Embracing Disruption

Tapping into the potential of thematic investing

Discover how an unconstrained thematic investing approach can help participating in the growth prospects resulting from an all-encompassing disruption.

Key takeaways

- In a world shaped by fundamental societal, environmental, and technological shifts an unconstrained thematic investing approach can help identify multiple new angles for participating in the growth prospects resulting from an all-encompassing disruption that is set to shape every aspect of our daily lives.

- We analyse several drivers behind disruptive megatrends and discuss their impact on and implications for our chosen themes in thematic investing.

Energising a growing power demand in a sustainable way

With a constantly growing appetite for energy, not least driven by the thirst of a continuously swelling number of data centres needed for the training of (large) artificial intelligence applications and to cover our increasing reliance on a digital infrastructure, smarter and more sustainable energy generation and energy storage solutions can help both satisfying a developing energy demand and avoiding greenhouse-gas (GHG) emissions.

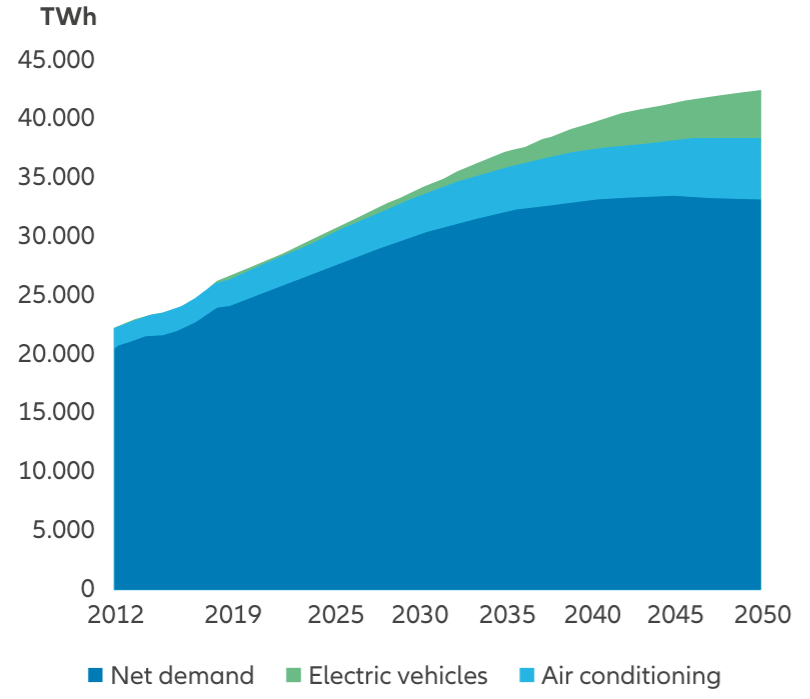

Exhibit 1: Demand for electricity will double by 2050

Source: New Energy Outlook 2019, BNEF 2019. June 2019.

Here, the further proliferation of more sustainable energy production and storage solutions, and the build-out of renewable energy capacities, can set the course towards natural-resources-saving ways of how energy is produced, consumed, and saved, fostering the electrification of public and private transport.

