Navigating Rates

Regaining potential value in high-income

High-income bonds could be a beneficiary of an eventual steadying in inflation and core rates. In the third of four articles exploring ways that investors can reset bond allocations, we look ahead to potential opportunities that could emerge within high-yield corporates and emerging market debt.

Key takeaways:

- High-yield fixed income has been shaken by volatility in bond markets in recent months.

- A stabilisation in inflation and rates could help high-income bonds find positive momentum.

- Investors may consider looking out for three catalysts for a turnaround in emerging market debt.

- For both global high-yield and emerging market debt, we favour strategies that try to tilt towards higher-quality issuers.

High-income bonds – fixed income assets typically rated below investment-grade – have felt the brunt of much of the volatility in bond markets in recent months as investors have focused on the challenges of rising inflation and interest rates. But once inflation and core rates stabilise, we think high-income assets could find positive momentum soon after.

Investors may be hoping that central banks can bring inflation under control and engineer a soft landing, ie, a less severe economic slowdown, for the major advanced economies. But policymakers have yet to demonstrate the precision required to avoid too large a deterioration in consumer demand, employment and economic activity more broadly.

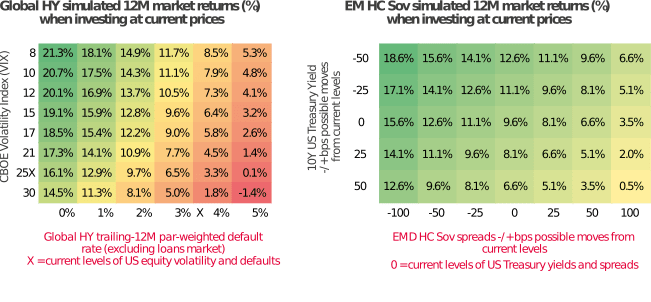

Recessions beckon in Europe and the US but spread asset valuations are not yet at recessionary levels. Still, two markets stand out which, at current yields, could offer a potential income cushion and potential long-term total returns: global high-yield corporate bonds and emerging-market external sovereign debt (see Exhibit 1).

Exhibit 1: at current yields, high-yield corporates and emerging-market sovereigns could offer a potential income cushion and upside

Source: Bloomberg. ICE. Allianz Global Investors. Data for global high-yield as at 31 October 2022. Data for EM HC Sov as at 2 November 2022. Global HY=ICE BofA Global High Yield Index. EM HC Sov=JP Morgan Emerging Market Bond Index (EMBI) Global Diversified. Past performance does not predict future returns. See the disclosure at the end of the document for the underlying index proxies, important risk considerations and simulation methodologies.

Some favourable factors for high-yield

First, we look at global high-yield corporate bonds. We see several reasons to be cautiously optimistic about their potential outlook:

- Many high-yield issuers have eased financing pressures by lengthening the terms of their debt, leaving a more limited short-term refinancing wall than in previous years.1

- Much higher starting yields could now provide a cushion, potentially making it harder for the market to deliver negative returns from here.

- Technical factors also seem potentially favourable at this stage. As long as spread volatility remains high, fewer issuers may come to market to issue new debt, and broker-dealer inventory of existing bonds could also stay low – helping to ensure coupons and proceeds from maturing bonds flow back to a more limited stock of high-yield bonds, creating possible excess demand that could support prices.

- But investors should consider actively-managed strategies as high-yield corporate bonds could pose greater volatility, as well as default-rate risks.

Default risk expectations could help guide investors

But investors need to be cognisant of default risks as major economies slow down. Our credit research team estimates the default rate in developed-market corporate debt rated BB-B at around 2.5% over the next 12 months. The global high-yield market could be closer to 5% due to the inclusion of CCC-rated credits and emerging markets (especially Asia) where default risk is substantially higher.

In a normal market environment, a 2.5% default rate would imply a spread of around 410 basis points, whilst currently investors are being paid around 465.2 But current conditions are far from normal, so historical spread averages and percentiles provide little comfort. There could be further rates- and spread-driven selloffs in the weeks ahead. Such episodes could potentially provide opportunities to buy select credit.

Divergence between good and bad credit

In the scenario of a hard landing for major economies, weaker consumer demand could make it more difficult for companies to pass on rising input costs, thereby eroding margins. This is worrying since much of the corporate deleveraging we have seen recently is driven more by earnings growth than debt reduction.

More cyclical and lower-rated credits remain the most vulnerable. For instance, there was a distinct underperformance of CCC spreads. Year-to-date they have widened 580 basis points compared to 130 basis points for BB and 140 basis points for B, illustrating that concerns are focused on the weakest part of the market.3 Similarly, the US consumer cyclical index has widened 203 basis points, while the consumer non-cyclical index has widened just 83 basis points, illustrating concerns about the economy.4

Away from macro forces, we see the biggest risks lying with idiosyncratic business failures. Expect more acute potential performance differentiation between good and bad credits over time.

