European Equities Outlook Q1 2025

Looking forward after a good performance in 2024 amid a difficult environment

In 2024, European equities posted a second consecutive year of strong performance despite several significant headwinds. Indeed, an unsteady political environment, a weaker than expected recovery in China, and the ongoing interest rate rollercoaster all presented issues for European corporates. So how did we end up with a positive performance? Several factors lie behind this. First, undemanding valuations at the start of the year allowed some room for rerating on the back of easing concerns regarding recession and a possible hard landing. Second, earnings growth has been resilient in most sectors and disappointments quite isolated . And third, dividend payouts have remained very attractive – around 3.5% in 2024 for MSCI Europe.

Key outlook takeaways

- Economy: business as usual, unfortunately. We expected low growth in most major European economies, but corporates will benefit from growth outside Europe.

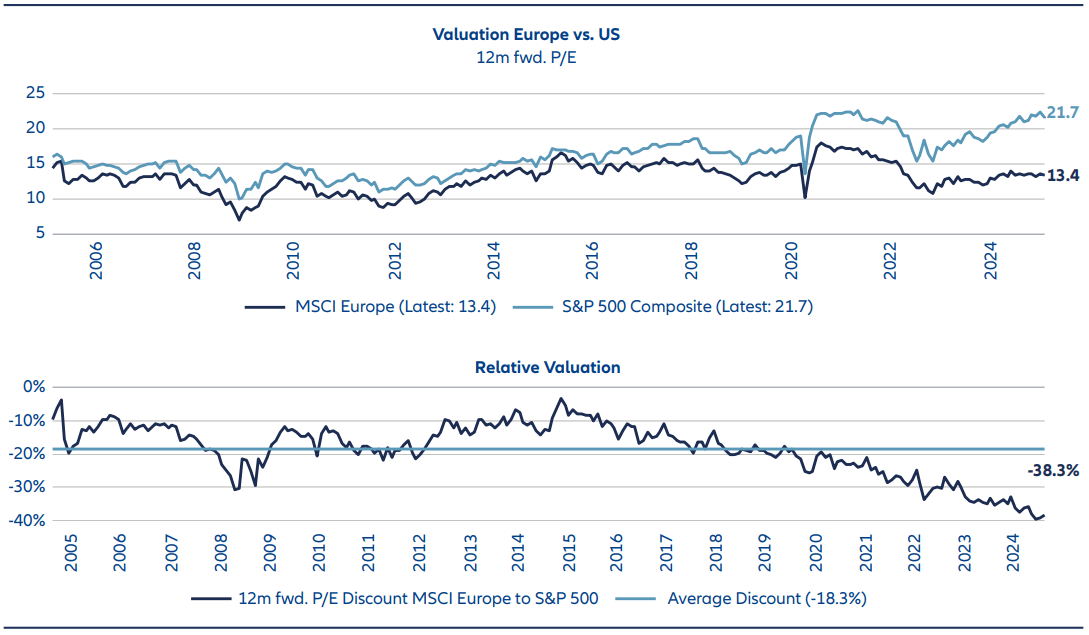

- Undemanding valuations: any stronger economic recovery is, at these valuations, more a “free option”.

- Political environment: clear risks, but also opportunities.

- Earnings: we expect growth again in 2025, though from lower than anticipated levels, and supported by a weak euro.

- Sectors: observing whether cyclicals keep outperforming will be crucial, and maintaining diversification to improve risk/reward key.

So, given the context, European equities performed well – with MSCI Europe posting a net return of 8.6% for year – though less favorably than US markets where, for instance, the S&P 500 returned around 25% in 2024.

Looking back

Looking back at 2024, we can make severable notable observations regarding European equities. Once again – for the fourth consecutive year – small caps outperformed large caps, while “growth” underperformed “value” due to a strong performance from financials and telecommunications Higher longer term interest rates and the underperformance of European tech also contributed to growth underperformance.

Country specific factors also played an outsized role in 2024 with, for example, French stocks suffering from domestic political travails and instability – as well as the luxury sector coming under pressure – while Spain and Italy benefited form the ongoing recovery of the Southern European banking sector. In Germany, we saw a strong stock market performance, largely thanks to several key corporates posting stellar returns – SAP was up 72% for the year, alone making up 41% of the DAX’s 2024 performance. Switzerland underperformed its European peers somewhat – the index heavyweight Nestlé posting disappointing organic growth, as well as two negative earnings revisions, was a key contributor here.

Sector focus

As mentioned above, the luxury sector – often a standout European performer – has come under pressure, driven in large part by falling sales in China. Indeed, industry bellwether LVMH recorded a 3% sales decline in Q3 2024.

