrate my CO2 reduction targets across the entire private markets portfolio? What criteria do I use? Which methodology shall be adopted?

In addition to the decarbonization of processes, infrastructure investors can not only support the decarbonization through investing in renewables but also drive investments in dedicated climate solutions, such as technologies that contribute to energy efficiency, climate adaptation or by financing the transition of companies.

Both the reduction of CO2 emissions through investments and the focus on climate solutions are often only possible to a limited extent with listed investments (such as stocks and bonds), meaning that institutional investors often have higher leverage to achieve their decarbonization goals when investing in either private equity and/or private debt.

Figure 2: Climate change/net zero is most prevalent sustainability topic for LPs

Source: Sustainability in Private Equity, 2024 | October 2024, BCG

3. Implementation

At what points in the investment process can I integrate my targets? What impact do my sustainability targets have on my sourcing and asset management? Which negotiating partners do I involve in the decision-making process and how?

Due diligence is key for every investment. Investors who provide capital in the form of equity can directly influence the direction of business strategies and thus push investee companies for CO2 reduction targets. During the holding period of the investment, investors can monitor progress and take corrective action if necessary. This is relevant for infrastructure investors who often have a long-term investment horizon that can span for decades. Therefore, fund investors should engage their fund managers to incorporate their own decarbonization ambitions. Although lenders have less direct influence than equity providers, they still have several options for exerting their influence. In particular, large and financially strong lenders are often in a powerful position to attach conditions to their financing dependent on sustainability conditions (such as the reduction of the creditor’s carbon intensity, energy or water efficiency).

For indirect strategies an example of an assessment tool is the ILPA ESG Assessment Framework6, which consists of six categories and allows the sustainability quality to be classified into four levels (Not present, Developing, Intermediate, Advanced). During both the due diligence process and the ongoing monitoring of investments, it is assessed whether sustainability risks, such as reputational or environmental risks, could negatively impact the investment.

4. Data

How do I deal with data gaps or different standards in different regions? On what basis do I make assumptions and develop them further with the aim of creating a uniform database? Which sector and industry standards can be used to expand the data situation?

From due diligence to reporting – every step relies on data. Despite an increase of disclosure requirements, such as the European Union’s Corporate Sustainability Reporting Directive (CSRD), investors face hurdles due to the lack of meaningful, quantitative, comparable, and material sustainability data. These factors combined with inconsistent standards for calculating principal adverse indicator data (such as greenhouse gas emissions), operational complexities, limited resources, and numerous evolving frameworks lead to challenges when illustrating and comparing progress.

Only 12% of the respondents in an institutional survey by FAZ Business Media in 2024 stated that the availability of data regarding ESG and sustainability had reached a good level.7 That said, there are frameworks to calculate data, such as PCAF (Partnership for carbon accounting financials) and experts to estimate data where it is not available.

Before implementation, investors need to establish a baseline for their decarbonization goals, such as the portfolio’s carbon footprint. Engaging in dialogue and encouraging better reporting practices is essential. Even if the data quality and availability has significantly improved in the last few years, further refinement will require more scrutiny and effort.

5. Reporting

How do I consolidate nonstandardized evaluations for meaningful reporting? What targets do I use to measure the change in reporting? Are there sanctions and how are they structured?

Reporting can be a powerful tool for monitoring and ensuring the progress towards sustainability goals and the ways in which they are achieved. Through close discussions with their fund managers and partners, institutional investors can monitor and support this progress and accelerate the implementation of necessary steps.

Many infrastructure assets such as utilities or other companies from the energy sector can usually track their emissions and therefore record the results of their decarbonization efforts. Direct equity investors are in a good position to voice their expectations and influence, and track progress made. In addition, debt infrastructure investors could leverage more on reporting in case they have implemented certain conditions in their lending agreements which can make an impact in the green transition of companies.

The challenge investors face when looking at diversified (infrastructure) portfolios with different instruments (debt/ equity), avenues (fund investments, direct investments, or secondaries) and vintages is the consolidated reporting of carbon emissions data at the portfolio level. Standardized carbon emissions metrics e.g., carbon emissions scaled by EVIC (Enterprise Value including Cash) of the investment, reporting forms on investment level (e.g., European ESG Template) and the application of proxies for data gaps are potential ways to address this challenge. Furthermore, reporting requirements can be included in legal documents of the investment and violations of these requirements can be penalized (e.g., sustainability-linked loans).

Summary

Despite most recent developments and the economic environment, the efforts to support the energy transition and decarbonization path remain key for many companies and investors.

The energy transition and digitization lead to a massive demand for infrastructure investments, in particular in the energy, communications, and transportation sectors. This demand comes with a lot of power for investors to voice their expectations for strong sustainability performance. Be it on the equity or debt side, institutional investors have multiple ways and means to further drive the decarbonization of their portfolios and increase their influence on this development – from implementation & due diligence to monitoring & reporting. In addition to institutional investors, smaller investors now also have the opportunity to allocate assets to private markets, like infrastructure.

Following a recent regulatory update, individual clients in Europe can invest in private markets assets under the ELTIF (2.0) (European Long-Term Investment Fund) structure. It provides access to illiquid investments for a broad range of investors. ELTIFs can, for example, hold stakes in Energy Transition Infrastructure Funds and co-invest in Renewable Energy projects. Hence, the energy transition and decarbonization efforts can be supported by investors other than institutions and professional investors, while potentially offering an attractive risk-return profile and diversification to listed Equity and Fixed Income markets.

1 Source: World Energy Transitions Outlook 2023: 1.5°C Pathway

2 Source: The net-zero transition: Its cost and benefits | Sustainability, McKinsey & Company

3 Source: Global Private Markets Report 2025 | McKinsey LP Survey, McKinsey

4 Source: The Evolution of Sustainability in the Private Market, BCG

5 Although there are opportunities in private equity and private credit to help finance energy transition solutions such as climate tech.

6 ESG assessment framework 2024, ILPA

7 Source: dpn-Investorenbefragung 2024 – Trends im Asset Management, dpn

4651823