Insights

China H vs China A: a tale of two markets

The Hong Kong stock market has been in the spotlight this year. The China H shares index has risen by around 25% with the DeepSeek announcement in particular boosting sentiment towards internet platforms.1 These are listed in Hong Kong and have high weightings in widely followed benchmarks. The Hong Kong market resurgence has also notably been accompanied by a surge in new listing activity, as Chinese companies raise capital to fund global expansion plans.

As a result, after several years in the doldrums, China H shares have recently significantly outperformed China A shares.

In this piece we address some of the most frequently asked questions regarding the merits of China H (“offshore”) versus China A (“onshore”) exposure. We believe both markets offer distinct exposure and can play complementary roles in global portfolio allocations.

Onshore vs. Offshore: market evolution

China’s equity universe is often viewed through the lens of onshore versus offshore markets. Although both represent Chinese companies, each market has distinct characteristics shaped by a number of factors including differing investor bases, historical accessibility and industry composition.

The onshore market refers to China A-shares listed on the Shanghai and Shenzhen Stock Exchanges. The China A shares market only became more accessible to international investors within the past decade. This was largely due to the launch of the Stock Connect scheme which has rapidly replaced previous quota-based systems. Nonetheless, domestic retail investors remain the dominant day-to-day price setters, typically accounting for around 70% of daily market turnover. Foreign investors own less than 5% of the overall China A market.2

The offshore market includes Chinese companies listed on both the Hong Kong and US stock exchanges. However, in recent years and as a result of geopolitical tensions, many companies that previously only had US listings (for example, Alibaba), now have a dual listing in Hong Kong. As a result, the offshore market has become increasingly synonymous with China H shares.

Historically, international – particularly institutional – investors have dominated the offshore market. However, in recent years, mainland China investor participation has increased significantly, and now accounts for around 25% of daily turnover in Hong Kong.

Chinese companies choose their listing locations based on a number of different reasons, including listing requirements, target investor base, operational footprint and other strategic considerations. For example, firms with a more international client base or supply chain exposure may prefer an offshore listing to gain broader visibility and access to global capital.

