Navigating Rates

Dispelling myths in emerging market debt

Improvements in fiscal competence and policymaking are transforming perceptions of emerging market debt.

Key takeaways

- Emerging market debt is a large, diversified asset class that has delivered strong performance thanks to big improvements in policy and governance.

- In our view, negative perceptions of the asset class – ie, that it is “too risky” – are outdated.

- We argue emerging market debt should be a strategic allocation in portfolios because of its potential to provide diversified alpha and compelling risk-adjusted returns.

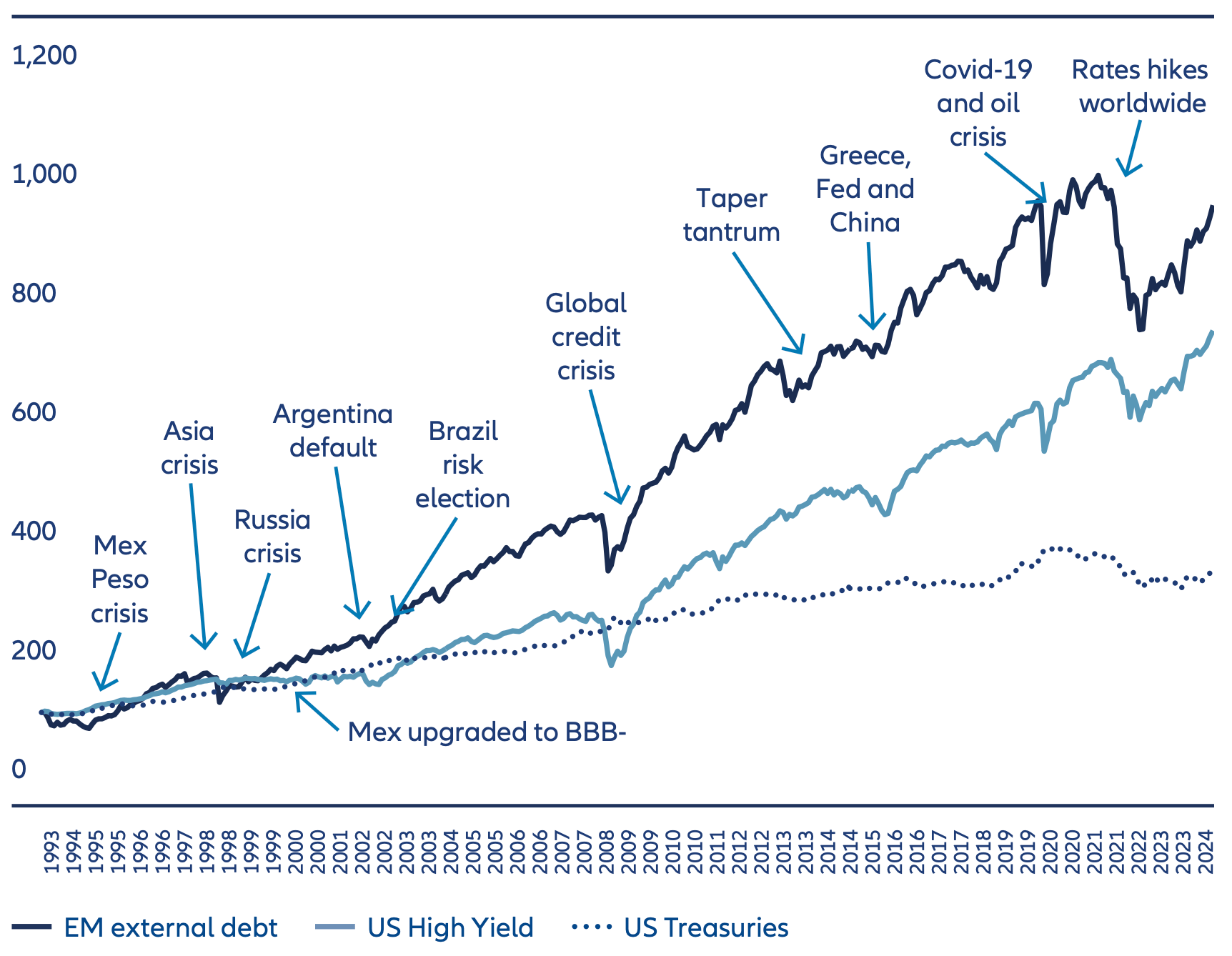

Emerging market debt has its origins in the 1990s, when defaulted sovereign bank loans were restructured into tradable hard currency (US dollar) bonds known as Brady bonds. The asset class has grown hugely since then – many more issuers have come to market and total assets have boomed (see Exhibit 1). Yet some negative attitudes formed in the early days of the asset class have proved persistent, even though they no longer reflect reality. In this article, we will puncture some of the myths about emerging market debt.

