Embracing Disruption

The pillars of premium brands’ price-setting power

Thanks to their price-setting power, premium and luxury brands can offer compelling investment opportunities, even in high inflation environments.

Key takeaways

- With inflation level remaining high, companies with high profit margins are less affected by consumer reticence.

- Spurred by several growth drivers, premium brands and providers of premium services are in a more favourable position to pass on the cost increases to consumers, resulting in higher pricing power.

- Premium and luxury brands can offer compelling investment opportunities, further backed by favourable trends that fuel long-term structural growth and the sector’s resilience in the face of changing economic landscapes.

Over the past few decades, the premium brand segment has experienced impressive growth pushed by strong market dynamics. Between 2003 and 2022, it maintained a compound annual growth rate (CAGR) around 6%, propelling the estimated value of the global personal luxury goods market to reach 353 billion Euros in 2022. The industry is expected to continue its upward trend with a projected 5.9% CAGR until 2030.

Personal luxury goods* revenues 2003 – 2030 (forecast) in € bn

Source: Bain.com. As of June 2023

Did you know?

The Veblen effect describes a scenario wherein the demand of a premium good rises with an increase in price as higher prices make premium brands more desirable for consumers – an inversion of the law of demand which states that with an increasing price the demand decreases.

Premium brands’ past and future skyward trajectory is mainly fuelled by four drivers:

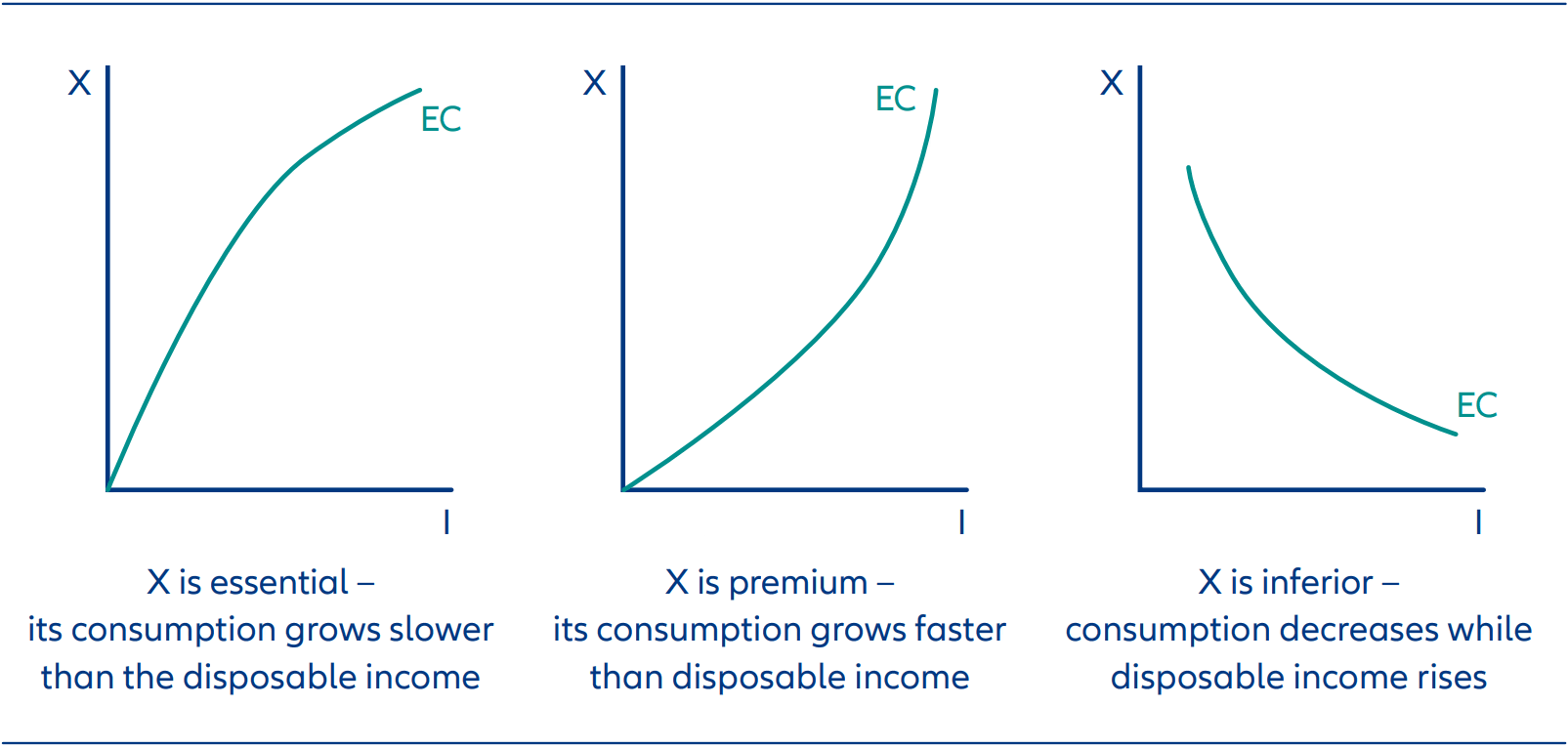

High elasticity in demand

With people becoming wealthier, they will disproportionately tend to buy more premium-segment goods due to a lower price sensitivity and the wish for exclusiveness and uniqueness. This, in turn, leads to higher consumer spending. Even if prices for premium goods increase significantly, consumers favour to postpone rather than to refrain from purchasing.1 This said, manufacturers of premium brands can maintain or even expand their typically higher margins.

Engel curve (EC) for essential, premium and inferior goods

Engel curve describes the interplay between household expenditure on a dedicated good or service and household income

The emergence of Gen Z

A significant portion of Gen Z’s spending, which is projected to grow three times faster than other generations through 2030, is predicted to go towards premium brands, as they have shown an early affinity for these products, particularly with the increasing visibility of the goods on social media and digital platforms. In fact, a report by Bain & Company2 found that Gen Z and Millennials were solely responsible for the growth of the luxury market in 2022 and are estimated to account for 70% of luxury spending by 2025.

As a result, premium brands are increasingly aware of the importance of catering to this trend. However, it’s crucial to acknowledge that these consumers differ significantly from their predecessors. Consequently, the premium brands market is undergoing a radical transformation as it gradually adapts to Gen Z’s and Millennials’ growing spending power and shopping preferences.