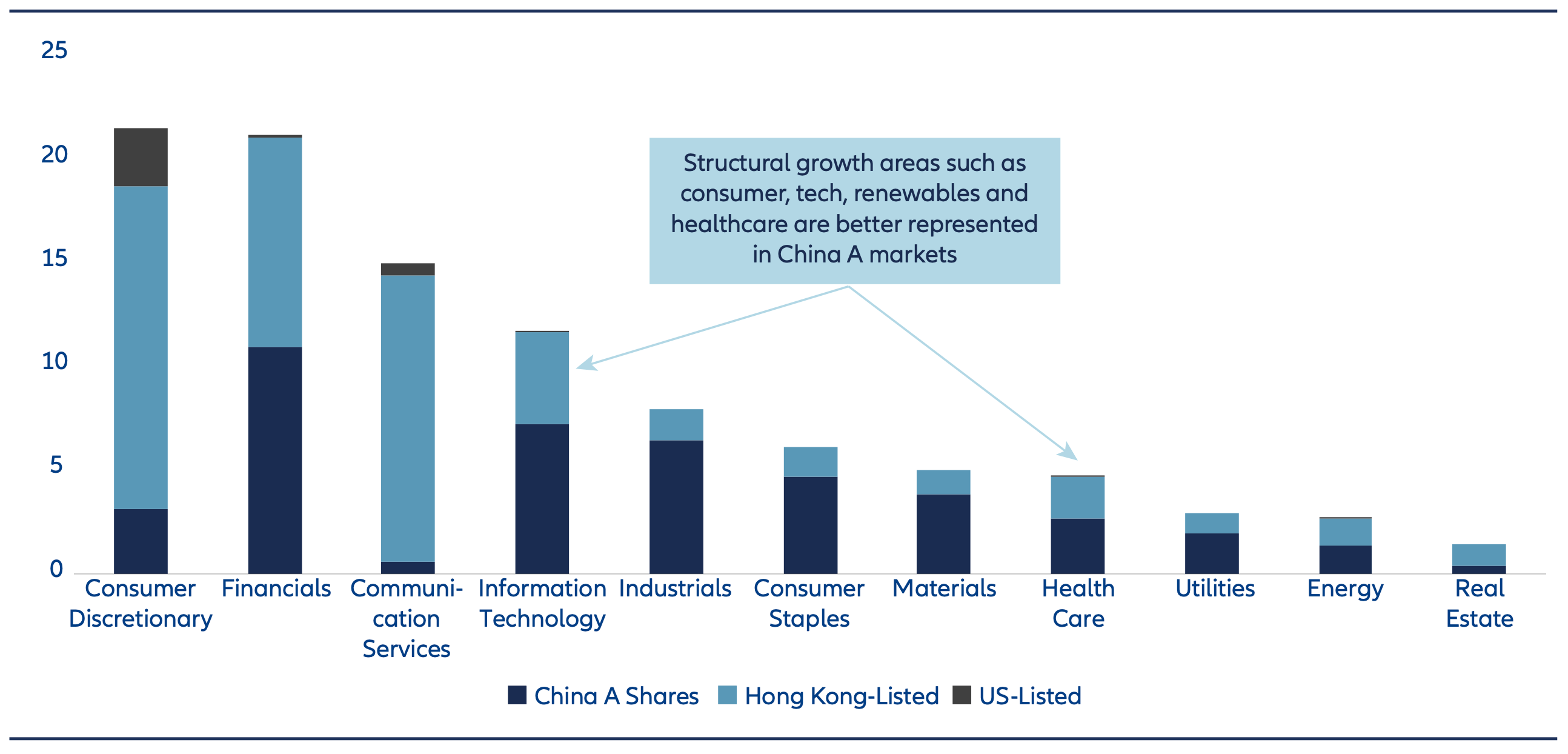

As a result the index composition of the onshore and offshore markets has historically been very different. The offshore market has been concentrated in large internet platforms as well as more traditional industries such as banks, property, utilities, and the energy sector. Meanwhile, the onshore China A market has been relatively more diversified, offering a broader representation of sectors and supply chains across the China economy (exhibit 1).

But this historical distinction in index composition is beginning to evolve. In 2025 there has been a notable wave of new issuance in Hong Kong from Chinese companies that were previously only listed in Shanghai or Shenzhen. Much of the new issuance comes from companies perceived to be among the best-managed in China, and which represent both the surge in technology-oriented innovation as well as companies seeking to expand globally. These include areas such as AI-related infrastructure, the humanoid robot supply chain, biotech and home appliances. As a result, the offshore market is gradually becoming more diversified, a trend which we expect to continue.

Exhibit 1: Sector breakdown of MSCI China All Shares Index by listing location (%)

