Navigating Rates

Carry on: three themes to watch in Asian fixed income

We think Asian fixed income could be one of the most suitable markets for carry in the second half of 2024, supported by a stable political and macroeconomic landscape, an improving credit cycle and good total yields with robust technical support.

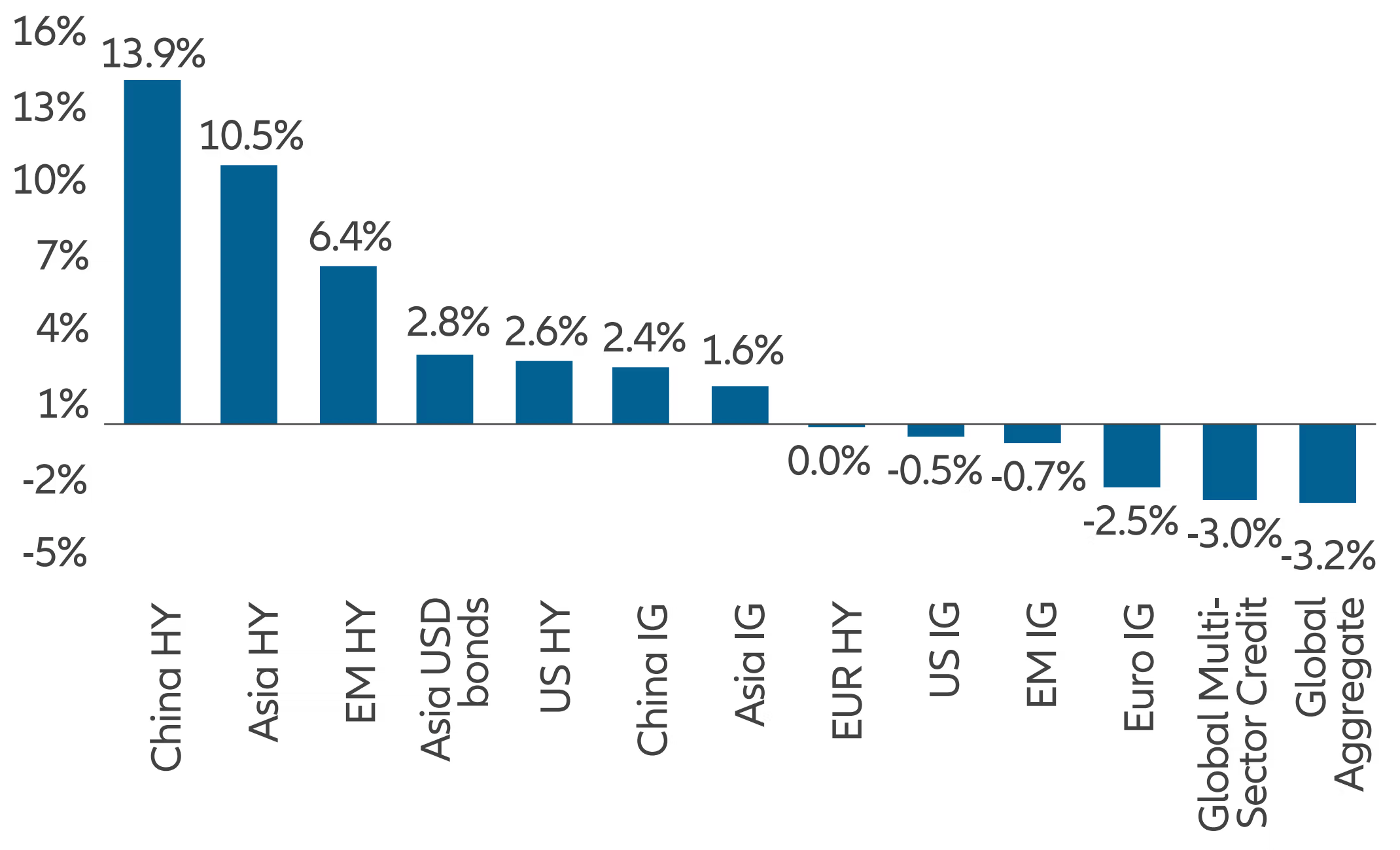

Exhibit 1: Global credit markets performance (year to date)

Source: Bloomberg. Data as at 28 June 2024. Note: HY = high yield. IG = investment grade.