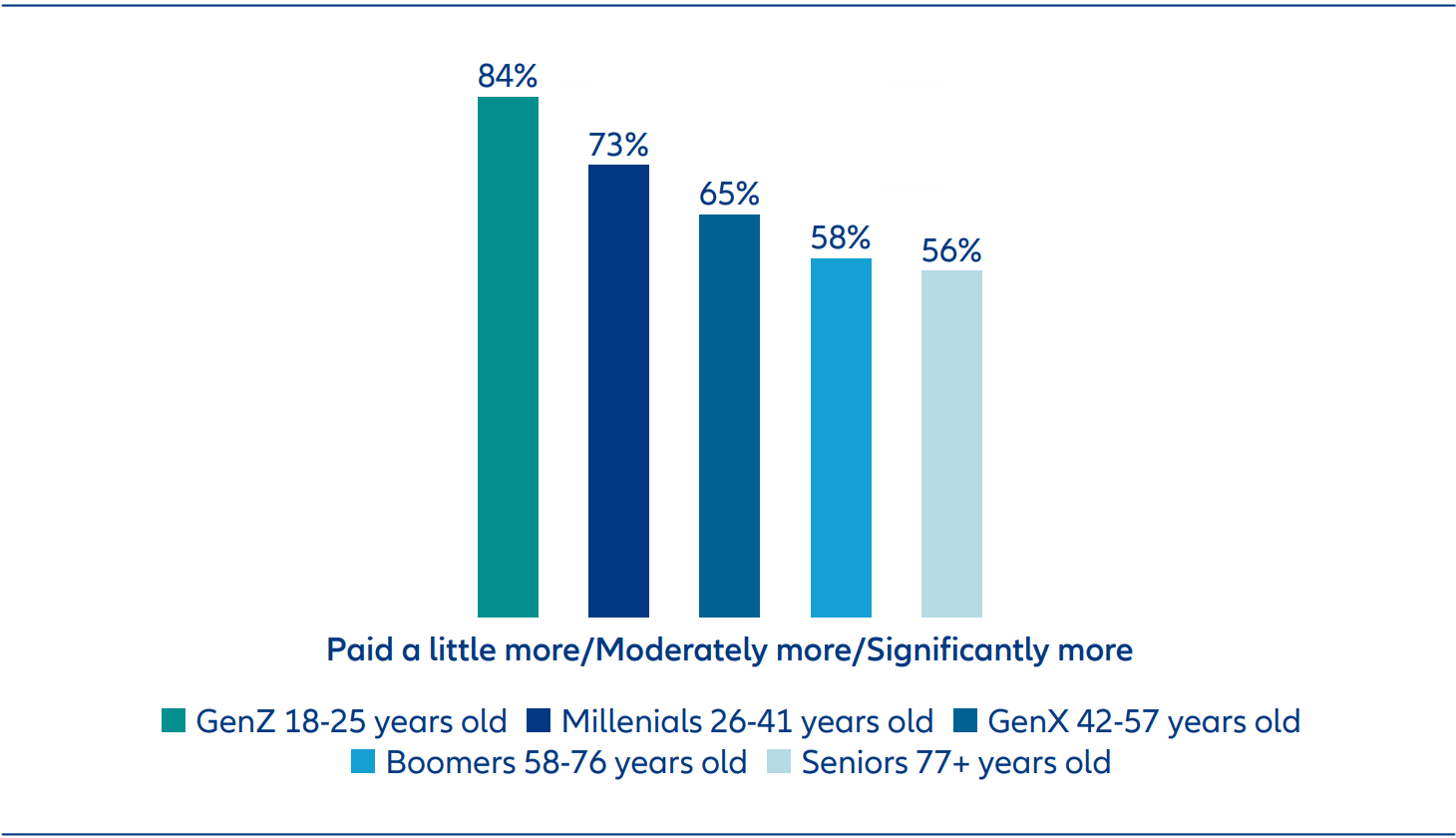

One such way is in the emergence of sustainability as a core focus. Given that 84% of Gen Z consumers are willing to spend more on sustainably produced and ethically sourced products, it is evident that this topic holds significant importance to them and strongly influences their purchasing decisions.

Source: TCS Consumer Retail Survey. US Key Findings report. Data as of January 2023

Luxury companies are rising to the challenge through launching, for instance, wholly sustainable collections that features pieces made from eco-friendly materials, including organic cotton, recycled steel, regenerated polyamide, and ECONYL, a material derived from post-consumer waste such as fishing nets and old carpets.

According to our Grassroots Research®, 10 out of 15 UK high-end multi-brand retailers that carry luxury brands say that there are sustainability initiatives by luxury brands—such as using recycled fabrics, unsold stock or normally discarded offcuts, and packaging with sustainable materials3 .

Embracing digital transformation

From personalised shopping experiences (well beyond mere product suggestions) to data analysis and predicting purchasing behaviour: the integration of artificial intelligence and machine learning in on- and in-store-sales is crucial for premium brands to add a sense of uniqueness to their costumers’ shopping experience and, not least, to embrace the digital nativeness of Gen Z in their advertising and sales strategies. With a generation that social media is so natural to, these platforms have made luxury goods more accessible and visible to their consumers than before, with 78% of Gen Z following high-end brands on their socials4 .