Source: IDS, Allianz Global Investors, as of 30 June 2025

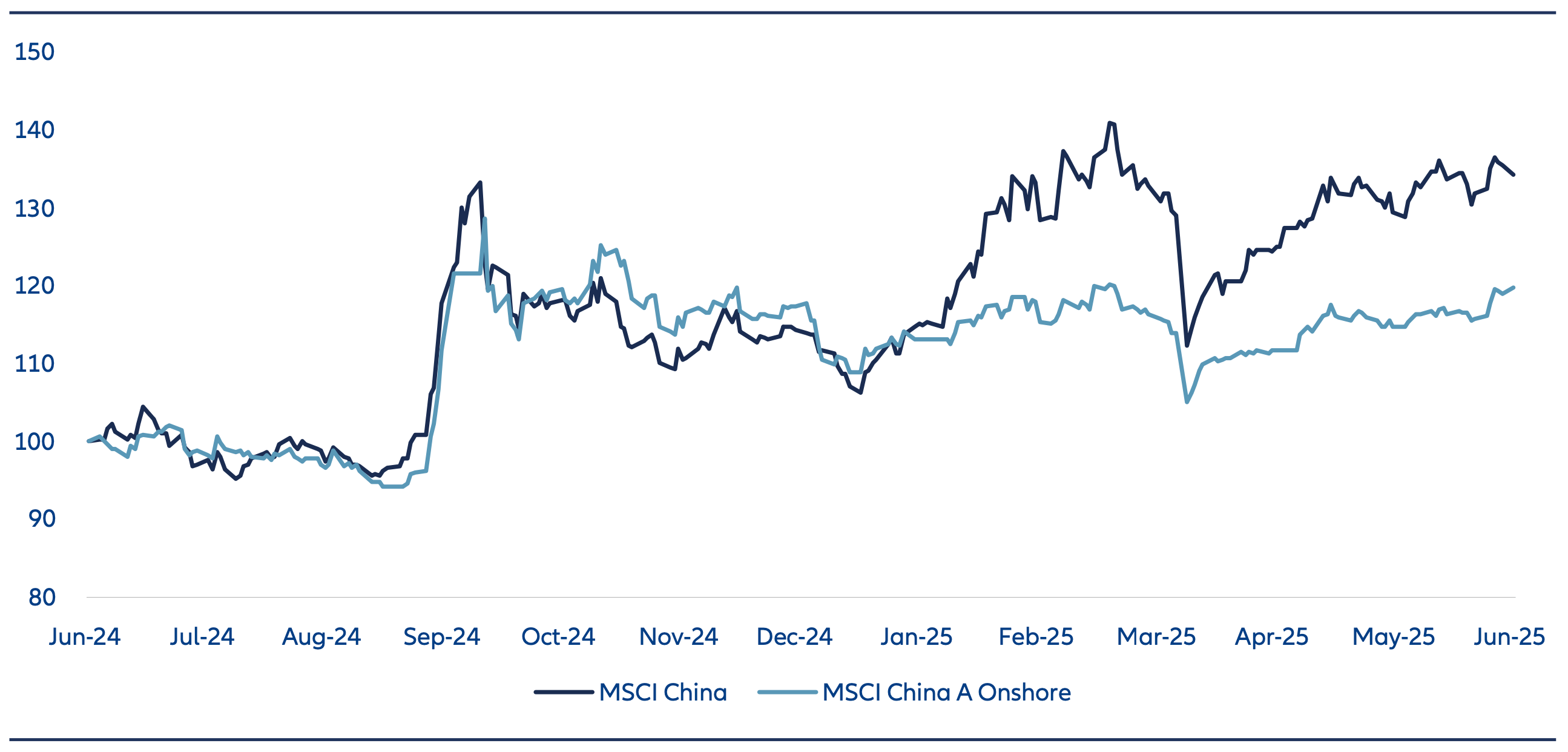

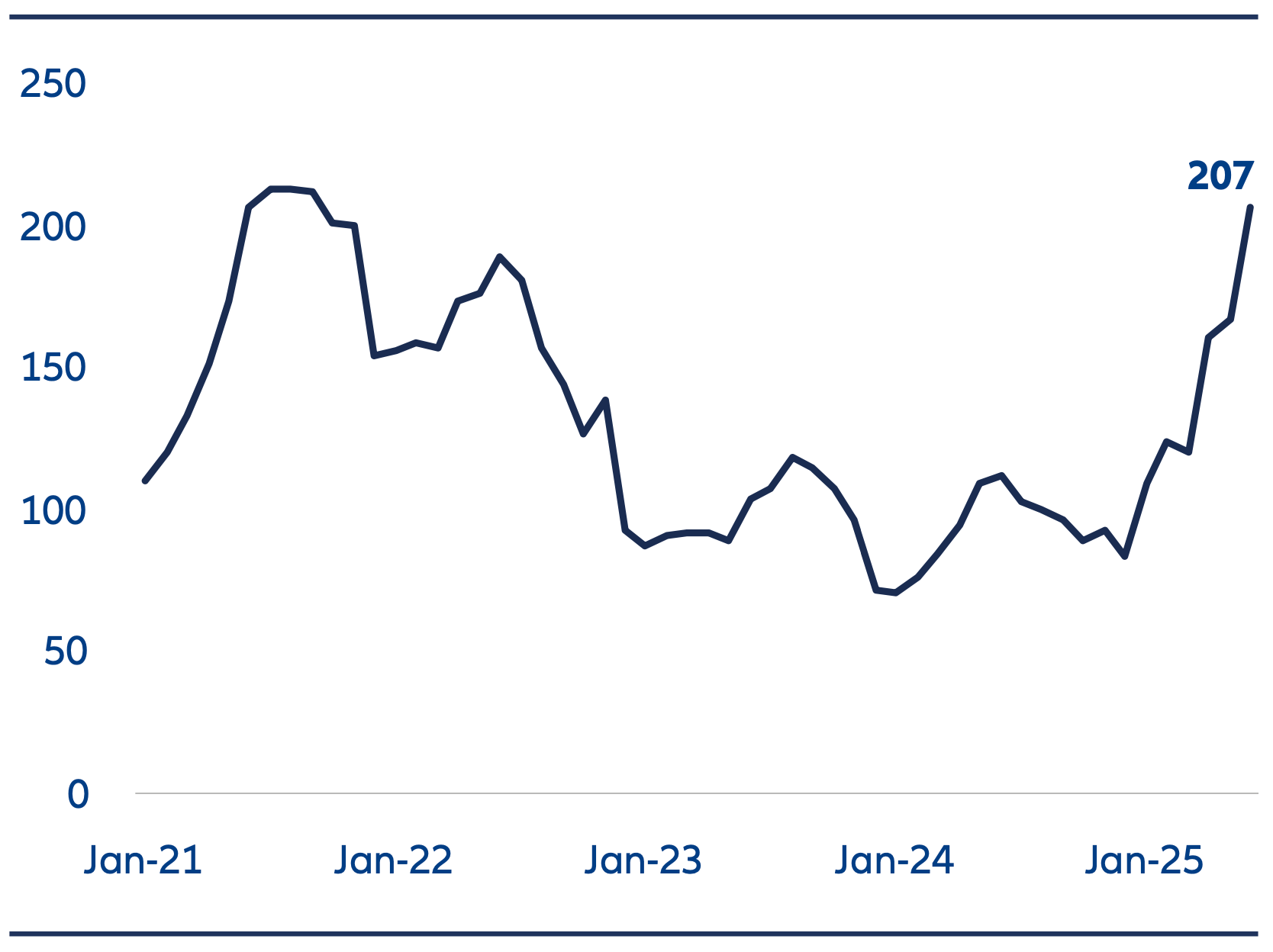

Exhibit 2: MSCI China vs MSCI China A Onshore

Source: LSEG Datastream, Wind, Allianz Global Investors, as of 30 June 2025

Offshore Market Momentum: Liquidity, IPOs, and Flows from Mainland China

The offshore Hong Kong market has significantly outperformed the onshore market in 2025 (exhibit 2), driven by a combination of strong liquidity, resurgence of IPO activities, increasing flows from mainland China-based investors, and a rally in benchmark-heavy internet platforms which are seen as DeepSeek beneficiaries.

