Climate change: banking on a greener future?

The banking sector is exposed to the risks of climate change through its financial activities, far more than its operations, and has much to gain from opening up opportunities in the economic transition. As scrutiny around climate transition strategies rises, structured engagement has a pivotal role to play in assessing banks’ readiness to meet this challenge.

Key takeaways

- A decarbonising economy will impact banking as some sectors they serve will be adversely affected or disrupted, while emerging sustainable industries will require backbone financing.

- This exposure to multiple sectors adds complexity to assessing banks’ preparedness for climate action, yet it is necessary to manage potential portfolio risk and upside opportunities.

- Our bespoke research framework for analysing the climate strategies of banks and guiding our voting was updated this year to provide a broader assessment of climate performance.

- Combining proprietary sustainability research with engagement, we have higher levels of conviction with respect to the climate performance of banks.

“Climate-related risks are clearly among the long-term risks to which financial institutions are exposed: monitoring these risks is not a ‘nice to have’… but a ‘must have’.” This statement came from France's central bank governor, François Villeroy de Galhau,1 on 24 April 2023, effectively throwing down the gauntlet to the financial sector to address arguably the greatest challenge of our time – life in a higher temperature world.

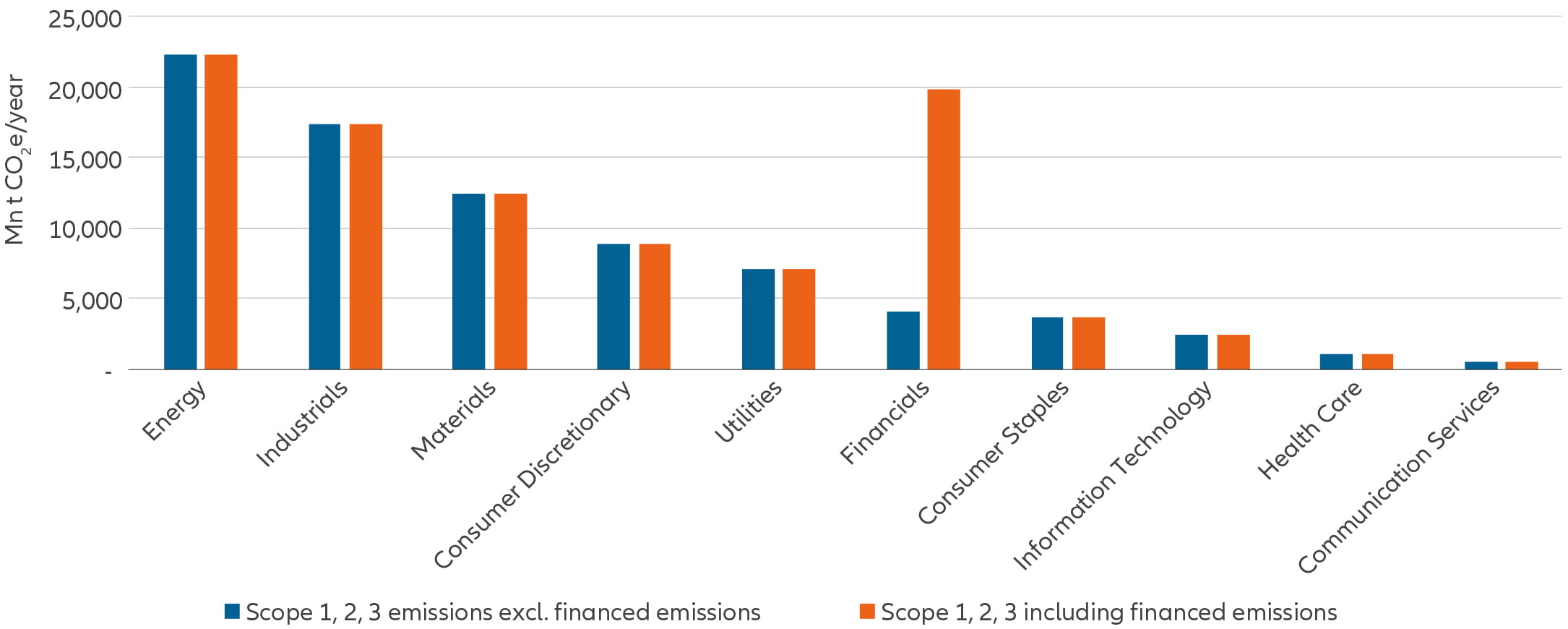

Discussions around greenhouse gas (GHG) emissions reduction often focus on high-emitting sectors such as energy, utilities or industrials. The operations of companies in these sectors account for the majority of global GHG emissions, as can be seen in Exhibit 1. Therefore, these sectors have been primary targets for engagement by asset managers, as highlighted in our paper “Oil & gas majors: active stewardship rather than divestment.”