This was its weakest quarter since the financial crisis (excluding the pandemic), though there is some expectation that we are now close to the bottom of the cycle.

Banks across Europe benefited from high interest margins, better than expected loan losses, as well as efforts to consolidate the sector, especially in Italy. Staying with financials, insurance also posted strong profits, and the longer-term prospects for the life segment are also improving thanks to the changing interest rate environment. This is also helpful for general insurers, who benefit from a positive spread between declining claims inflation and price increases due to previous inflationary trends.

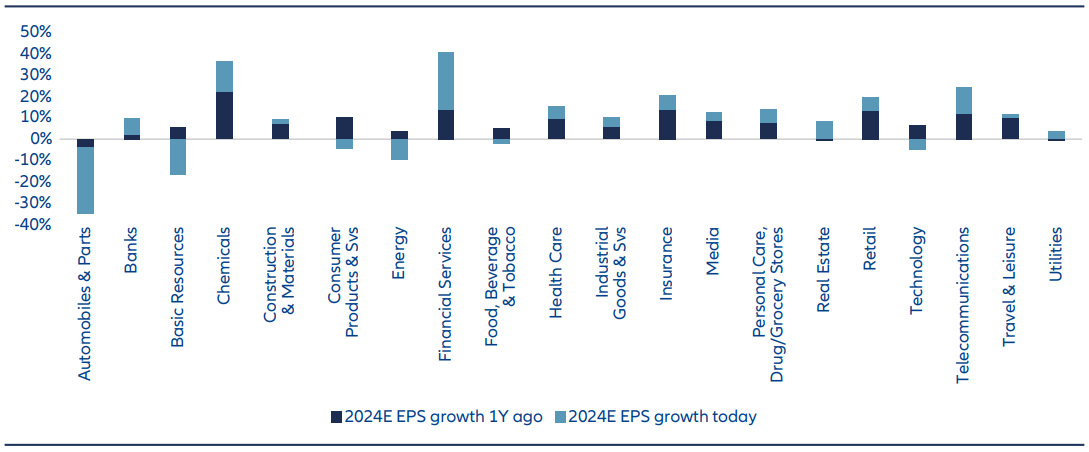

Turning to industrials, weak economic growth in Europe and weak demand from China combined to present significant headwinds. However, irrespective of this cyclicality, several European industrial champions have continued to benefit from secular trends such as electrification, data center proliferation, and the digitalization of industrial value chains. Chemicals delivered double-digit earnings growth – but only thanks to very weak results in 2023 where earnings dropped by around 40%. And European tech suffered an usual year, with the positive expectations of one year ago turning into negative earnings growth, mainly driven by difficulties in the semiconductor/equipment space.

Overall, most European sectors posted earnings growth in 2024. However, one clear negative outlier was automotive with all major manufacturers issuing profit warnings. Of course, this is a sector currently in a state of flux due to the transition to electric vehicles and the effect of strong new competition from Chinese players.

Chart 1: European sectors: 2024 EPS growth (yoy) versus last year’s expectations

Source: Bloomberg as of January 2025

Outlook

Taking a broad view, the key European economies will unfortunately continue to post lackluster growth in 2025, despite some corporates benefiting from better fundamentals outside of Europe. Indeed, current consensus points towards average eurozone GDP growth of around 1%, but with even lower expectations for the major economies and the risks being more to the downside – recent manufacturing PMIs remain weak (German 42.5, France 41.9) and some patience will be required before we can see improvements. While potential tariffs also present a further risk factor, some support should come from further ECB rate cuts.

Of course, the political environment – both within Europe and outside – will weigh heavy on potential outcomes in 2025. While possible tariffs have, so far, dominated discussions around the effect of the second Trump Presidency, the impact will go well beyond this. For instance, many European corporates have sizeable US businesses with local production and/or localized services. These entities may benefit from lower corporate taxes. Furthermore, European corporates might benefit in a relative perspective if new US tariffs are focused on Chinese imports. And the impact of various proposed policies – such as tariffs and immigration – on inflation and the US fiscal deficit is yet to be seen. In this respect, the positive impact the election result had on US stock markets may revert at some point during the coming months.

Closer to home, we are still seeing some fallout from the recent political turbulence in France – French government spreads remain elevated compared to Germany at around 80bps on 10-year debt. While, from the perspective of equity markets, current spread levels are manageable, the elevated debt position combined with the expected fiscal deficit will remain something to be aware of. In Germany, the situation is different – the economy remains very well positioned from the perspective of “balance sheet capacity”, with around 63% debt-to-GDP ratio at end of 2024, but still lacks growth and some key sectors such as automotive face structural challenges.