The divergence between the two markets became more pronounced in late January 2025, when the DeepSeek announcement triggered a realisation that China’s technology developments were significantly more advanced than had previously been recognised.

In particular, many internet giants – such as Alibaba and Tencent – are only listed in offshore markets. Since DeepSeek sprung to global prominence, they have announced significant commitments in areas such as cloud and data centre infrastructure, reinforcing their role in China’s AI ecosystem.

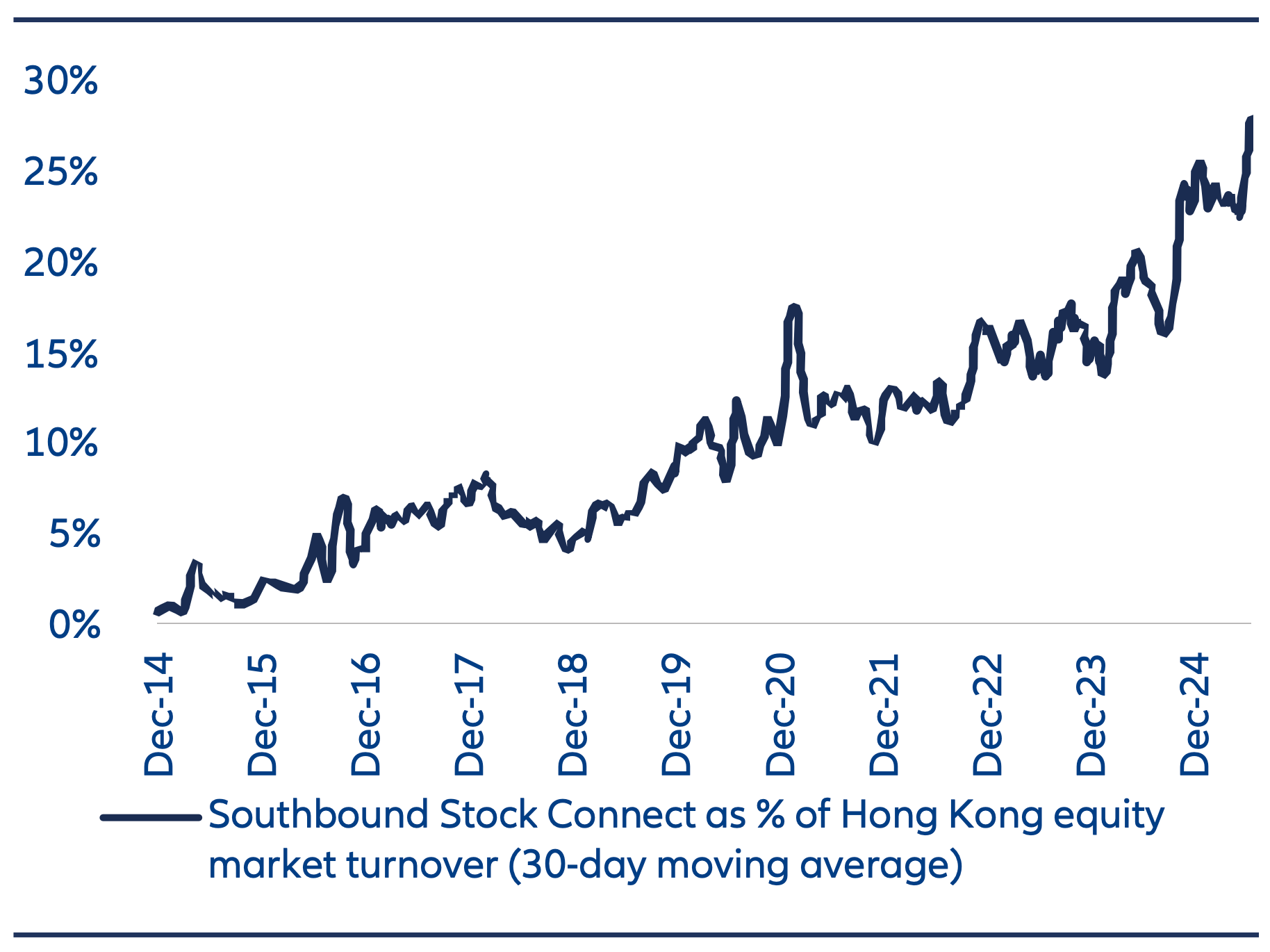

Southbound flows via Stock Connect (i.e. flows from mainland China into Hong Kong) have also played a critical role in the offshore market strength. While global investors often associate Stock Connect with access to China A-shares, the scheme also enables mainland Chinese investors to buy eligible Hong Kong listed stocks.