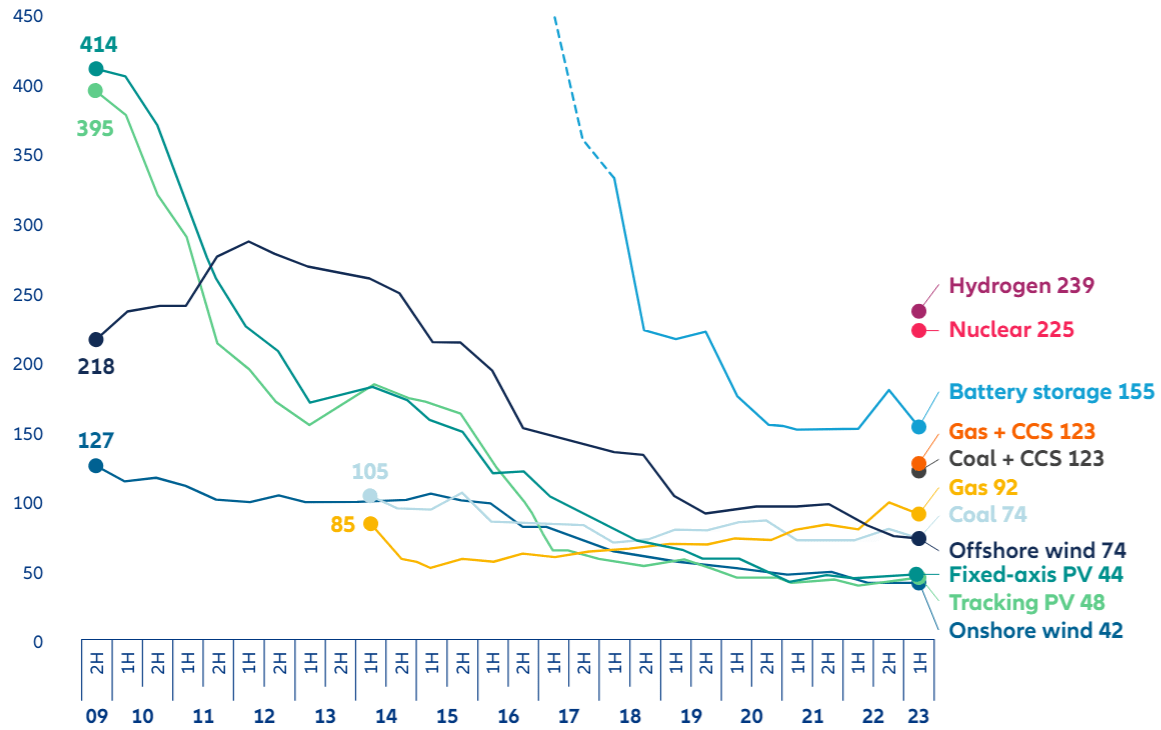

Combined with falling producer prices in key sustainable energy technologies and markedly lower costs for energy from sustainable sources, the greater penetration of renewable energy will also boost large-scale investment into renewable technologies and strengthen their competitiveness in the long run.

Exhibit 2: Global levelised cost of electricity benchmarks, 2009–2023, USD/MWh (real 2022)

Source: BloombergNEF. As of June 2023.

Finally, prominent advocates for an accelerated development of energy efficiency and sustainable energy solutions – such as last year’s COP 28 pledge to triple renewable energy capacity globally and to double the global average annual rate of energy efficiency (from 2% p.a. to 4% p.a.)1 – can give an additional boost to the expansion of renewables.