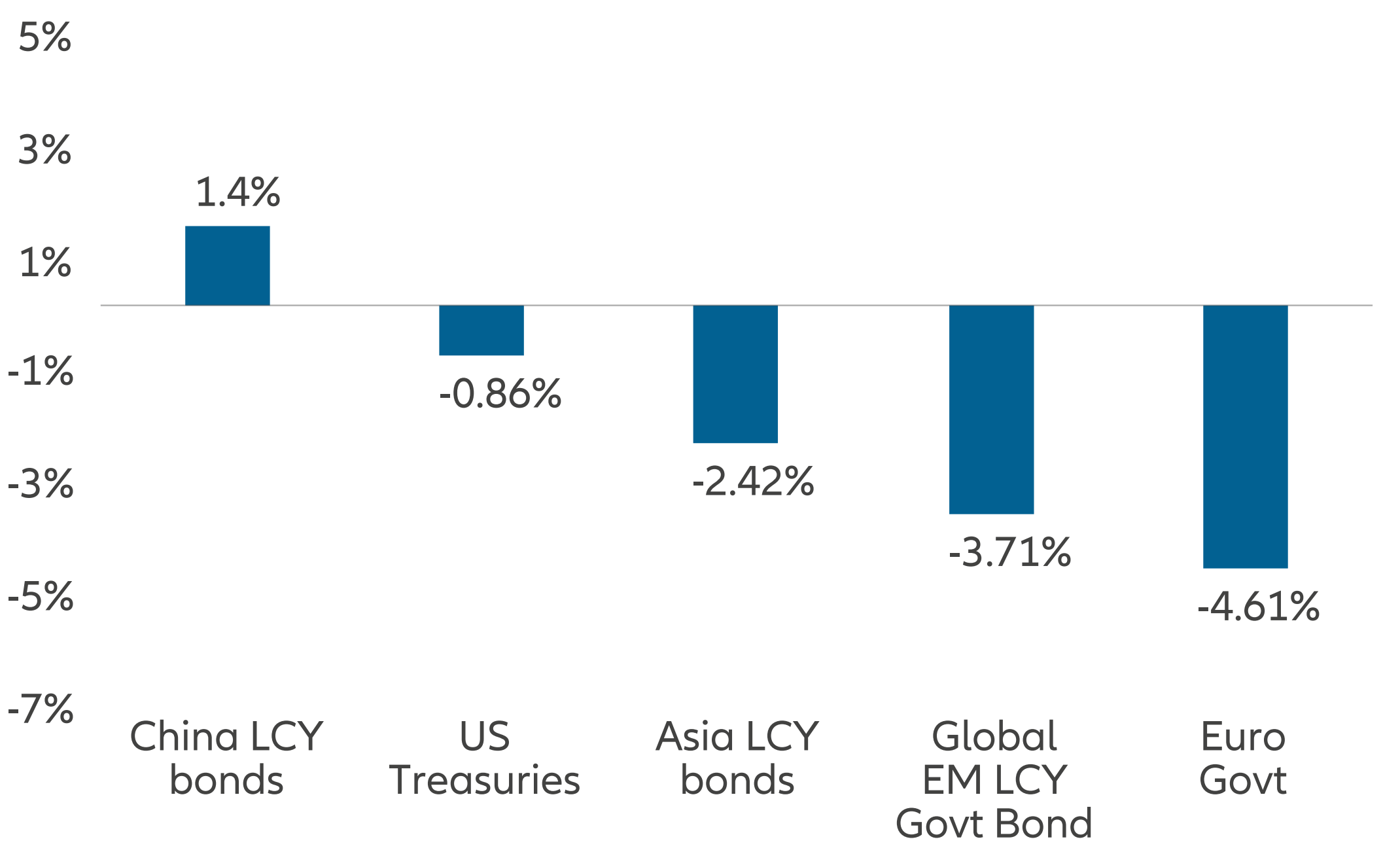

Exhibit 2: Global local currency markets performance (year to date)

Source: Bloomberg. Data as at 28 June 2024. Note: LCY = local currency.