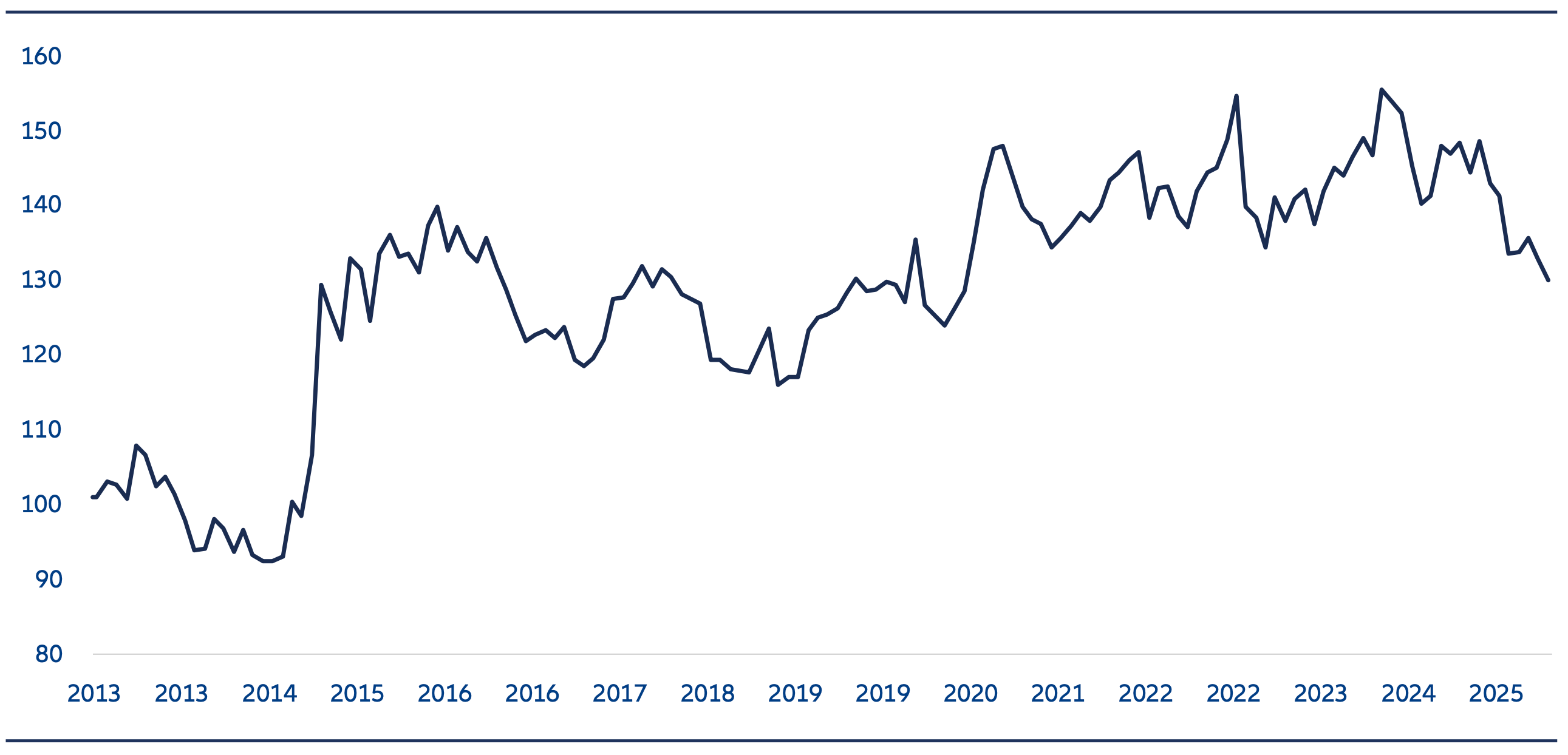

In the first half of 2025 alone, Southbound flows reached close to US$100 billion, almost the same level as the whole of 2024.3 With these flows accounting for a growing share of daily turnover in the Hong Kong stock market (exhibit 3), they have provided a meaningful additional source of liquidity in the market.

Exhibit 3: Southbound Stock Connect as % of Hong Kong equity market turnover (30-day moving average)

Source: Wind, Allianz Global Investors, as of 11 July 2025. Turnover is calculated based on 30 day moving average number

