Achieving Sustainability

The modern workforce: are we ready for the shift?

Is artificial intelligence destroying jobs and do we have the right skills needed for emerging job opportunities? These are among the factors reshaping the workforce amid stagnating productivity and rising risks.

Key takeaways

- The nature of work is changing as factors such as technology and demographics transform the global labour market.

- With a longer-term, more strategic approach to work – including efforts to reskill the workforce – employers can minimise risks and maximise socioeconomic opportunities.

- Emerging work trends are financially material issues, particularly as they affect productivity, and they may impact future global growth and investment opportunities.

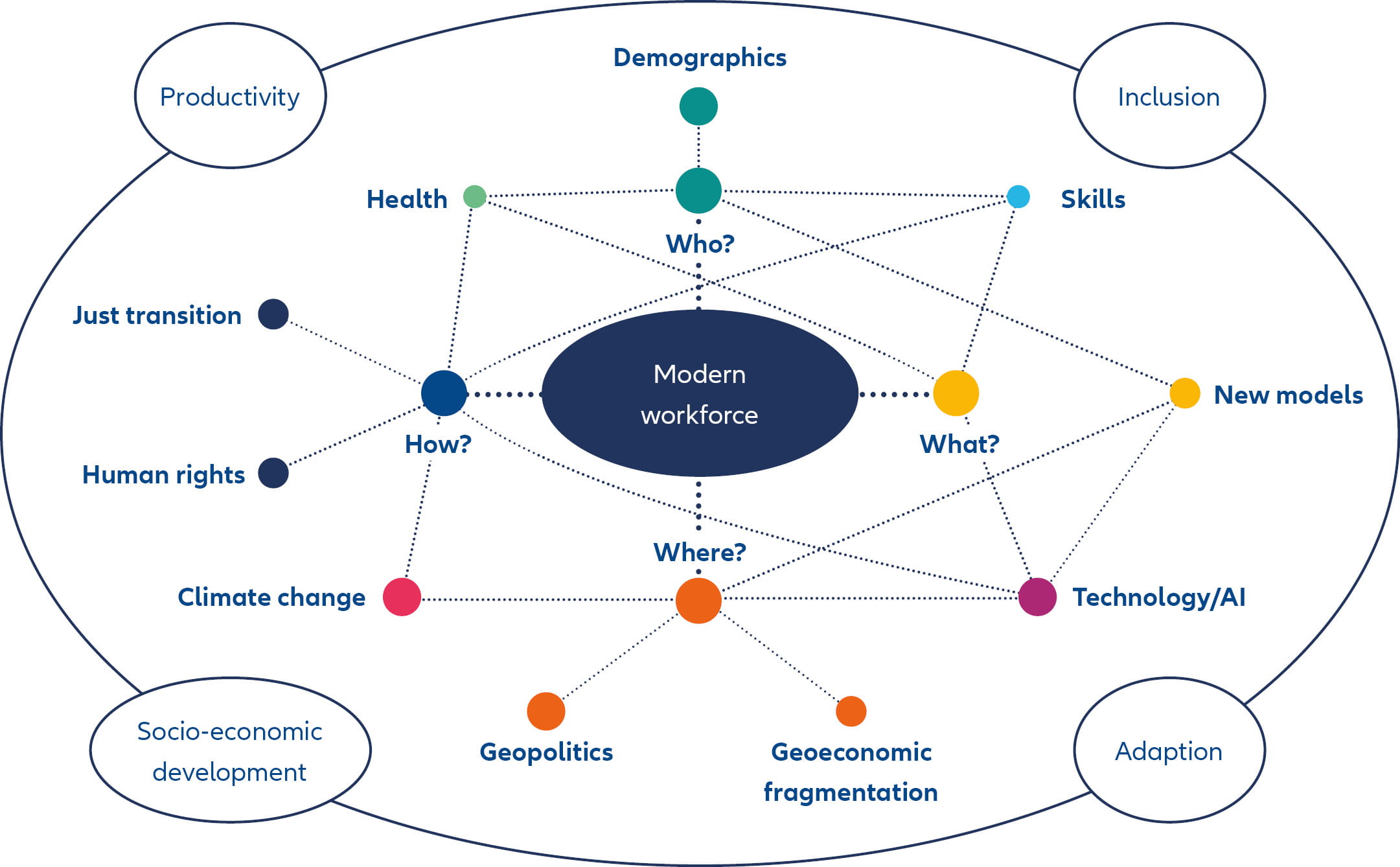

Exhibit 1 – Reshaping the modern workforce

Source: Allianz Global Investors, Sustainability Research 2025

The material influence of the factors shown in Exhibit 1 will vary by sector and region, but in aggregate they are important considerations for improving productivity, creating new work opportunities, and adapting the workforce – for both companies and long-term investors.

