Supply chain shake-up sparks innovation revolution

New technologies are helping companies reinvent disrupted supply chains and build more resilience into the system.

Key-takeaways

- Supply chains are still reeling from the impact of Covid-19, crisis in Ukraine and deglobalisation in some sectors

- Upheaval to trade may impact corporate earnings, but companies are mitigating risks by shaking up their supply chains and investing in technology

- Amid the disruption, investors can find opportunities in sectors such as robotics, data centres, and agricultural technology that underpin the supply chain revolution

While the recent resumption of grain shipments from the port of Odesa offers some relief to the myriad countries reliant on Ukraine for food staples, the supply chain stresses that have beset the global economy since 2020 are lingering.

Shortages of goods from toilet paper to semiconductor chips have been a headache for consumers and businesses alike around the world over the past two years or so, due to factors ranging from Covid-19 to deglobalisation in certain sectors and, most recently, the crisis in Ukraine.

While there are some signs of supply chain pressures easing most recently, stresses remain at historically high levels and the risk of escalating geopolitical tensions, labour strikes and further Covid-19 lockdowns in China loom on the horizon.1

But this period of disruption has a silver lining. In many instances, it is accelerating innovation as businesses seek to future-proof their operations, often by investing in technology or overhauling decades-old supply chain strategies.

For investors, the shake-up represents both challenges and opportunities for their portfolios.

In the shorter-term, the supply chain dislocation is likely to squeeze corporate profit margins, particularly for those companies most vulnerable to higher costs caused by supply delays. These companies include transport and logistics firms, manufacturers and retailers. In the longer-term, however, investors can position for opportunities in areas from robotics to supplier diversification as businesses seek to build more resilience into their operations.

Investing in innovation

So, how are companies innovating in the face of today’s disruption? From managing greater inventory build-up to helping pack shipments more efficiently, companies are exploring how to optimise supply chains through automation and smart use of data. This includes greater use of robots. With many firms grappling with higher expenses from surging inflation, robots can also help companies streamline routine tasks such as inventory and fulfilment, while managing labour costs, focusing on staffing in higher-value areas where automation isn’t viable.