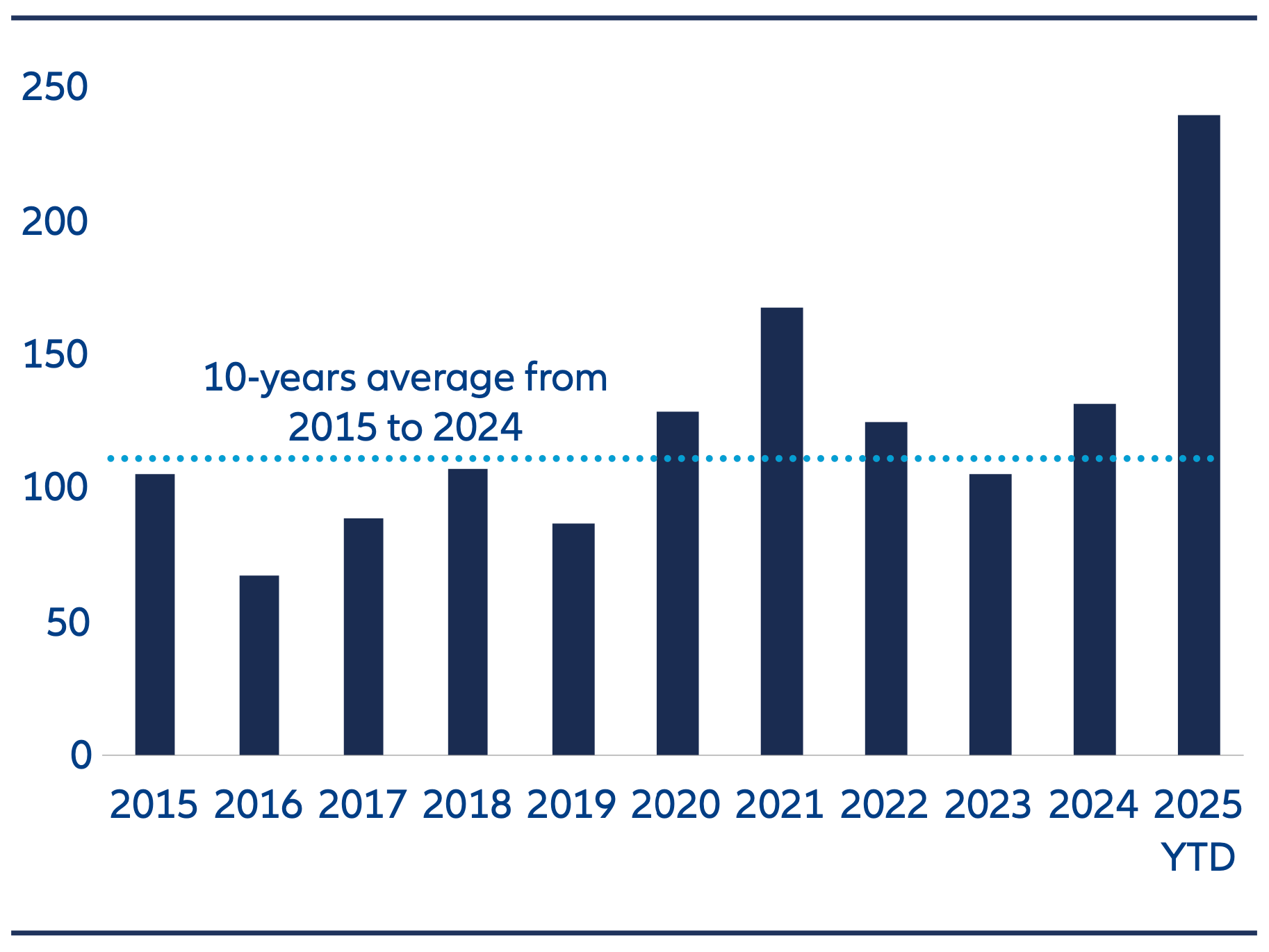

Partly as a result of these increased flows, the Hong Kong stock market has recorded its highest daily turnover levels in over a decade (exhibit 4). And this, in turn, has helped to support the heavy pipeline of new listings.

Year to date, IPOs on the Hong Kong Exchange have raised USD16 billion, already exceeding the USD11 billion raised in the full year of 2024 and the USD10 billion annual average during 2022 to 2024 (exhibit 5). This resurgence reflects both a recovery from the subdued macro environment of recent years, and the impact of more accommodative listing rules.4

In October 2024, the Hong Kong Stock Exchange introduced a fast-track listing process, allowing eligible China A share companies to list in as short as 30 business days. In contrast, as a result of tighter regulations, China A share markets have seen a significant decline in new listings - from around 300–500 annually between 2021 and 2023 to just 100 in 2024 and 54 year-to-date in 2025.

Exhibit 4: Average daily trading amount of Hong Kong stock market (HKD bn)

Source: HKEX, Wind, Allianz Global Investors, as of 16 July 2025

Exhibit 5: Number of active IPO application in Hong Kong stock exchange

Source: HKEX, HSBC, Allianz Global Investors, as of 25 June 2025. *The application no. is recorded over the period of since Jan 2021

Valuations: assessing the A-H Premium?

Historically China A shares have generally been regarded as “more expensive”, with many trading at a valuation premium to their H-share counterparts. One way of measuring this has been the Hang Seng AH Premium Index. This tracks the valuation discrepancy between stocks dual-listed on both mainland and Hong Kong stock exchanges.

The strong rally in Hong Kong listed stocks has resulted in the A-H premium coming down to its lowest level in the last 5 years (exhibit 6). In addition, some of the recent IPOs are also trading much closer to the valuation of the China A listings.