The significance of the co-dependency between work and productivity is outlined in Goal 8 of the 17 UN Sustainable Developments Goals: “Decent work and economic growth,”1 which encompasses job creation, productive work, fair pay, labour rights and safe, secure working environments.

Below we look at how each factor in Exhibit 1 is contributing to reshaping the workforce:

- Demographics: Significant divergences in global population trends will feed through into declining or rising pools of working-age individuals in some regions.2 A well-functioning workforce will need to address any potential imbalance in resources, skills and job candidates.

- Skills: Building and evolving skills is critical and extends through an individual’s education, working life, and into productivity opportunities for those nearing retirement. Developing core skills is key, but with a focus on adapting to changing circumstances of what work is to be done and on mobility, through continuous training and knowledge transfer.3 An estimated 39% of existing skill sets will either be transformed or will become outdated by 2030.4

- New models: Shifting work patterns are creating new models of how work is contracted, performed, managed and resourced. An example is the “gig economy” which refers to independent or freelance, short-term work usually made available across digital platforms. The World Bank estimates up to 435 million workers (12.5% of the global workforce) contribute to the “gig economy”5 gaining flexible opportunities in less urban communities, especially younger workers, but not necessarily with the labour protections of traditional employment.6

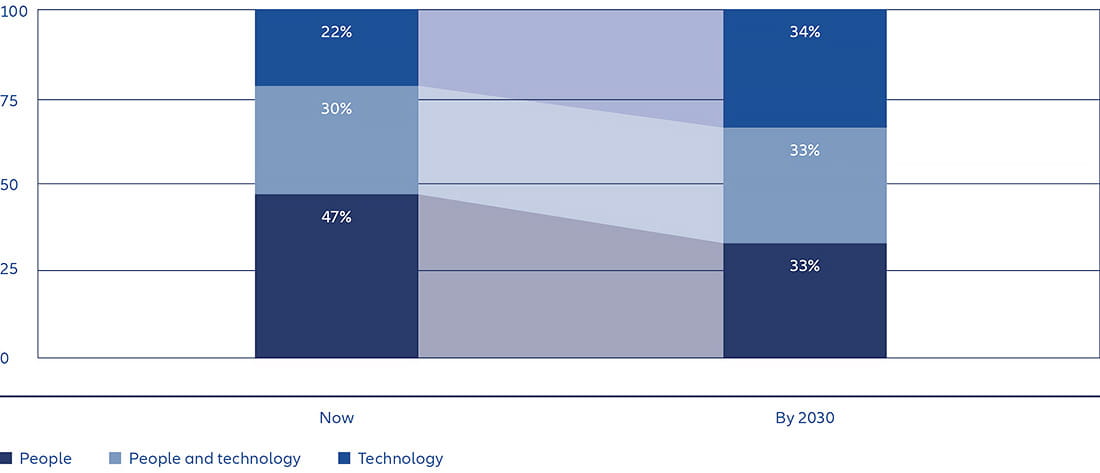

- Technology: The three factors above highlight the significance of technology in reshaping the workforce. The same World Bank report highlights that technology will create 170 million jobs (14% of current total employment). These are expected to offset the displacement of 92 million current jobs, but will require the necessary new skillsets, as highlighted in Exhibit 2.

Exhibit 2 – Share of total work tasks delivered by people and machine, 2025-2030

Source: World Economic Forum, The Future of Jobs Survey, 2024

- Geoeconomic fragmentation: The increasing division of the global economy into distinct blocs is a key trend – highlighted by the World Economic Forum – and is causing businesses to reconsider the question of “where” in their economic models and supply chains.

- Geopolitics: Linked to the above point, geopolitics are adding tensions in the form of trade disputes and conflicts that are straining global labour markets.7

- Climate change: Rising temperatures, physical climate risks and changing ecosystems are testing the resilience of workplaces and workers. An estimated 1.6 billion outdoor workers are already exposed to the negative health outcomes of extreme heat and air pollution.8

- Human rights: A balance needs to be struck between the needs of employers and the rights and welfare of employees to help lower operational, financial and reputational risks. Health and safety, living wages,9 training and workers rights’ protections can be compromised when local job opportunities are constrained.

- Just transition: Similar protections are needed for employees at risk from the transition to a greener economy, which could see five million jobs displaced in the move away from fossil fuel dependency. This requires policy and investment support to reskill or upskill workers for the expected 30 million new roles in clean energy and low-emission technologies by 2030.10

- Health: The long-lasting impacts of Covid-19, a rising mental health crisis11 and increased physical health impacts from long working hours are contributing to high levels of economic inactivity where people are not in employment.12 Companies need appropriate safeguards and policies in place to monitor and address these and other health risks.13

Productivity: an urgent global challenge – and opportunity

Did you know?

- Three quarters of organisations plan to adopt AI technologies by 2025.

- Generative AI could enable labour productivity growth of 0.1-0.6% annually up to 2040.16

- AI could empower less specialist employees to perform a greater range of “expert” tasks, while enhancing solutions for already skilled professionals.