Yet European political events also present opportunities, as well as risks. Current polls suggest the upcoming German election will probably lead to a more businessfriendly coalition – led by the conservative CDU and with Friedrich Merz as the new chancellor. However, it is far less clear which party or parties will join a potential coalition, and even whether the liberal FDP will remain in parliament at all. Key here will be looking to ease the strict German policy on fiscal deficits in a way that fosters innovation, supports education and training, and improves infrastructure.

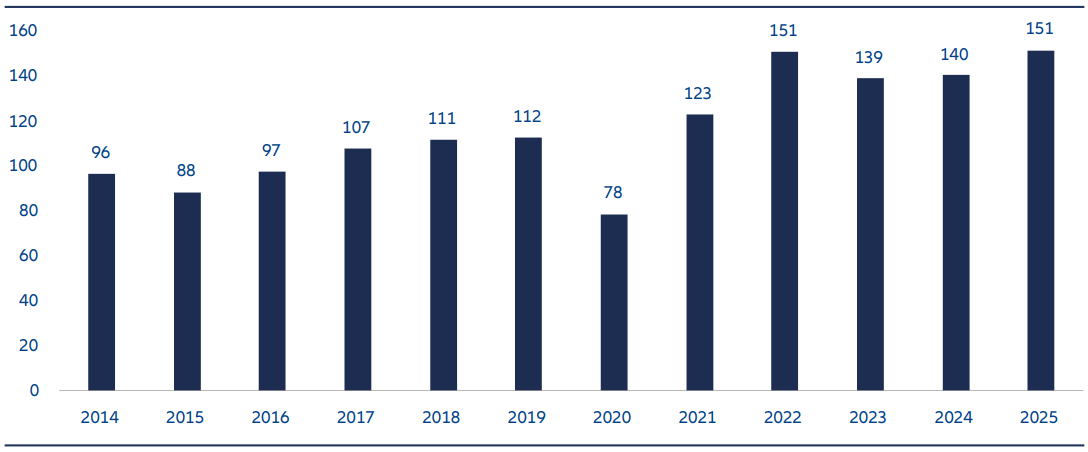

In terms of earnings, we expect a return to growth, though from lower than anticipated levels due to negative revisions in Q4 2024, while also being supported by a weak euro. Indeed, while earnings growth in 2024 was lackluster – especially compared to the US – profits have stabilized at healthy levels. And given sizable businesses outside the eurozone for many key players, a weaker euro should also contribute to earnings growth.

Having risen in the first half of 2024, but fallen in the second half, we note a recent, albeit still modest pick-up in 12-month forward earnings.

Chart 2: MSCI Europe earnings per share

Source: Bloomberg as of January 2025

While earnings growth in Europe in 2025 is likely to be relatively broad-based, there are several sectors that may be poised to deliver above average results. For instance, we expect the tech sector to return to double digit growth after a lackluster 2024 as AI-related capital expenditure continues and demand for non-AI semiconductors continues to recover. Industrial goods will continue to benefit from structural trends such as electrification, while we expect European pharmaceuticals to benefit from both highly successful drugs and a stronger USD.

In consumer-related sectors, more caution regarding a return to strong growth is required as, the substantial prices increases of recent years continue to be digested and, further afield, a meaningful improvement in consumer sentiment in China is awaited – something that is key to the European luxury sector. Meanwhile, earnings growth for European banks will be more subdued after a healthy few years driven by net interest margins.

The strong outperformance of cyclicals we have seen in the clear risk-on environment since September may continue in the near term, but we expect a more balanced performance for the rest of the year as new policy announcements from the incoming administration may lead to greater volatility. However, any significant loosening of fiscal policy in Germany or progress towards peace and reconstruction in Ukraine my lead to continue strength in cyclicals.

Chart 3a: Valuation Europe vs. US and Chart 3b: Relative Valuation

Source: LSEG Datastream as of 16 January 2025

Conclusion

After a strong 2024 for global and European equity markets, we also expect positive returns for 2025. Indeed, while we should not ignore the risk factors discussed above, there is also potential key upside risks for European equities. For instance, Chinese stimulus could be bolder than expected, a worst-case scenario of high and broad-based US Tariffs might be avoided, and an end to the war in Ukraine may be on the horizon. And the outcome of the German elections may result in and fiscal stimulus leading to re-ignited economic growth.

Overall, European equity markets remain well diversified and, at current valuation levels, offer an attractive balance of risk and reward, as well as a diversification benefit compared to more concentrated US stock markets. Indeed, European valuations continue to look undemanding, and the discount to the US has further increased – while this is clearly influenced by sector composition, we are also observing strong European companies trading at significant valuation discounts compared to similar US peers.

4209584