To capitalise on this trend, premium brands will need to leverage their online presence to foster deeper connections and engagement with this tech-savvy audience.

Simultaneously, the increasing importance of online channels is reshaping the premium goods market, challenging the dominance of brickand-mortar stores. Premium brands are now focusing on establishing their own channels, like monobrand stores and online platforms, to enhance brand loyalty and identification. This strategic shift represents a significant growth opportunity as it enables brands to directly connect with consumers, curate unique experiences, and foster a sense of exclusivity and authenticity that aligns with Gen Z’s preferences. Behind the scenes of enhanced shopping experiences, artificial intelligence is fundamentally transforming the entire value chain of manufacturers of premium brands and providers of premium services, deeply affecting distributional operations as well as creative processes, and ranging from time-and money-saving online- and in-store-designs to virtual try-ons and entirely AI-generated campaigns.

Expanding middle classes and premium brands’ global reach

The global expansion of the middle class, driven by economic growth and improved living standards, is proving advantageous for the premium industry. With more consumers possessing increased purchasing power, the demand for exclusive goods and services is on the rise across various regions and markets. Notably, the rapid growth of the middle class in Asia, particularly in India and China, presents significant opportunities for premium brands to thrive in these markets.

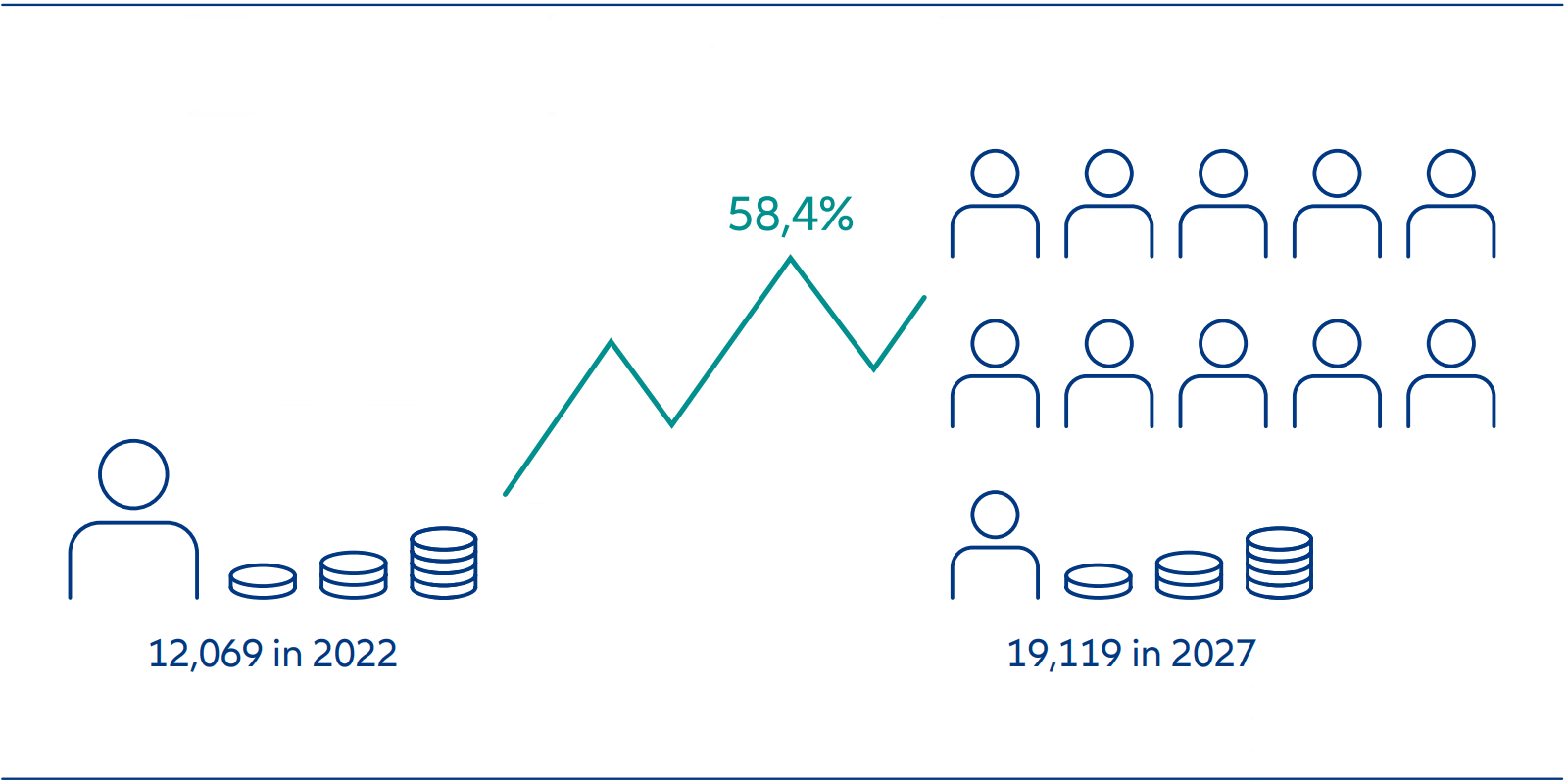

India’s middle class is undergoing impressive economic growth, estimated at a rate of 7%, and is expected to achieve a GDP of USD 26 trillion by 2047, according to EY5 . In addition, the country has seen a significant surge in the number of Ultra High Net Worth Individuals (UHNWIs, with a net worth of more than USD 30 million). In fact, the number of ultra-rich individuals has grown by 11 times over the last decade, positioning India as the thirdlargest billionaire population globally, trailing only the US and China.6 This UHNWI upward trend will continue unabated as recent estimates show.7

Number of UHNWIs in India

Unsurprisingly, premium brands are increasingly directing their focus towards the sub-continent, recognizing the immense potential in tapping into the growing aspirations and purchasing power of India’s flourishing middle and upper classes. Projections suggest that in 2023, the country’s premium goods market will account for a value of USD 8.5 billion, more than a tripling of the USD 2.5 billion reached in 2021.8

In Asia, the Chinese consumer is set to wield considerable influence in the global luxury market, representing a substantial 38% of luxury purchases and accounting for a staggering 60% of total spending growth on personal luxury goods.

This impressing purchasing power is even set to gain momentum as findings of our Grassroots Research® show9 :