Perhaps the biggest surprise is the strong performance of China fixed income. In the first half of 2024, China investment grade delivered a total return of 2.4%, China high yield rallied 13.9% and China government bonds returned 1.4% in USD terms.

The backdrop for this positive performance? We think Asia has entered a multi-year virtuous cycle, underpinned by stronger economic fundamentals, pro-reform governments, a superior infrastructure ecosystem and favourable demographic positioning.

These factors – combined with the region’s relative political stability – should enable Asia to capture new growth opportunities and attract large capital inflows. Over time, we think this will lead to lower FX volatility and a significant repricing of local bonds and credit.

Turning to the more immediate prospects for the region, we have identified three themes to watch during the rest of 2024. We think these themes underpin continued resilient performance for Asian fixed income.

Theme 1: Stable political landscape with policy continuity in the region

Other regions are seeing heightened volatility driven by political risk. In contrast, Asia has cruised through an election-heavy first half of the year with only minor bumps in the road.

- India: While the failure of Prime Minister Narendra Modi’s Bharatiya Janata party to win an outright majority disappointed markets, it does not materially alter India’s economic outlook. India remains in a sweet spot with steady economic growth, declining inflation and fiscal prudence. It is supported by multiple structural growth drivers including demographics, infrastructure investment and a manufacturing push. The full-year 2025 budget, unveiled by Mr Modi’s third term, continued to focus on fiscal consolidation, laying out a roadmap for long-term reforms while balancing economic priorities in the near term. We think the government’s plan to lower its debt ratio will be seen favourably by rating agencies.

- Indonesia: Incoming president-elect Prabowo Subianto has voiced his intention to increase fiscal spending and raise the country’s debt ratio to achieve 8% growth. As he sets out to gain a strong parliamentary coalition, the likelihood of legislative changes to relax fiscal rules – in particular, the 3% GDP fiscal deficit ceiling – is rising in the medium term and this will be a key risk to watch. These concerns are compounded by the scheduled departure in October of respected Finance Minister Sri Mulyani, who has been a reassuring safeguard of fiscal discipline. However, an improving foreign reserves outlook and conservative issuance target should support Indonesian government bonds in the near term.

- China: China’s Third Plenum just held – a key political meeting of the Chinese Communist Party – generated little surprise, based on the communique issued on 18 July. The long-term goal of building a “high-standard socialist market economy” by 2035 was reiterated. The tone of the communique was pragmatic with the word “reform” repeated 53 times and “development” 44 times. The Plenum was expected to focus on long-term structural reforms and strategies. But discussions touched upon this year’s GDP growth target (of 5%) and property and local government debt, signalling the recognition by the top leaders of the urgent need to address such issues.

We also await the year-end Central Economic Work Conference and the National People’s Congress next year for any legislation to facilitate the reform agenda. The month-end Politburo meeting will be more relevant for cyclical policies.

In general, we expect a continuity of policy adjustments since the April Politburo meeting, aiming to maintain a baseline of economic growth. The economy will continue to grow below potential because of structural imbalances and continuous drag from the property sector. But we expect incremental procyclical policies in the second half. Overall, we think China government bond yields are entering a consolidation phase after a strong bull run year to date, although we see limits on how much yields can rise.

- Thailand: One exception to Asia’s benign political outlook might be Thailand, where the political situation has been in flux for some time and presents major uncertainties around fiscal implementation and overall policymaking. This follows a period of expansionary pandemic-era fiscal spending that have raised debt levels materially, while GDP growth momentum remains lacklustre compared with regional peers. Against this backdrop, the ongoing constraints on both fiscal and monetary policy do not auger well for Thai assets, which could be volatile and underperform in the interim. Longer term, the market will be looking for signs that the leverage trajectory will eventually stabilise as a key anchor for offshore debt ratings.