The operational emissions of banks are comparatively much smaller. This perhaps explains and justifies why they have historically been a lower priority when developing some of the commonly used engagement and analysis frameworks.2

Exhibit 1: Financed emissions reveal the significant relevance of climate change for banks

Source: MSCI, as at 12 October 2023. GHG emissions aggregated by sectors for MSCI ACWI Index constituents, based on companies' most recently reported or estimated Green House Gas (GHG) emissions modelled by MSCI depending on data availability and quality.

Why engage with banks on climate?

Banks fulfil a critically important role in financing a broad range of economic activities. By facilitating these activities, they are associated with the emissions of their clients, such as investee companies, debtors, mortgage holders and any other client using banking services to facilitate carbon emitting activities. While benefiting from growth in certain sectors, such as those providing climate solutions, banks are also exposed to business risks, for instance, when the profitability of certain sectors declines.

The Carbon Disclosure Project estimated in 2020 that financed emissions3 by banks are over 700 times greater than direct emissions.4 Many banks have considered the association between their financial activity and carbon emissions of their client base and many have considered climate risks more broadly. They have consequently made strong commitments to ensure associated risks are managed, for example by becoming signatories to the UN-convened Net Zero Banking Alliance.5

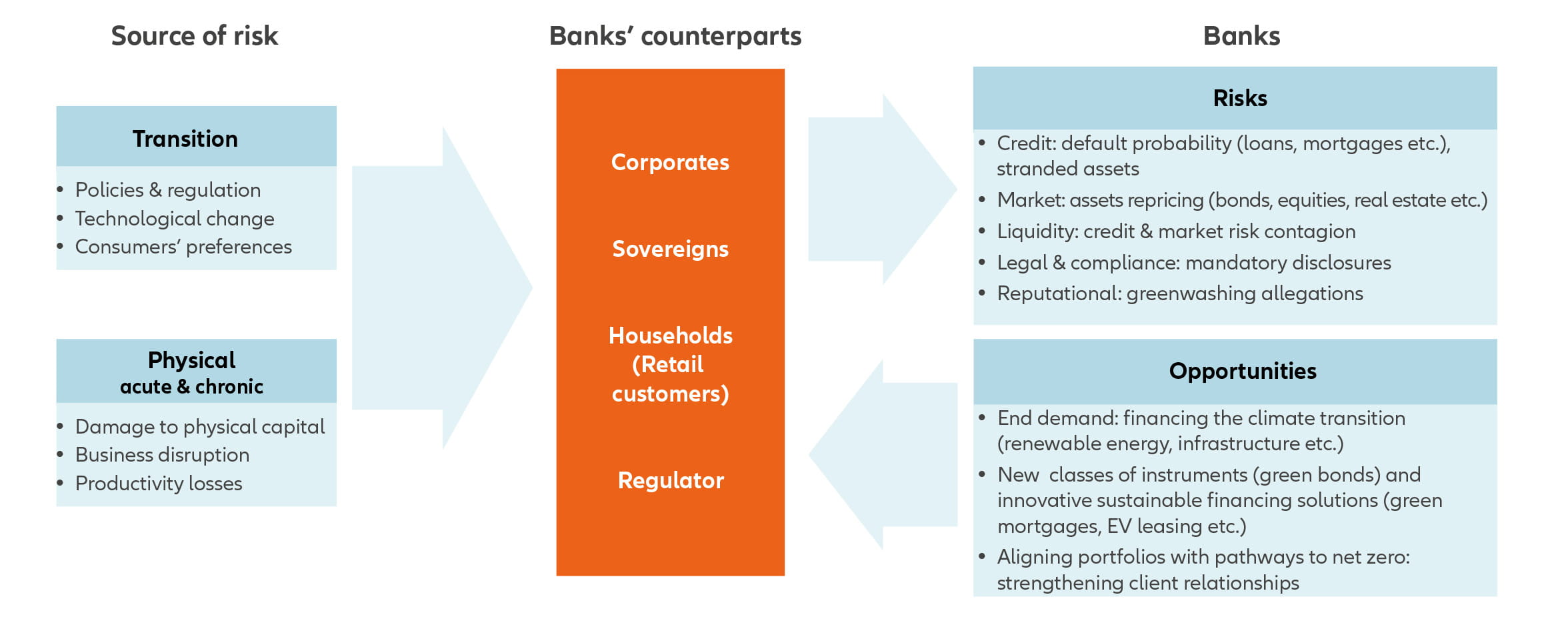

How climate risks are likely to translate into business risks:

- Banks may find their corporate lending books shrink if their client mix fails to capture emerging sectors which focus on sustainable growth.

- Mortgage providers may find, in some areas, a growing proportion of houses are impacted by physical climate risks that are material to their valuation.

- For laggard banks, there may be regulatory and legal risks, as climate stress-testing by prudential authorities matures and as climate litigation gathers momentum.

Recognising these issues, we engaged with banks to understand how they mitigate these risks. It became clear that we needed a structured way to assess their approach to the impact of climate change on their business activity. This is because banks provide such a wide range of financial services to retail and corporate clients – including everyday banking, lending, mortgages, credit, deal support and investments – and these clients operate across the entire range of economic activity. The largest global banks have an added dimension of complexity – geographic spread. Off-the-shelf existing frameworks and engagement initiatives were not sufficiently covering the depth and breadth of this sector.

Exhibit 2: Climate-related risks and opportunities for banks

Source: The Network of Central Banks and Supervisors for Greening the Financial System (NGFS), June 2021 and Allianz Global Investors

How we assess the climate strategies of banks

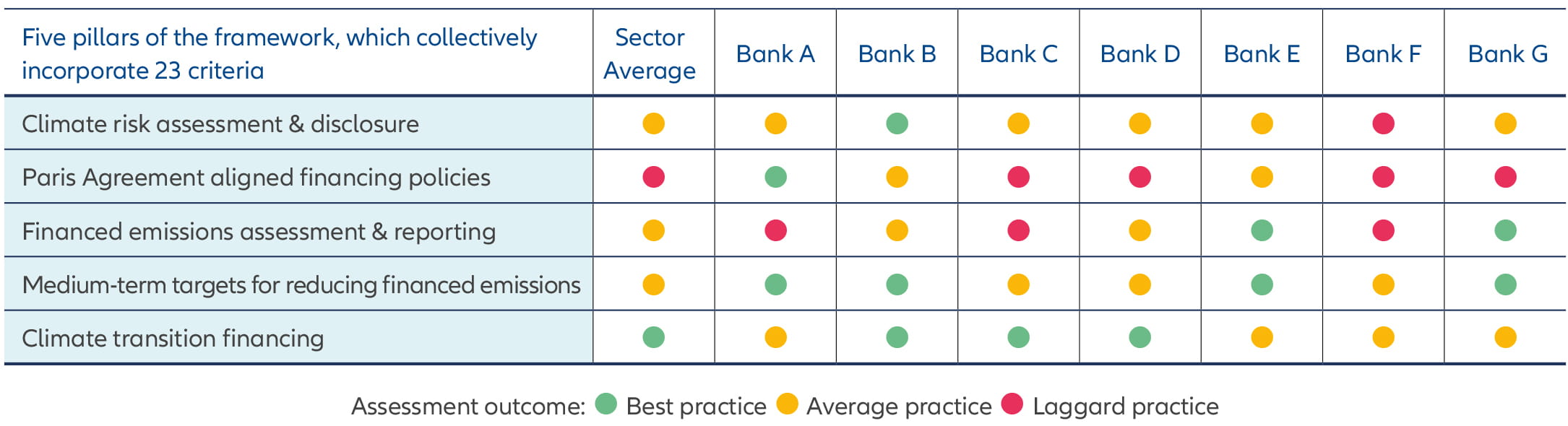

Combining our sustainability research and stewardship engagement experience, in 2022 we developed a framework to guide voting in management resolutions on Say on Climate in the UK and shareholder resolutions in the US. We evolved this framework in 2023 by adding several new criteria, extending certain thresholds, and expanding its use to drive more targeted engagement.