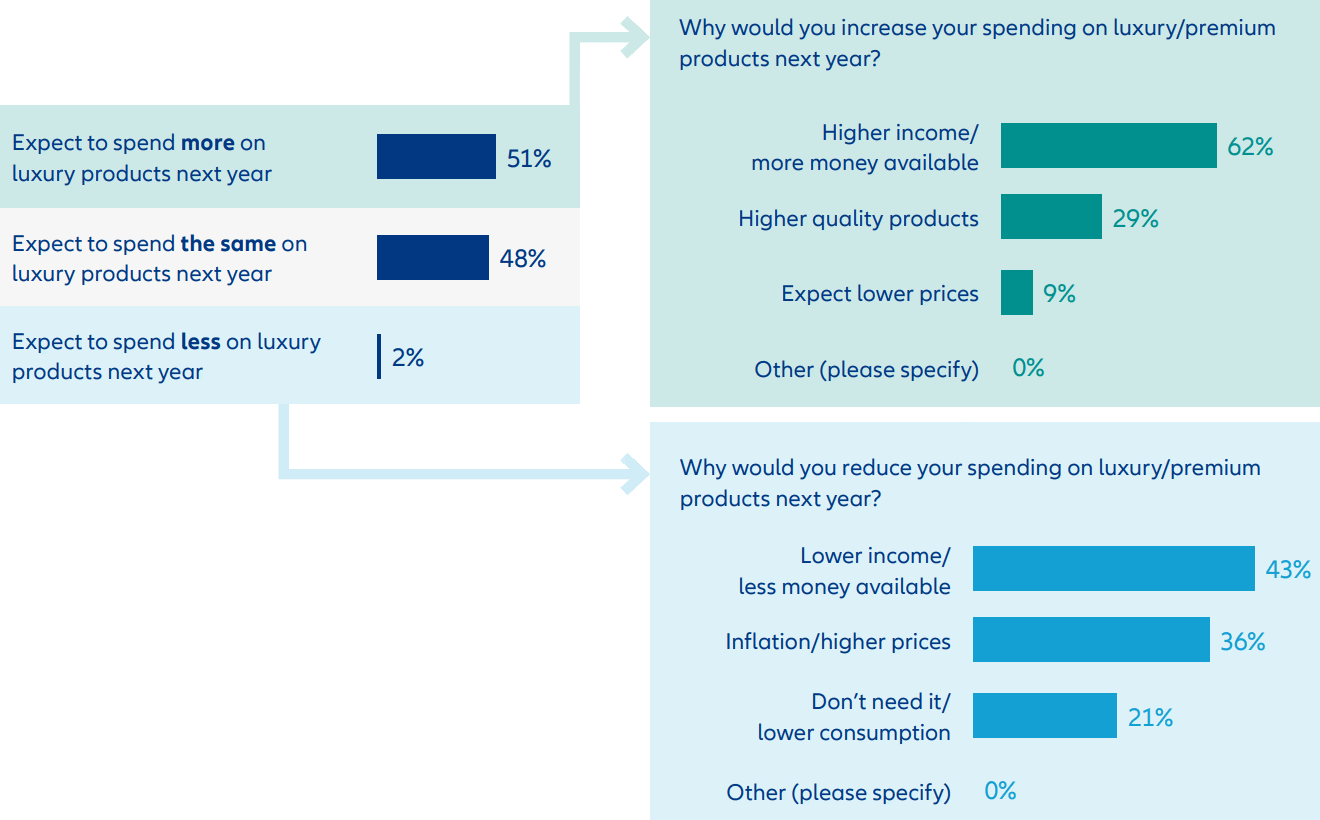

Going forward, how do you expect to spend on luxury/premium products (including all spending categories) next year?