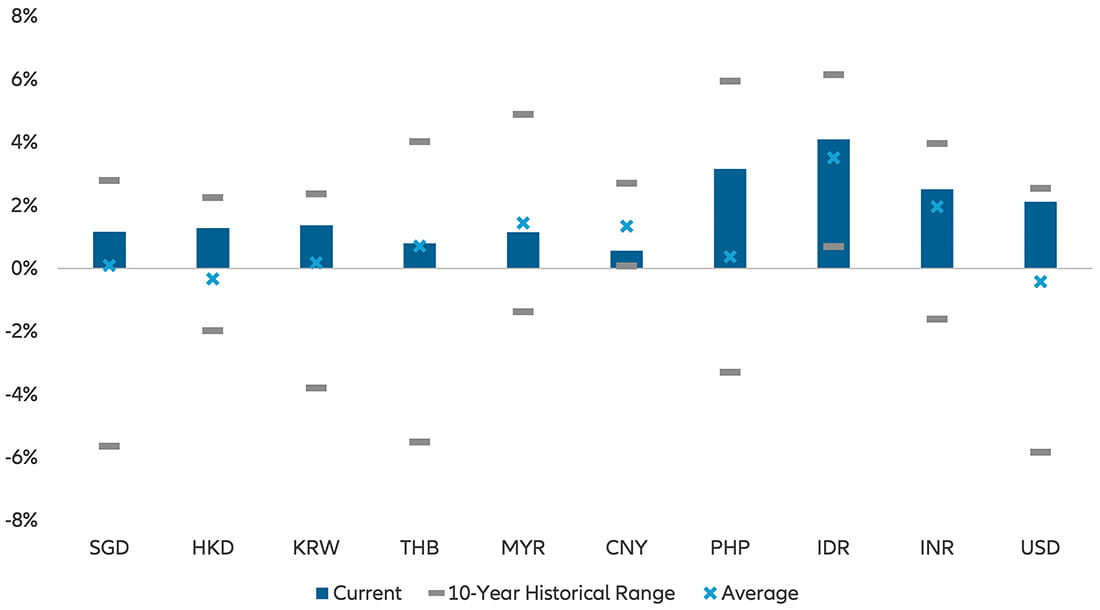

With the US Federal Reserve in no hurry to lower interest rates, we see carry as the main theme for Asian rates and FX strategy in the second half of 2024. We are constructive on higher-yielding bond markets where inflationary pressures are contained, such as Indian and Indonesian government bonds, preferring the 5-year tenor due to the flatness of both yield curves. For Asia FX carry, we favour a long Indian rupee (INR) versus the offshore Chinese yuan (CNH). Both central banks are committed to capping FX volatility, which further improves risk-reward. The Chinese central bank’s gradual fixing depreciation adds further upside to this carry trade.

We also see selective opportunities across Asian markets (see Exhibit 3). We are constructive on 3-year Korean Treasury bonds as we believe the odds of rate cuts are underpriced amid subdued inflation and increasing pressure for policy easing to spur domestic demand. Possible inclusion in the FTSE Russell World Government Bond Index (WGBI) in the upcoming September review provides further technical support for Korean Treasury bonds, given little pre-positioning by WGBI funds.

We also like to be positioned with long Indonesian rupiah (IDR) versus the Philippine peso (PHP), as both central banks adopted opposite approaches to FX management. Indonesia’s central bank is committed to IDR stability whereas its Philippine counterpart has been less interventionist. The latter guided that its policy stance has turned more dovish, with a policy rate cut in August more likely, and added that FX depreciation had limited impact on inflation. Despite the better entry level due to the IDR selloff, we remain mindful of Indonesia’s policy continuity risk.

Exhibit 3: Asian local currency government bond real rates

Source: Bloomberg. Data as at 28 June 2024. Note: SGD = Singapore dollar, HKD = Hong Kong dollar, KRW = South Korean won, THB = Thai baht, MYR = Malaysian ringgit, CNY = Chinese yuan, PHP = Philippine peso, IDR = Indonesian rupiah, INR = Indian rupee, USD = US dollar.