As a result, the AH Premium Index has become less of an effective overall gauge of relative China H and China A valuations. More broadly, there is now greater flexibility to access key China growth opportunities across both onshore and offshore markets.

Exhibit 6: China A/H Premium Index

Source: Bloomberg, Allianz Global Investors, as of 30 June 2025

Onshore Resilience: Domestic Focus and Policy Support

While we expect the offshore market to remain supported by strong IPO activity, robust Southbound flows and ample liquidity, nonetheless this part of the China investment universe is also more volatile. The volatility is partly related to the sensitivity of the more global investor base to factors such as geopolitical considerations.

In contrast, the onshore market is primarily driven by domestic investors, whose sentiment is more closely aligned with China’s domestic economic recovery than with external geopolitical developments.

Importantly, policy support from the Chinese government is also directed primarily towards the onshore market. It has been notable that during periods when the government has mobilised resources to support equity markets during periods of volatility, these have been used to buy onshore ETFs and therefore to stabilise the China A market.

As a result, we see China A markets as having a significantly higher degree of downside protection compared to offshore markets.

From a sector perspective, while the offshore market is gradually diversifying, the onshore market currently still offers broader exposure to China’s structural growth drivers. For example key upstream segments such as electric vehicles, autonomous driving, robotics and advanced manufacturing are better represented in the China A shares universe. Additionally, domestic consumer brands are also more exclusively listed in the onshore market.

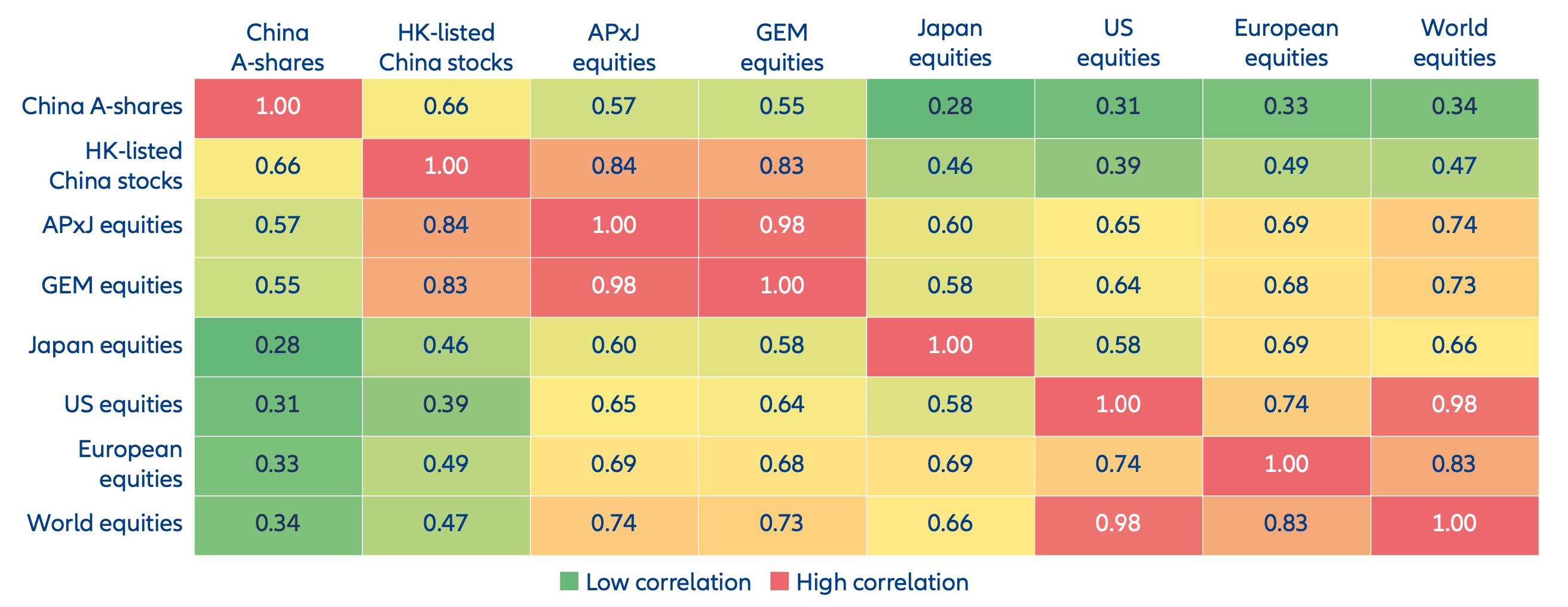

It is also notable how China A shares offer meaningful diversification benefits for global investors. Their historically low correlation with major global indices makes them a valuable tool for reducing overall portfolio volatility and enhancing risk-adjusted returns.

Exhibit 7: Historical correlation between major equity markets

Source: Bloomberg, Allianz Global Investors, as 30 June 2025. Correlation data is calculated based on historical return of respective MSCI indices for the past 10 years, using weekly USD return.