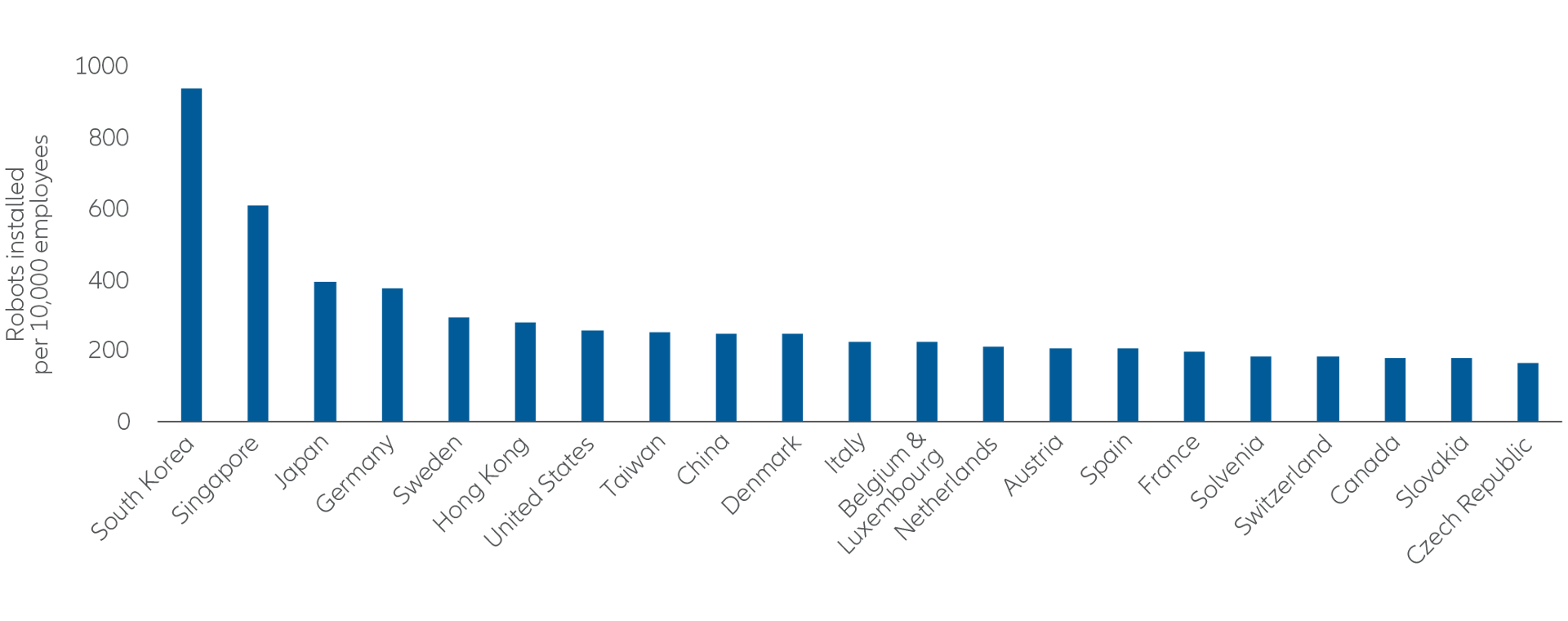

And there’s potential for more investment. Currently, there are 126 industrial robots per 10,000 manufacturing jobs globally, implying a robot density of about 1%, according to the latest figures from International Federation of Robotics. High single-digit robot density in manufacturing hubs like South Korea and Singapore shows the potential for catch-up in markets such as China, the US and France, where density is much lower (see Exhibit 1).2

Exhibit 1: Robot density in the manufacturing industry

Note: Robot density nearly doubled globally – International Federation of Robotics (ifr.org).Source: World Robotics 2021.

Focus on food

Another area of innovation is agricultural technology. Food security fears intensified by the Ukraine crisis and Covid-19 have ignited further interest in agricultural technology. Food prices reached record highs in the early part of 2022 and although they’ve since eased, high fertiliser prices, a bleak economic outlook and currency movements could threaten the outlook. We think this will open the way for more investment in agricultural technology and water irrigation equipment.

The sector’s long-term growth outlook has strengthened in recent years as more countries seek to build resilience into food supply chains to reduce the impact of increasingly regular natural events such as drought and floods brought on by climate change. Investment in farm tech venture capital, spanning everything from the use of robots to GPS technology, surged to a record USD 11.3 billion in 2021, up 61% from the previous year.3 Spending is likely to ramp up further as modern farm technology brings down usage of water, fertiliser and pesticides.

Gathering the data

Other technology in the form of advanced analytics can help companies plan and navigate risks. One of the challenges highlighted by the recent supply chain instability was that very few firms had an overview of their supply chains at every stage. According to a 2021 McKinsey survey, companies that successfully managed the Covid-19 pandemic were 2.5 times more likely to report they had pre-existing advanced-analytics capabilities.4 Firms investing in advanced analytics might be better placed to ride out supply chain dislocations and economic headwinds. The thirst by companies for more sophisticated information is also sparking greater interest in data centres. For investors, data centres offer diversification and exposure to assets with long-term growth drivers.

Supply chain shifts

But aside from appreciating the technological revolution, investors also need to be attuned to broader strategic changes businesses are making to their supply chain management – and seek out those companies taking a proactive approach to the recent challenges.

A significant hurdle thrown up by the recent disruption has been limitations in companies’ ability to respond in an agile way to changes in consumer demand or geopolitical events, such as US-China trade tensions, Britain’s exit from the European Union, or the crisis in Ukraine.

In response, some car manufacturers and other firms are ripping up just-in-time models that have formed the backbone of supply chain management for decades in favour of just-in-case, which requires holding greater inventory.

Other firms are diversifying suppliers in the form of nearshoring – the process of transferring manufacturing or supplier business closer to the location of customer demand.

Nearshoring trends may help support interest in local warehouses as more firms seek to build greater supply chain resilience to help guard against bottlenecks caused by either geopolitical flare-ups or a repeat of the shortages that plagued supplies during the Covid-19 pandemic.

In some cases, governments are seeking to reduce their countries’ reliance on key components sourced from overseas. In August 2022, the United States passed a law to provide billions of dollars of subsidies for domestic semiconductor production and research. The European Union and others have announced similar plans to develop their own chipmaking industries. Eventually, that may help ease a global chip shortage stoked by surging demand for cars and other products that include chips.

Those companies that manage supply chain challenges now could be better positioned to ride out – and even thrive – during periods of future disruption.

In summary, investors should think strategically about what supply chain issues mean for their portfolio – both the impact on assets from short-term disruption and the longer-term opportunities that may arise from broader structural shifts in manufacturing and logistic markets and the technologies that support them.

1Source: Global Supply Chain Pressure Index, Federal Reserve Bank of New York, July 2022

2Source: 2021 World Robot Report, International Federation of Robotics, December 2021

3Source: Investment Monitor (citing PitchBook data), 8 July 2022

4Source: McKinsey, 23 November 2021

The Ukraine crisis and the related sanctions against the Russian Federation, the separatist regions of DNR and LNR, and Belarus are constantly evolving. The statements included herein are as of the date provided and are subject to change.

2413044