Myth I: Emerging market debt is suitable only for a few specialised investors

Emerging market debt is sometimes considered a niche asset class that is appropriate only for a limited set of investors with a high risk tolerance. The perception is that liquidity is low and credit events frequent in this space. For those who hold this view, it is no wonder that emerging market debt accounts for a small or non-existent allocation in many portfolios.

Reality: Emerging market debt is a large and well-diversified asset class

Emerging market debt has undergone a remarkable transformation over the last 30 years. Today, emerging market hard currency bond issuers span over 70 countries and include a wide array of opportunities across geographies and credit profiles (Exhibit 1).The landscape of emerging market local currency opportunities has also developed significantly, with the number of countries in the main reference index – the JPMorgan GBI-EM Global Diversified index – growing from 11 in the early 2000s to 19 today. Indeed, most emerging market issuance is now in local currency, reflecting growing and deepening domestic debt markets. With local dynamics taking on more importance, local currency opportunities have become a richer source of investment outperformance, or alpha. This evolution underscores what we see as the maturity and relevance of the asset class as a core component of global fixed income.

Exhibit 1: Emerging market debt has grown into a deep and diversified asset class

Myth II: Emerging market debt involves too much risk for too little return

For some investors, emerging market debt calls to mind high-profile defaults and financial crises, such as Argentina’s sovereign default in December 2001 or the Mexican peso crisis of December 1994. These events shape a perception that the asset class is inherently risky and unsuitable to deliver attractive risk-adjusted returns.

Reality: Emerging market debt has delivered strong risk-adjusted performance

Returns on emerging market debt have outperformed both US high yield bonds and US Treasuries over the past 30 years (Exhibit 2). Over this period, many emerging market countries have strengthened their institutions, adopted more prudent fiscal policies and built robust foreign exchange reserves, making them more resilient to shocks. As it has grown, the asset class has become more diversified, which can help to reduce contagion risk – if crises occur, they do not necessarily impact the entire asset class. With active management and thorough sovereign and credit analysis, we believe emerging market debt can offer attractive risk-adjusted returns and diversification benefits within a global portfolio.

Exhibit 2: Emerging markets have outperformed core fixed income over the last 30 years

Note: Total Return of J.P. Morgan EMBI Global Diversified Composite Index (JPEIDIVR Index), ICE BofA US Cash Pay High Yield Index and ICE BofA US Treasury Index, for a $100 Original Investment since 1993. EM External Debt: JPEIDIVR Index, US High Yield: J0A0 Index, US Treasuries: G0Q0 Index. Source: BofA Global Research, Bloomberg, J.P. Morgan EMBI Global Diversified Composite Index, ICE Data indices, LLC. Data as of 31 December 2024. Past performance does not predict future returns.

Myth III: Emerging market countries are poor at policymaking

Emerging market governments have often been viewed as laggards in policymaking. They are seen to be grappling with governance challenges and institutional instability that far exceeds what is found in developed markets. This perception has historically deterred some investors, who view emerging market sovereign issuers as inherently unstable and unpredictable.