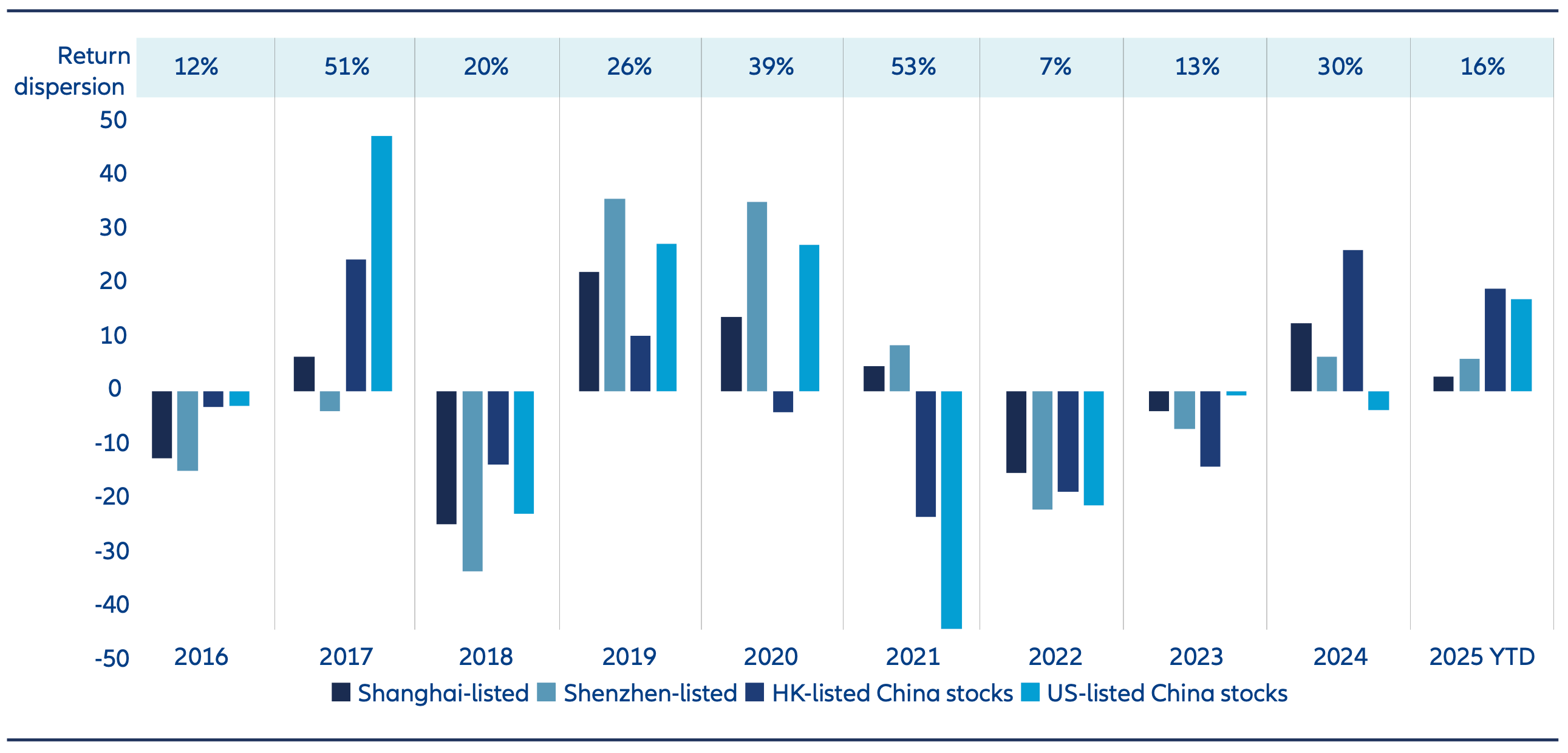

Exhibit 8: Returns of China stocks according to listing

Source: Bloomberg, Allianz Global Investors, as of 30 June 2025

Summary – and why ‘All China’ is gaining traction

While China H shares have recently enjoyed a performance tailwind, history shows that the performance of onshore and offshore markets can change significantly over time. This divergence reinforces the importance of maintaining exposure to both parts of the market, in our view. This also allows investors to capture the full breadth of opportunities in China’s evolving landscape.

In recent years there has been a trend for some investors to carve China out of their broader emerging market allocations. In this context, an ‘All China’ strategy can offer an effective solution to accessing the full equity universe:

- Complementary onshore and offshore companies provide comprehensive exposure to China’s economy and financial markets in a single portfolio.

- A more holistic and efficient approach than separate China A and China H allocations. Flexibility to navigate valuation anomalies for dual listed stocks as more leading China A share companies pursue dual listings in Hong Kong.

- Diversification benefits as China equities – particularly China A-shares – exhibit low correlation with global indices.

1Source: Bloomberg, as of 31 July 2025

2Source: Goldman Sachs Investment Research, as of 30 September 2024

3Source: Wind, as of 11 July 2025

4Hong Kong Stock Exchange, HSBC Qianhai Securities Limited, as of 6 June 2025

4764643