Source: AllianzGI/Grassroots Research®, September 2023

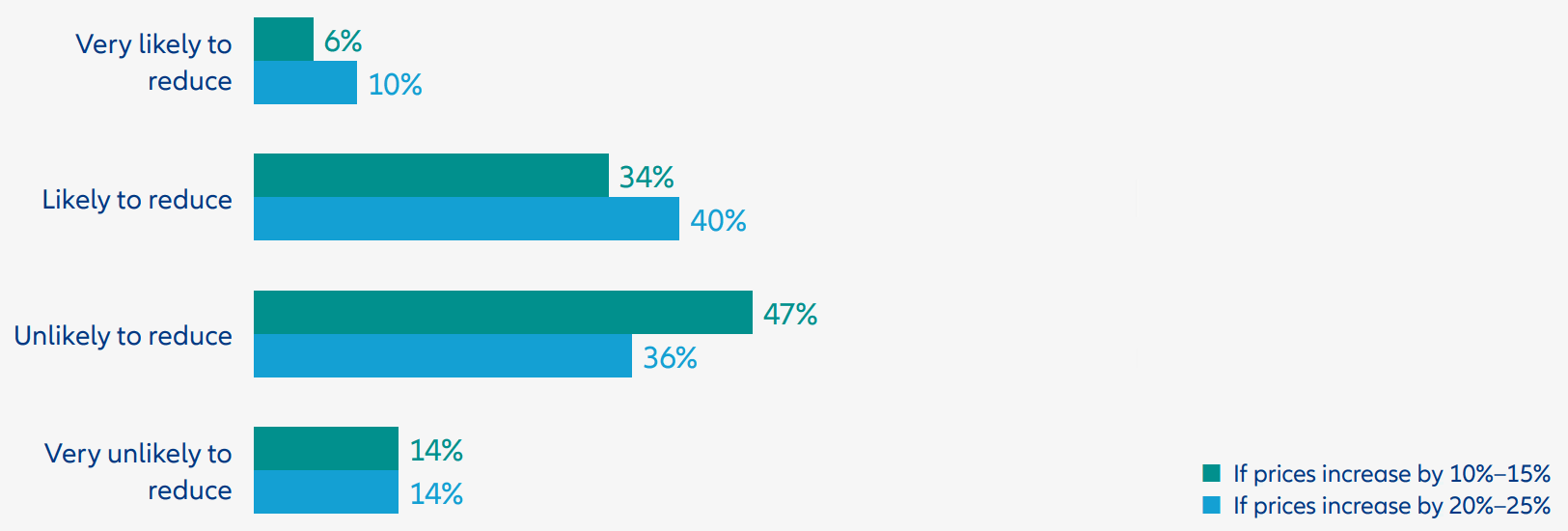

Even higher prices would only marginally affect Chinese consumers’ future spending intentions for premium products10 :

Assuming high inflation and increasing prices for your favorite luxury/premium segment products:

Would you reduce your spending on those items, if prices increase by 10%–15%? By 20%–25%?

Source: AllianzGI/Grassroots Research®, September 2023

While China is still in recovery mode following the pandemic, the surging upper and middle class in other countries in the region is generating increased attention from premium goods companies. Southeast Asian countries, boasting the third-largest workforce globally after India and China, are paving the way for a broader class of mid- and highincome consumers. This shift is evident in the strong performance of the Asian luxury goods market (excluding China and Japan), which experienced an impressive surge of 43% in 2022 reflecting changing consumer habits in Thailand and other Southeast Asian countries.11

Enduring premium brand identity for long-term value

The luxury industry presents a compelling investment opportunity, not only due to its favourable growth profile but also from the resilience luxury companies have demonstrated in the face of economic challenges. The luxury sector’s appeal to investors is further enhanced by the desirability of its high-quality goods, which also serve as a valuable inflation hedge, offering stability and potential for long-term value generation.

Some of the most famous premium brands in the world have been around for over a century and continue to be highly revered. Their ability to reinvent themselves and adapt to changing markets has helped them to maintain their timeless appeal. These brands consistently appear on Interbrand’s prestigious Best Global Brands list12, which features the 100 most valuable brands each year. What’s even more impressive is that eight premium brands have held their place in the ranking for the past 20 years, since 2002. This remarkable achievement speaks to the unwavering strength and lasting impact of these brands on the luxury industry, solidifying their status as reliable investments and enduring value.

1 Giorgia Gili: The elasticity of demand in the luxury market and Gucci’s case study. Libera Università Internazionale degli Studi Sociali. As of 2018/2019

2 Bain.com: Renaissance in Uncertainty: Luxury Builds on Its Rebound January 17, 2023

3 AllianzGI/Grassroots Research®, September 2023

4 VI3.com: Don’t Sleep on Gen Z: How Luxury is Attracting the New Consumer. As of June 2022

5 Ernst & Young: EY projects India to become a USD 26 trillion economy by 2047 with a six-fold increase in per capita income to USD 15,000. As of January 2023

6 Outlookindia.com: India 3rd In Billionaire Population Globally; Number of Ultra HNIs Up 11%. As of March 2022

7 Knight Frank: The Wealth Report. March 2023

8 CNBC.com: India’s luxury market set to soar to USD 200 billion by 2030. As of May 2023

9 AllianzGI/Grassroots Research®, September 2023

10 AllianzGI/Grassroots Research®, September 2023

11 Bain.com: Global luxury goods market accelerated after record 2022 and is set for further growth, despite slowing momentum on economic

warning signs. As of June 2023

12 Interbrand.com: Best Global Brands 2022 As of November 2022

3244014