Theme 2: Improving credit cycle with continuous decline in default rate

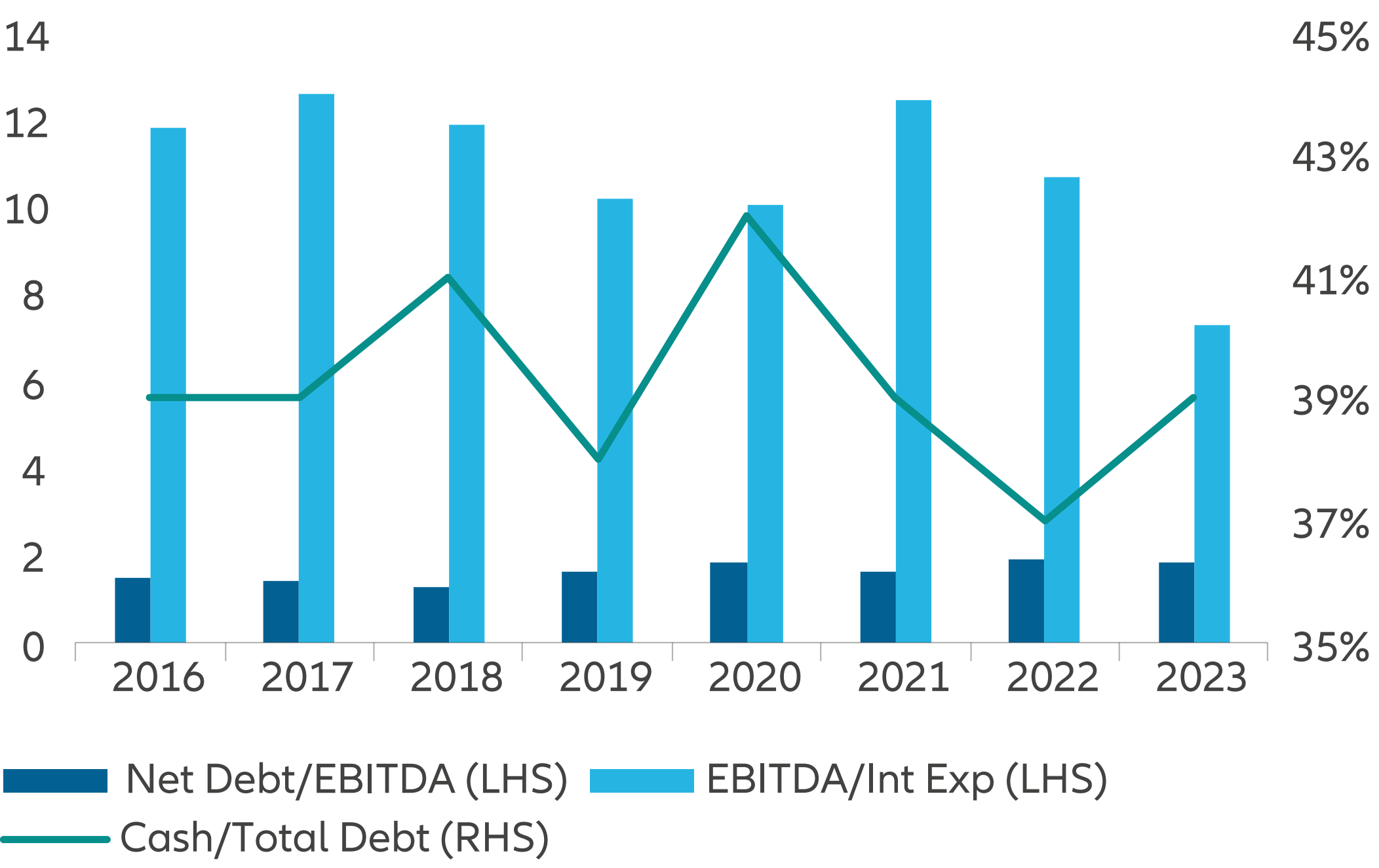

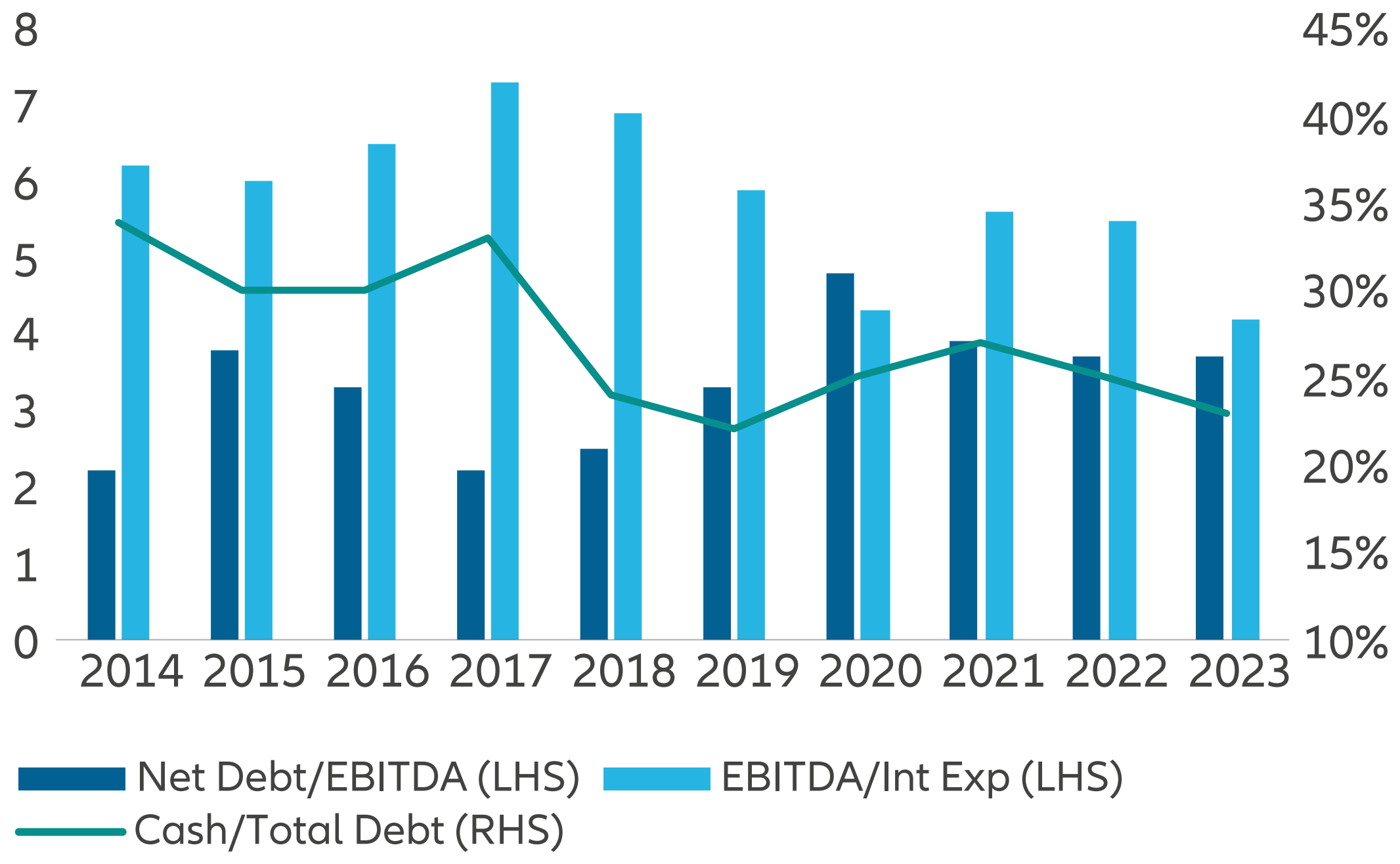

Earnings reported by Asian corporates and financial institutions confirm our opinion that Asian credit is in a sweet spot of the credit cycle. Most corporates have shown resilient fundamentals, evidenced by stable leverage and decent liquidity (see Exhibits 4 and 5).