Mapping a sustainable workforce transformation

Based on identifying the key factors in Exhibit 1 that are influencing the future of work, we have embedded critical workforce related topics into our sustainability sector and company analyses.17 This allows us to identify and quantify different levels of materiality across industry sectors and regions. As a result, our investment teams can gain a deeper understanding of the investment opportunities and risks around work and productivity.

Exhibit 3 shows our process for materiality analysis of four social topics in the automotive sector – a framework that we use across a further 23 key sectors. The different levels of materiality shown in blue will prompt different weightings to each factor and will include specific underlying key performance indicators (KPIs) to assess company performance. Dedicated thematic and sector engagement guidance for our investment teams complements this sector and company analysis.

Exhibit 3 – Materiality analysis of a selected sector’s ESG and sustainability factors

| Factor: Social | Materiality | Drivers and KPIs |

|---|---|---|

| Health & Safety | Low impact |

|

| Working conditions and environment |

Medium impact |

|

| Human capital Management/ Development |

High impact |

|

| Labour relations | Medium impact |

|

Source: Allianz Global Investors, Sustainability Research 2025

Where specific ESG and sustainability factors have high materiality, we conduct “deep dives” on selected companies in the sector. These deep dives provide more detail of the materiality, examples of leading and laggard practices, and specific engagement guidance – see Exhibit 4.

Exhibit 4 – Example of a deep dive analysis on human capital management

The automobile manufacturing industry is experiencing a profound change in transitioning to electric vehicles (EVs). The subsequent transformation of jobs will directly or indirectly affect close to 14 million workers in Europe alone.18

| What are we looking for? | Description | Best practices | Laggard practices |

|---|---|---|---|

| Upskilling and reskilling |

|

|

|

Source: Allianz Global Investors, Sustainability Research 2025

Workforce-related KPIs remain immature, which makes engagement a critical tool to assess company strategy and performance. Exhibit 5 summarises a recent engagement on mental health – a fast-emerging workplace issue.

Exhibit 5 – Case study: Engaging on workplace mental health with a software & services company

Engagement goal: We engaged with a high-profile company whose ability to attract and retain talent is critical to performance. We discussed strengths and weaknesses highlighted by a CCLA19 assessment which showed an overall summary decline compared to last year’s metrics.

Outcome: The company developed and launched a mental health training curriculum for managers, and introduced chapters on mental health into its mandatary training.

Source: Allianz Global Investors, Sustainability Research 2025

In conclusion we have conviction that companies’ positive actions on the social factors of ESG are linked to long-term financial performance and returns. Companies and their workers will need to adapt collaboratively to changing demographics, a shifting world order, the consequences of climate change and the emergence of disruptive technologies. Done successfully and there are opportunities for higher productivity and improved socioeconomic development and growth.

As these challenges currently persist in both stagnating growth and undermining the existing model of employment, we expect to see workforce-related topics being increasingly recognised and addressed by businesses.

1 Read more on this: Allianz Global Investors, Unlocking the “S” in capitalism, 2022

2 In the Global South in the next ten years, an estimated 1.2 billion people will become working age adults. competing for approximately 420 million jobs, “leaving nearly 800 million without a clear path to prosperity”. World Bank Group Launches High Level Council to Tackle Looming Jobs Crisis, August 2024

3 OECD: Facilitating-knowledge-transfer-between-generations.pdf, 2024

4 World Economic Forum, Future of Jobs Report 2025, page 6

5 World Bank blog, What we’re reading about how the online gig economy is transforming work, 2023

6 World Bank blog, What we’re reading about how the online gig economy is transforming work, 2023

7 International Labour Organization, World Employment and Social Outlook: Trends 2025

8 International Labour Organization, Excessive Heat Linked To Climate Change Affects 70% Of Workers - Health Policy Watch, 2024

9 International Labour Organization, living wage definition: “the wage level that is necessary to afford a decent standard of living for workers and their families, taking into account the country circumstances and calculated for the work performed during the normal hours of work,” 2024

10 International Energy Agency, Net Zero by 2050 - A Roadmap for the Global Energy Sector, 2021

11 World Health Organisation, Globally, an estimated 12 billion working days are lost every year to depression and anxiety at a cost of USD1 trillion per year in lost productivity, Mental health at work, 2024

12 Office for National Statistics, Economic inactivity, 2021

13 CCLA, CCLA Corporate Mental Health Benchmark Global 100+ Report 2024

14 McKinsey, Investing in productivity growth, 2024

15 World Economic Forum, Global Economic Futures Productivity in 2030, 2025

16 McKinsey, Economic potential of generative AI, 2023

17 Read more on our sector frameworks and company analyses: Sustainable investing and stewardship report 2024

18 European Parliament, The future of European electric vehicles, 2024

19 Churches, Charities and Local Authorities - CCLA Investment Management - Good Investment, 2025

4560957