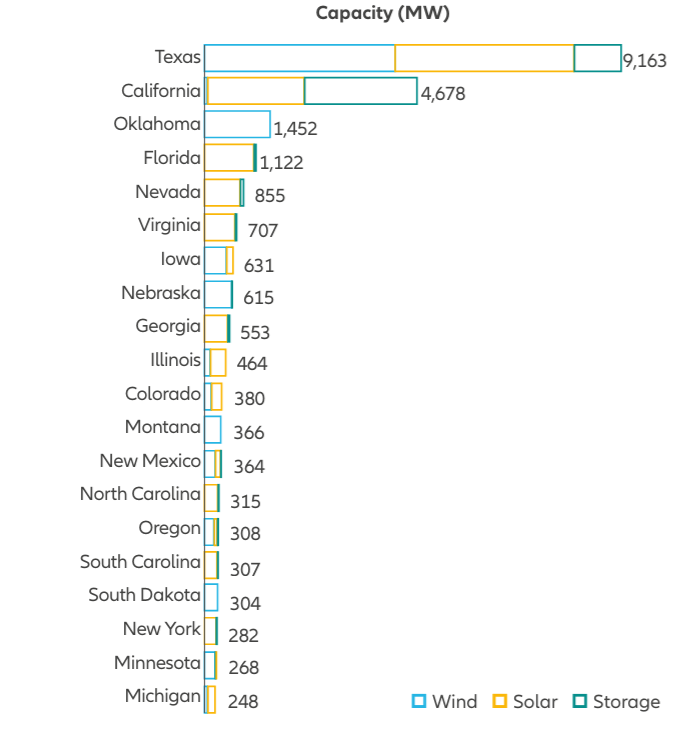

An impressing proof of a significant clean-energyaugmentation is reflected by the wind- and solar energy additions in Texas in California in 2022, catapulting the “Lone Star State” and the “Golden State” to the top two places for US-wide clean energy additions.

Exhibit 3: Texas and California, frontrunners in clean clean power additions in 2022

Source: American Clean Power CLEAN POWER ANNUAL MARKET

Artificial Intelligence, a cross-sector catalyst that has the potential to disrupt industries and enlarge its share of value added (Digital Life)

With their growing significance and increasing proliferation, large language models like ChatGPT, and artificial intelligence (AI) in general, have become an integral part of our everyday life. They are already profoundly shaping the way we live, work, produce, communicate, and collaborate. And this is only set to accelerate.

While AI’s integration in core business processes is gaining momentum across all industries, the transformation of selected sectors may be more marked.

- Building multi-layered lines of defence for business processes, data, and IT infrastructure: with the integration of automated threat detection, malicious patterns prediction, accelerated data protection and risk-based conditional access features, AI-enabled cyber security solutions – a market projected to grow at a double-digit compound annual growth rate (CAGR) of 19.4% between 2023 and 20322 – can help protect companies from sophisticated cyber-threats.

- Regulatory framework to foster global cyber security market growth: cyber security regulations like the in December 2023 by the US Securities and Exchange Commission (SEC) adopted new disclosure requirements for cyber incidents are likely to further raise companies’ priority and budget focus on regulation-compliant security.

Building the backbone for digital lifestyles

A growing urban population that by 2050 is forecasted to account for more than two thirds of the world’s inhabitants3, is facing acute challenges like inadequate urban infrastructure, rising levels of pollution, growing water and energy consumption, and surging social inequalities. Addressing these pressing challenges means to foster the further build-out of smart cities with more efficient and more sustainable infrastructure. This is even more the case when considering the economic weight of the world’s cities that are responsible for more than 80% of global GDP4 and forceful drivers of a prospering global smart cities and smart building market projected to reach nearly USD 7 trillion by 20305 and USD 127 billion by 20276 respectively.

So, speeding up the build out of smart cities requires innovative transport solutions. Furthermore this also implies to augment digital solutions for a real-time assessment of critical resources like energy and water, for instance by integrating sensors and real-time data for leak detection and predictive analytics, and to extend smart communication infrastructure as the backbone of digital lifestyles.