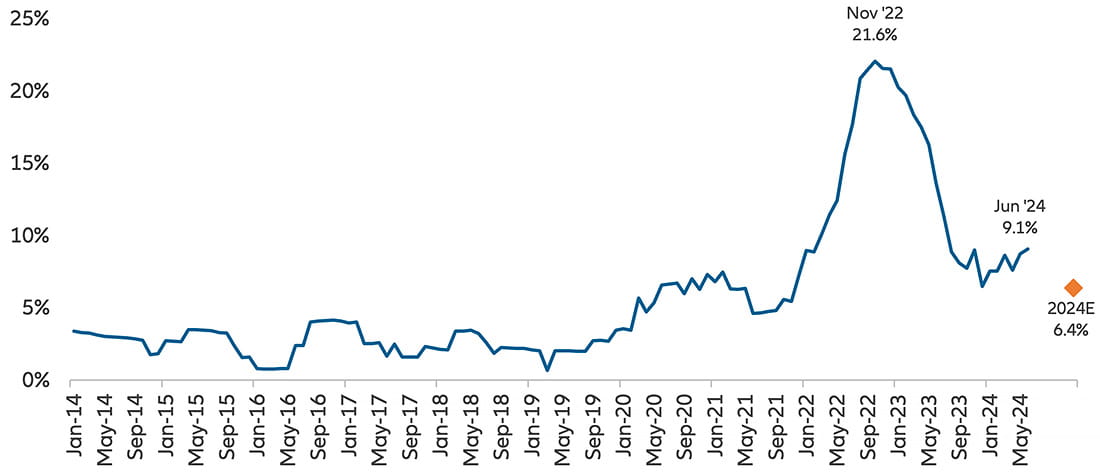

Downgrades have mainly occurred in sectors identified by our credit research as being in the downcycle, such as Chinese non-bank financials and Chinese real estate. Importantly, the Asia high yield default rate fell significantly to 9.1% in the first half of 2024 after being in double digits since 2021 (see Exhibit 6).2 We expect the rating trajectory to remain stable and the default rate to normalise to the mid-single digit range.

Exhibit 4: Investment grade corporates credit fundamentals

Source: JPMorgan. Data as at 28 June 2024.

Exhibit 5: High yield corporates credit fundamentals

Source: JPMorgan. Data as at 28 June 2024.

Exhibit 6: Asia high yield default rate*

Source: BofA. Data as at 30 June 2024. *Data pertaining to default rates reflect 12 months trailing default rates calculated based on number of defaults for Asian high yield.

Theme 3: Carry with risk discipline will be the key performance driver now that valuation is much tighter

The rally in the first half was largely broad-based. Sectors we are constructive on – such as Macau gaming, India infrastructure, China tech and Southeast Asia AT1s – are now much tighter than six months ago, leaving much less room for further spread tightening in the near future.

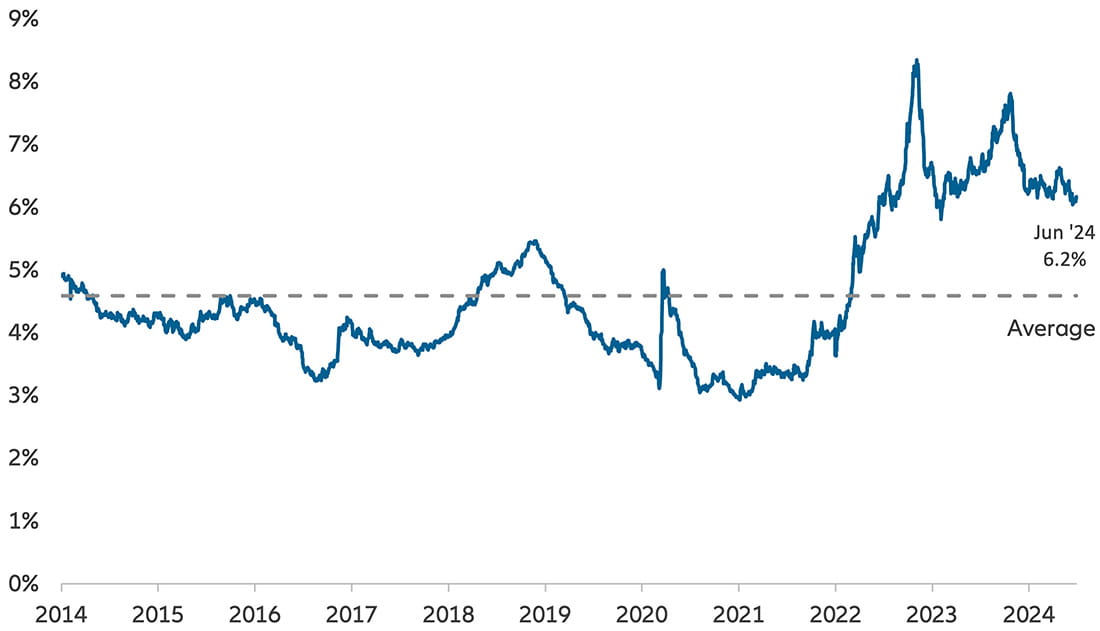

Nonetheless, on a total yield basis, we think the current 6% yield of the JACI China High Yield index remains attractive in a historical context. This makes carry the most attainable strategy, particularly given Asia’s stable fundamentals, supportive technicals and low historical volatility.