As an example, this year we engaged with a large US listed bank, forming a positive view of its climate transition performance that included progress against climate intensity targets. As an outcome, we did not support a shareholder proposal that called for absolute GHG reduction goals.

Our framework comprises five pillars with 23 criteria (expanded from 16 in 2022). We need this number of criteria to capture the complexity of banks’ climate strategies. Each criterion is assessed against a pre-determined scale of performance for which we referenced commonly used available frameworks. For 2023 we recalibrated some of the performance scales to reflect evolving market practice. For example, in assessing one of the 23 criteria – around commitment to align financing and investment with the Paris Agreement – we stepped-up the level of expectation by adding mortgage and capital markets, because the methodology for assessing these areas is becoming available.

Benefits of a structured engagement framework

Our framework enhances our engagement activity, giving us better conviction on a bank’s progress versus both peers and our expectations. Ahead of selected annual general meeting votes and in preparation for engagement meetings, we analyse reported material and complete the assessment per framework. Although reported material can run into hundreds of pages, more is not necessarily better. By distilling our analysis into key indicators benchmarked against pre-set scales, we obtain a clearer picture of the banks we have analysed.

Through engagement meetings, often with specialised teams of sustainability and climate experts fielded by the company, we gain additional insight to supplement the reported information. For example, these meetings may help clarify the background of decisions reported. Beyond gaining better clarity on the company’s climate strategy, engagements can be helpful to gain a first-hand impression of the internal resources that have been committed to implement these strategies. Finally, these meetings allow us to convey our specific expectations for issues we have raised.

Exhibit 3: AllianzGI proprietary framework shows banks’ climate progress

Source: Allianz Global Investors, August 2023

This process, and our enhanced engagement framework, provided key learnings. First, collaboration matters. Combining both our thematic research and our stewardship activity increases our effectiveness. The analysis described in this paper was the product of collaborative work between our dedicated Sustainability Research and Stewardship teams. Engagement quality is boosted by the depth of research, and engagement output contributes to further honing of the research.

Second, less is more. For some banks we looked at, climate reporting spanned several lengthy documents. No doubt the intention was to address a broader set of interested stakeholders and more detailed set of regulatory expectations. Yet at times we found it difficult to extract necessary, quantified pieces of information that we saw as relevant from our own point of view. For example, use of climate-related metrics does not always align with an investor’s perspective. Some banks report financed emissions as raw numbers but fail to specify the limited coverage in terms of asset class, activities or geographies. In other words, we know the magnitude of their financed emissions for part of the business, but we are not able to contextualise it within a complete picture of their entire activities. It means that we are limited in our ability to assess the extent of associated investment risk and mitigation measures relative to the whole institution.

From commitment to action

In a year when climate progress in the energy sector has been tested, it was encouraging to see that so far, the leading banks have maintained momentum by delivering on long term climate commitments, and notably by broadening sector coverage of mid-term emissions reductions. At the same time, many gaps remain, with some banks falling short of our expectations.

The 2030 deadline for achieving intermediary milestones of the Paris Agreement temperature goal is very much in sight. Rightly, the emphasis for climate strategies has now shifted decisively to the implementation of commitments made in the past year or two. The more we build up our understanding of this implementation across financial institutions over time, we will be able to assess the effectiveness of chosen strategies. For example, it would become increasingly difficult to explain a bank’s persistent underperformance versus initially anticipated emissions reduction trajectories.

We believe this approach to engaging with banks will aid investors in making better-informed decisions and put clear distance between the laggards and the leaders across the banking sector.

1 Reuters, April 2023 Climate change fight a 'core duty' for central banks - ECB's Villeroy

2 Climate Action 100+, Science Based Target initiative, Transition Pathways Initiatives are examples of organisations that have developed such frameworks.

3 Financed emissions are those that are linked to the investment and lending activities of financial institutions.

4 Climate Disclosure Project, The Time to Green Finance - CDP Financial Services Disclosure Report 2020

5 Net-Zero Banking Alliance, https://www.unepfi.org/net-zero-banking/

3244033