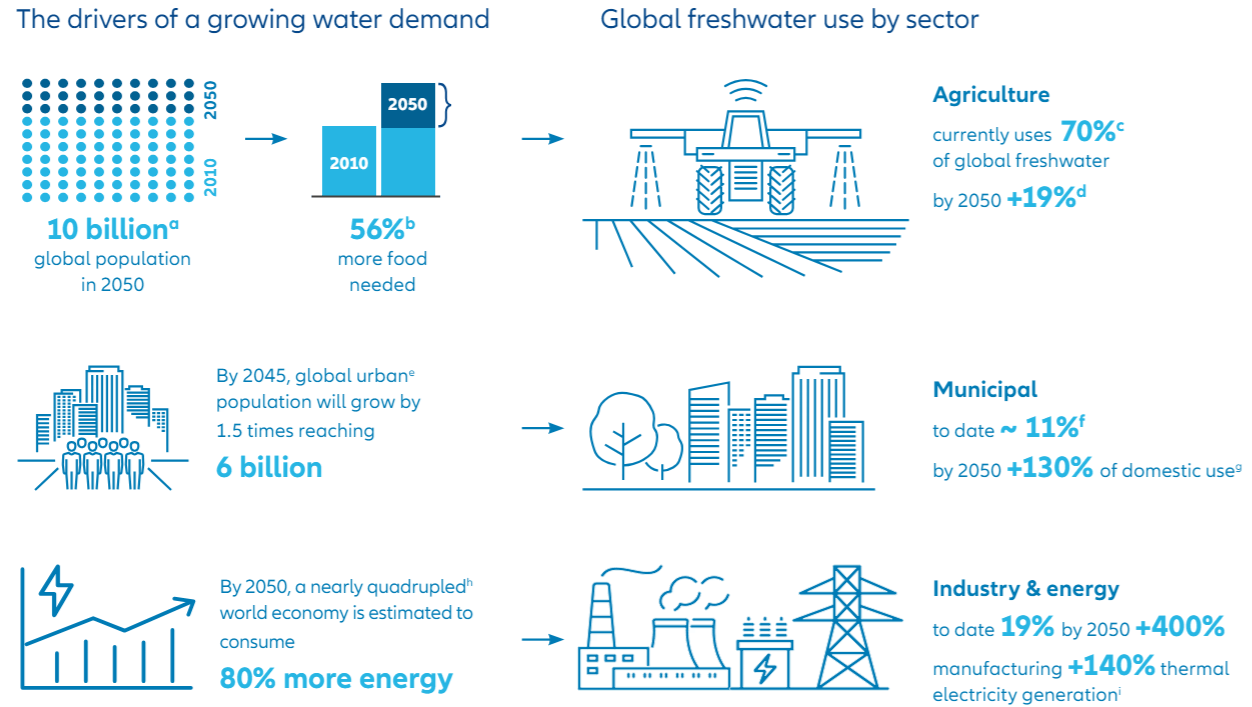

Paving the way for sustainable water solutions

Investments in solutions that focus on improving the resilience of strained natural freshwater resources, such as aquifers and groundwater reservoirs, are among the most important levers to ensure water provision for an ever-growing global population, with correspondingly higher food and energy demands, both of which heavily rely on sufficient water supplies.

AI’s transformational impact on industrial automation and production

With their growing significance and increasing proliferation, large language models like ChatGPT, and artificial intelligence (AI) in general, are already profoundly shaping the way we live, work, produce, communicate, and collaborate. And this is only set to accelerate.

While AI’s integration in core business processes is gaining momentum across all industries, the transformation of selected sectors may be more marked.

- Next evolutionary step in industrial automation: AI-powered digital twins can help improve automated factory production lines – from automotive to food production to retail – while cutting down on labour costs, enhancing efficiency, reducing redundancies, and improving throughput.

- AI delivering long-term value to the semiconductor industry: according to a recent McKinsey survey7, semiconductor companies could massively benefit from deploying AI, potentially adding an annual value of up to USD 95 billion over the long term.

From health care to patient-tailored treatments

Translating the disruptive potential of AI into the health sector means transforming a one-size-fits-all approach into individually tailored health services based on patients’ personal needs and history. In addition to improved patient experiences, the integration of AI into the health care sector can also contribute to significantly accelerated drug discovery processes, eliminating time– consuming trial-and-error and contributing to considerable cost savings. Not least, using AI-enabled solutions can help detect diseases earlier or even prevent them, foster the further development of robot-assisted minimally invasive surgery, and reduce patient travel for minor diagnoses or follow-ups by means of telemedicine/ telehealth applications.

- Advancing health tech though with room for improvement: following a recent OECD study, over half of OECD countries are still badly prepared to embrace the digitisation of their health systems. While almost 90% stated to have an online health portal available, in only 42% of the countries the public could both access and interface with all their health-related data through the designated portal8.

