Achieving Sustainability

What is the Net Zero Alignment Share and how does it help to manage climate transition strategies?

In our article, Climate impact to climate transition, we explored how climate transition investing extends beyond simply investing in renewable energy or low-carbon emitters. Equally crucial is actively supporting companies in their decarbonisation efforts. This process demands a structured and objective assessment. Our proprietary Net Zero Alignment Share classifies companies according to their preparedness to reach net zero by the middle of this century. It is a strong indicator of a company’s ability to reduce future carbon dioxide-equivalent (CO2e) emissions.

Key takeaways

- The Net Zero Alignment Share is based on companies’ emissions disclosures, targets and performance, according to market-leading datasets.

- Companies that are aligning to a net zero pathway, or have a commitment to do so, have lowered their carbon intensity by more than companies without a commitment, according to our analysis.

- In a portfolio context, this metric allows investors to allocate capital not only to low emitters but to companies across all sectors making tangible progress on a pathway to net zero.

Net zero requires an economic transformation across all industries and sectors, implying both risks and opportunities. As part of our sustainability ambitions, AllianzGI seeks to influence investee companies to plan for net zero through risk mitigation and adaptation. We also aim to encourage capital to flow towards the significant, growing set of climate investing opportunities.

To allocate this capital effectively we have developed a proprietary analytic tool: the Net Zero Alignment Share, based on the Net Zero Investment Framework 1.0 from the Institutional Investors Group on Climate Change. This tool allows us to strengthen our conviction on transition finance by classifying companies based on net zero preparedness.

Methodology of the Net Zero Alignment Share

Each company is assessed on six criteria using datasets from the Science-Based Targets initiative, the Transition Pathway Initiative and the Carbon Disclosure Project. The criteria include emissions disclosures, short and medium-term emissions reduction targets and emissions performance. Companies in high-impact sectors have stricter fulfilment requirements to reach the same category. Each company is then classified into one of five categories:

- Achieving net zero

- Aligned to net zero

- Aligning to net zero

- Committed to aligning to net zero

- Not aligned to net zero

Companies classified under categories 1-3 make up the Net Zero Alignment Share.

The Net Zero Alignment Share offers the opportunity for fund managers to allocate and overweight assets towards companies with an enhanced transition profile to meet carbon reduction objectives over the long term, while staying diversified in each sector.

The Net Zero Alignment Share in action

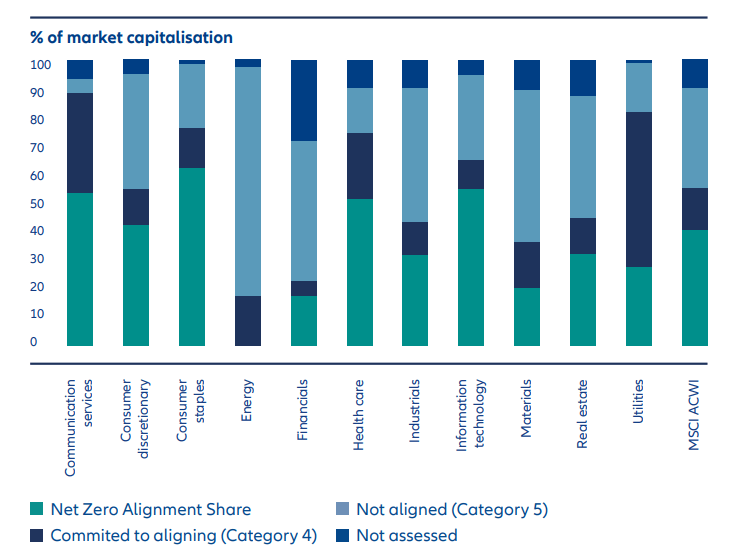

To demonstrate how the Net Zero Alignment Share works, we analysed the MSCI ACWI index – a universe that covers about 85% of the global investable equity set (see Exhibit 1). We selected companies that reported their emissions at least twice in the five-year period from 2019 to 2024.

Exhibit 1: Breakdown of the MSCI ACWI index by Net Zero Alignment Share

Except for Energy, there are companies with Net Zero Alignment Share in every sector.

Source: MSCI ESG, AllianzGI. Data as at December 2024

We then calculated each company’s carbon intensity per million USD of sales, which is a way to measure emissions relative to a company’s turnover, allowing for an easier comparison between companies of different size.1