Challenging backdrop to emerging markets

Emerging-market external sovereign debt is our second area of focus. For emerging markets, it’s hard to see how the news flow can become incrementally worse from here. Much of the debt is long-dated and prices have fallen as US interest rates have risen. The sell-off also reflects poor liquidity and an increase in default risk. Countries which have effectively defaulted or undergoing debt restructuring include Belarus, Lebanon, Sri Lanka, Suriname, Russia and Zambia.5 Moreover, unrecorded restructurings of bilateral loans provided to emerging economies by Chinese state-owned entities are likely to have ballooned, according to the International Monetary Fund.6

It’s important to remember that emerging-market external debt is a very mixed bag. There are around 80 emerging-market countries that issue sovereign debt in USD and are characterised by different debt dynamics. For example, the commodity price surge has been supportive of balance of payments positions across several countries in Latin America and the Middle East.7 In contrast, external balance sheets have become much worse for some commodity-importing countries in eastern Europe and Asia.8 Another characteristic of the asset class is that about 60% of the market value of outstanding US dollar bonds is rated investment-grade.9 The yield premium of high-yield over investment-grade debt has reached historically high levels in 2022, as has the number of bonds trading at distressed levels well below average recovery values.

Signposts to watch for emerging market recovery

We believe there is a trio of catalysts to watch out for closely, to be ready to potentially increase emerging market exposure:

- A deceleration (not just stabilisation) in energy and food inflation which constitutes a larger share of consumption baskets in emerging markets.

- A recovery in economic data from China, which is a major buyer of emerging-market goods.

- Some loosening of global (dollar) liquidity, which tends to underscore flows into emerging market debt.

Still, the potential for increased rates of default and volatility means careful selection and management of assets is important to help offset the greater risks inherent in emerging markets.

Two guidelines to follow

For both global high-yield and emerging market debt, we favour investment strategies that aim to do two things well. Firstly, strategies that try to tilt toward higher quality issuers with healthy or improving debt and environmental, social and governance dynamics, without being constrained to the credit rating distribution of a benchmark index. Secondly, it’s important that strategies aim to allocate freely across geographies, without being tied to major swing sectors in specific regions such as energy or property.Investors following these two guidelines could potentially be well positioned to benefit from a potential regain in value of high-income bonds.

1. Source: Credit-trends: where to look for refinancing vulnerabilities through 2023 amid market turmoil, S&P Global Ratings, June 2022

2. Source: ICE BofA Global High Yield Index, November 2022.

3. Source: ICE BofA Global High Yield Index, November 2022.

4. Source: the ICE Diversified US Cash Pay High Yield Consumer Non-Cyclical Index and the ICE Diversified US Cash Pay High Yield Consumer Cyclical Index, November 2022.

5. Source: Global Financial Stability Report, IMF, October 2022.

6. Source: Shining a light on debt, IMF, March 2022.

7. Source: Regional Economic Outlook for the Western Hemisphere and Regional Economic Outlook for the Middle East and Central Asia IMF, October 2022.

8. Source: Regional Economic Outlook for Europe and Regional Economic Outlook for Asia and Pacific, IMF, October 2022

9. Source: JP Morgan Emerging Market Bond Index (EMBI) Global Diversified, November 2022

A rating provides no indicator of future performance and is not constant over time.

The Chicago Board Options Exchange (CBOE) Volatility Index (the VIX) measures the expected 30-day market volatility of the US equity market, based on aggregating weighted prices of call and put options on the S&P 500 Index over a wide range of strike prices.

The ICE BofA Global High Yield Index tracks the performance of USD, CAD, GBP and EUR denominated below investment-grade corporate debt publicly issued in the major domestic or eurobond markets.

The JP Morgan EMBI Global Diversified Index tracks liquid, USD-denominated emerging market fixed- and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

The ICE Diversified US Cash Pay High Yield Consumer Non-Cyclical Index consists of USD-denominated below-investment grade bonds from corporate issuers in the consumer non-cyclicals sector, including the consumer goods, discount stores, food & drug retail, restaurants, and utilities sub-sectors.

The ICE Diversified US Cash Pay High Yield Consumer Cyclical Index consists of USD-denominated below-investment grade bonds from corporate issuers in the consumer cyclicals sector, including the automotive, leisure, real estate development & management, department stores, and specialty retail sub-sectors.

Simulation methodology for global high-yield corporate bonds: To calculate returns, we first take the current effective yield of the ICE BofA Global High Yield Index. High-yield spreads are a function of expected default rates with an assumed 35% recovery rate, plus an illiquidity premium that is correlated to the VIX. We compute what spreads should be under the default and VIX scenarios in the table. We then look at the change in spread from the current level for the Index and multiply this by the duration of the Index. This impact is added to/subtracted from the Index’s effective yield. Finally, we take the default rate less the 35% recovery rate, and then deduct that number from the return calculation to give us the expected Index returns. Note that we make no assumptions on changes in interest rates.

Simulation methodology for emerging-market external sovereign bonds: Index returns for emerging-market external sovereign bonds are composed of moves in US Treasury yields, moves in emerging-market credit spreads, and the carry from being long the JP Morgan EMBI Global Diversified Index over the holding period. We look at the change in yield and spread, multiplied by the duration of the Index, and add/subtract this figure to/from the yield of the Index to calculate the expected Index returns.

2862699