- AI, mHealth and governmental digitisation efforts driving health tech growth: according to analysts, the global smart healthcare market is expected to reach a value of USD 482 bn by 2027, more than doubling the USD 216.63 billion reported for 2022 and expanding at a double-digit pace of 19.70% annually over the next three year9.

The main drivers behind this robust growth can be identified in AI applications such as AI-enhanced conversational agents and virtual assistants, in the rise of wearables/mobile health applications like blood glucose levels monitoring sensors and, not least, in more and more governments expanding funding for health tech research and development.

- More info, more income, higher demand for longterm care: the baby-boomer generation (adults born between 1946 and 1964) today represents the largest population segment in many countries. In the US, this birth cohort makes up around 70 million of the total population, the second-largest generation group behind Millennials (approx. 72 million)10 holding 70% of all disposable income and projected to have over USD 53 trillion in wealth in 2030, equivalent to around 45% of all household wealth11.

- Within the baby-boomer generation, multimorbidity (living with two or more chronical/long-term health conditions) is the “big elephant in the room of […] health care systems12” driving both healthcare expenditures and the demand for medical resources far above current levels. However, the baby-boomer generation, in contrast to widespread perceptions, are embracing technological innovation, with studies saying almost three third of them actively engage with digital healthcare activities.

How the rise of Gen Well opens up new business opportunities

Gen Z (born between 1997 and 2012) and Gen Y/ Millennials (born between 1981 and 1996) together now make up about 40% of the global population and 50% of the global workforce13. Gen Z is expected to surpass the Boomer generation (born from 1946 to 1964) as a percentage in the workforce in 2024 implying a significant cultural shift. This socio-demographic megatrend opens new opportunities for companies, that can adjust to fundamentally changing consumption patterns across the age cohorts.

- Most diverse, educated, connected, and most socially conscious. Both, Gen Z and Gen Y/Millennials have different values, preferences and behaviours, than older generations, and they are reshaping the world to their image as they move into decision-making positions within companies and politics. With a particular focus on quality over quantity and conscious and mindful consuming patterns, these generations prioritise experiences, sustainability, and social responsibility in their buying habits.

- Companion Animals – Pets are the new children. Millennials and Generation Z are at the forefront of the trend of humanisation of pets, having grown up with pets and considering them essential family members. They prioritise the health and well-being of their pets to a higher degree than previous generations and demonstrate a willingness to spend more on high-quality health care, nutrient-rich food, and premium services, offering several investment angles to participate in this growth.

Bottom line

While the disruptive forces behind the megatrends remain intact, individual drivers of these fundamental shifts may change, both in terms of their weighting and their socioeconomic significance. In this context, it is even more important to diversify and to precisely identify those themes that will benefit most from the major transformations of our time and make them investable for investors.

1 International Energy Agency: Massive expansion of renewable power opens door to achieving global tripling goal set at COP28. As of January

2024

2 Deloitte.com: AI in cybersecurity: A double-edged sword. As of 2023.

3 Our World In Data – urbanisation, November 2019

4 https://www.un.org/en/un-chronicle/it%E2%80%99s-all-about-cities-we-mustn%E2%80%99t-flip-coin-sustainable-investment. As of October 2023

5 Precedence Research January 2023

6 Precedence Research 2020

7 McKinsey on Semiconductors. As of November 2021

8 OECD (2023), Health at a Glance 2023: OECD Indicators, OECD Publishing, Paris

9 Precedence Research: Smart Healthcare Market Will Grow at CAGR of 19.7% By 2027. As of November 2023

10 Statista: Resident population in the United States in 2022, by generation. As of August 2023

11 Deloitte University Press: The future of wealth in the United States. Mapping trends in generational wealth. As of November 2015

12 Oxford Academic - The Journals Of Gerontology: An International Perspective on Chronic Multimorbidity: Approaching the Elephant in the Room.

As of October 2018

13 PwC Uganda: How prepared are employers for Generation Z? As of 2022

3600521