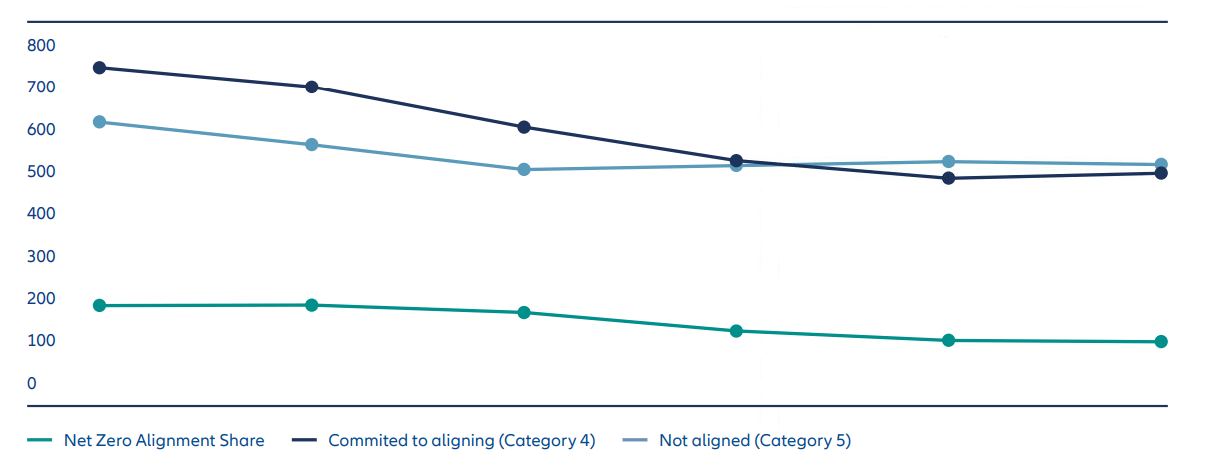

Our findings indicate that, overall, the universe achieved an 23.8% reduction in intensity from 2019 to 2024, with every company weighted equally. But, when broken down by net zero commitment, the results are instructive (see Exhibit 2).

Exhibit 2: Comparative reduction of emissions intensity

Companies’ average carbon intensity (scope 1 and 2) per million USD of sales

Source: MSCI ESG, AllianzGI.

- Progress: companies classified as not aligned to net zero (category 5) managed a 16.2% reduction in the period, while those that had committed to aligning (category 4) achieved a reduction of 33.5%. Companies aligning to net zero (category 3), however, scored a 46.2% reduction on average, while also having the lowest carbon intensities. Theirs was a carbon intensity reduction almost three times higher than their non-aligned counterparts.

- Pathway: companies committed to aligning (category 4) achieved a steeper pathway in reducing emissions their non-aligned counterparts (category 5). Although category 4 companies started with a higher level of emissions intensity, they reduced it to below the level of non-aligned companies after 2022. These results highlight that companies that are committed to aligning to net zero are actively taking steps to fulfil their net zero commitments, which in turn positively impacts the reduction of their carbon intensity.

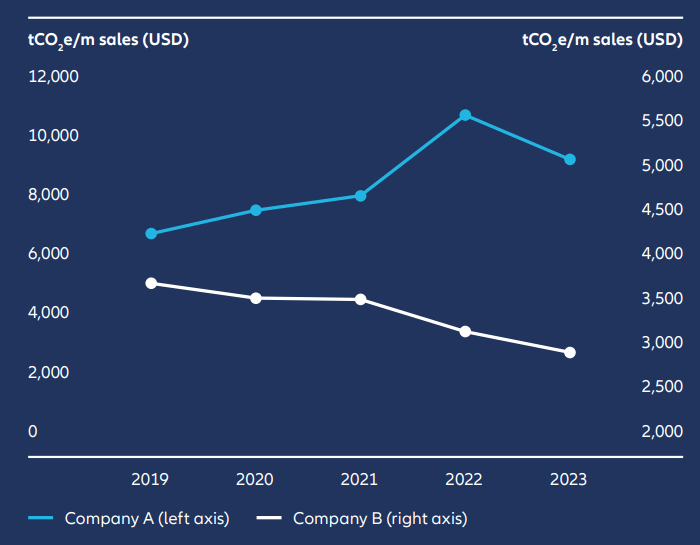

How the Net Zero Alignment Share reflects emissions

Source: MSCI ESG, AllianzGI.

To get a more focused view, we looked at two companies in the same sector. Company A is a cement manufacturer that is not aligned to net zero (category 5). Company B, also in the business of building materials, is categorised as aligning to net zero (category 3).

Company A has shown variation in emissions intensity. Despite falling between 2023 and 2024, the emissions intensity of this company increased over the five-year period by 37%.

In contrast, company B achieved progressive declines in emissions intensity across the period, resulting in an impressive 21% reduction. The company’s commitment to reducing its carbon footprint underscores the broader trend that net zero-aligned organisations tend to demonstrate more pronounced reductions in emissions intensity over time.

Lighting the path to a net zero future

In 2023, AllianzGI introduced an investment approach based on key performance indicators (KPIs), allowing portfolios to be managed, monitored and reported in line with specific sustainability metrics. Greenhouse gas intensity has been a popular KPI with our clients and can help support the transition to a net zero future. We are now pleased to offer the Net Zero Alignment Share as an additional or single KPI for selected strategies. Those strategies have set a minimum threshold to invest in companies with a positive Net Zero Alignment share and commit to increase the minimum threshold over time.

Instead of investing only in lower carbon emitters, this approach aims to increase investments in companies transitioning towards, or already aligned with, a net zero pathway for real-world decarbonisation. We believe it is an invaluable tool to identify long-term growth opportunities that align with our vision of a sustainable future – and our clients’ objectives.

The Net Zero Alignment Share can be leveraged by our fund managers through the investment process to filter the investment universe or select companies with the highest potential for decarbonisation.

4428472