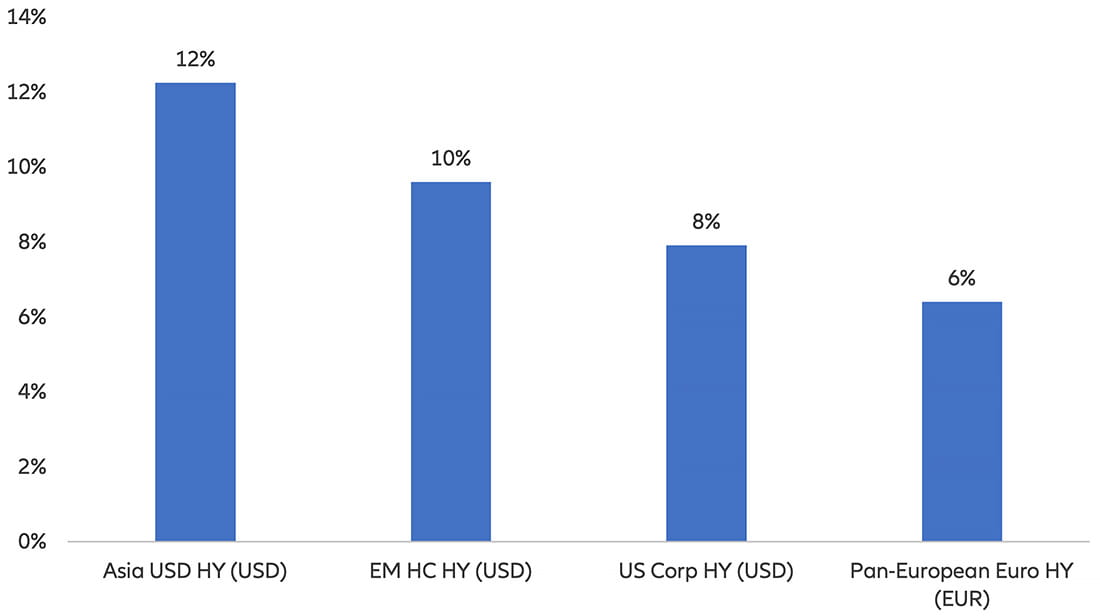

Moreover, we think Asian high yield remains attractive versus its peers in other markets, despite strong outperformance in the first half (see Exhibits 7 and 8).

According to JPMorgan, as of H1 2024, JACI BB corporates still offer approximately 100bps pickup versus US BB corporates, while JACI B corporates offer nearly 350bps over US single-B corporates. As the default rate continues to normalise, these risk premia will likely also normalise, although it may take longer than six months.

In our view, the best carry opportunities are from sectors and companies in the sweet spot of the credit cycle. These include Indian infrastructure, China utilities, Macau gaming and select bank capital securities, where the credit trajectory remains stable to positive, default rates are low and total yield is reasonable.

While mainly pursuing a carry strategy in the second half, we continue to see market dislocation and alpha opportunities in Asian credit, particularly in the high yield space. We also detect a certain level of complacency in the market after the strong first-half rally as risk appetite returns, which calls for risk management discipline.

All things considered, however, there are reasons to be positive about Asian fixed income in the months ahead.

Exhibit 7: Asian USD bonds yield to worst

Source: JPMorgan. Data as at 28 June 2024

Exhibit 8: Yield to worst of various high yield bonds

Source: JPMorgan. Data as at 28 June 2024

1. Source: Bloomberg, 28 June 2024

2. Source: BofA, 30 June 2024. Data pertaining to default rates reflect 12 months trailing default rates calculated based on number of defaults for Asia high yield.

3755212