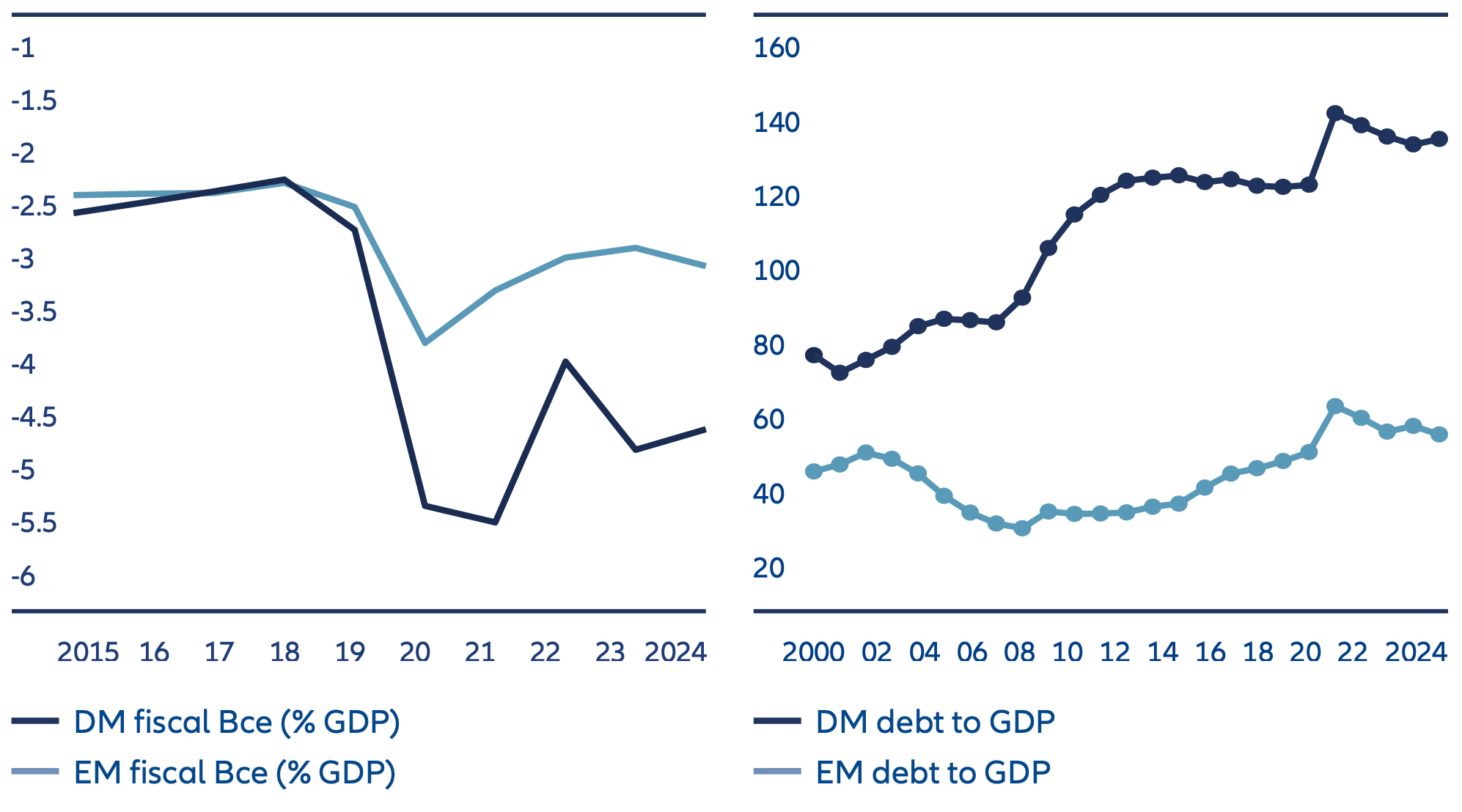

Reality: Emerging markets are increasingly fiscally competent and economically healthy

Emerging markets have come a long way. Indeed, many of them enjoy better fiscal positions than developed markets. During the Covid-19 crisis, several emerging market central banks acted decisively by raising interest rates early to combat inflation. This allowed them to cut interest rates ahead of developed markets, having built up a “cushion” of real inflation-adjusted rates that allowed them to support economic growth while preserving financial stability. The economic health of emerging markets is indicated by their fiscal deficits and debt-to-GDP ratios, both of which are preferable to those of developed markets (Exhibit 3). In addition, emerging market economies are growing faster than developed markets, and the gap seems to have increased in recent years. Far from slowing down, we believe that emerging markets may be accelerating faster than their developed market peers.

Exhibit 3: Emerging market sovereigns have lower fiscal deficits and debt ratios than developed markets

Source: Allianz Global Investors, IMF World Economic Outlook (WEO), as of January 2025. Note for right-hand side chart: emerging market (EM) and developed market (DM) debt as % of GDP. Based on WEO data with JP Morgan EMBIG weights for the EM average and simple average for DMs of US, UK, Eurozone and Japan.

We think it is time to reevaluate emerging market debt

Emerging market debt has undergone a profound transformation over the last 30 years, yet perceptions among some investors have not caught up. Early crises and defaults in the 1990s cast a long shadow, but many emerging economies have made great strides in strengthening their policy frameworks and institutional resilience. They have built more diversified economies, deepened their local debt markets and improved communication and relations with international investors. This progress was evident during the Covid-19 crisis, when several emerging markets responded with agility and effectiveness.

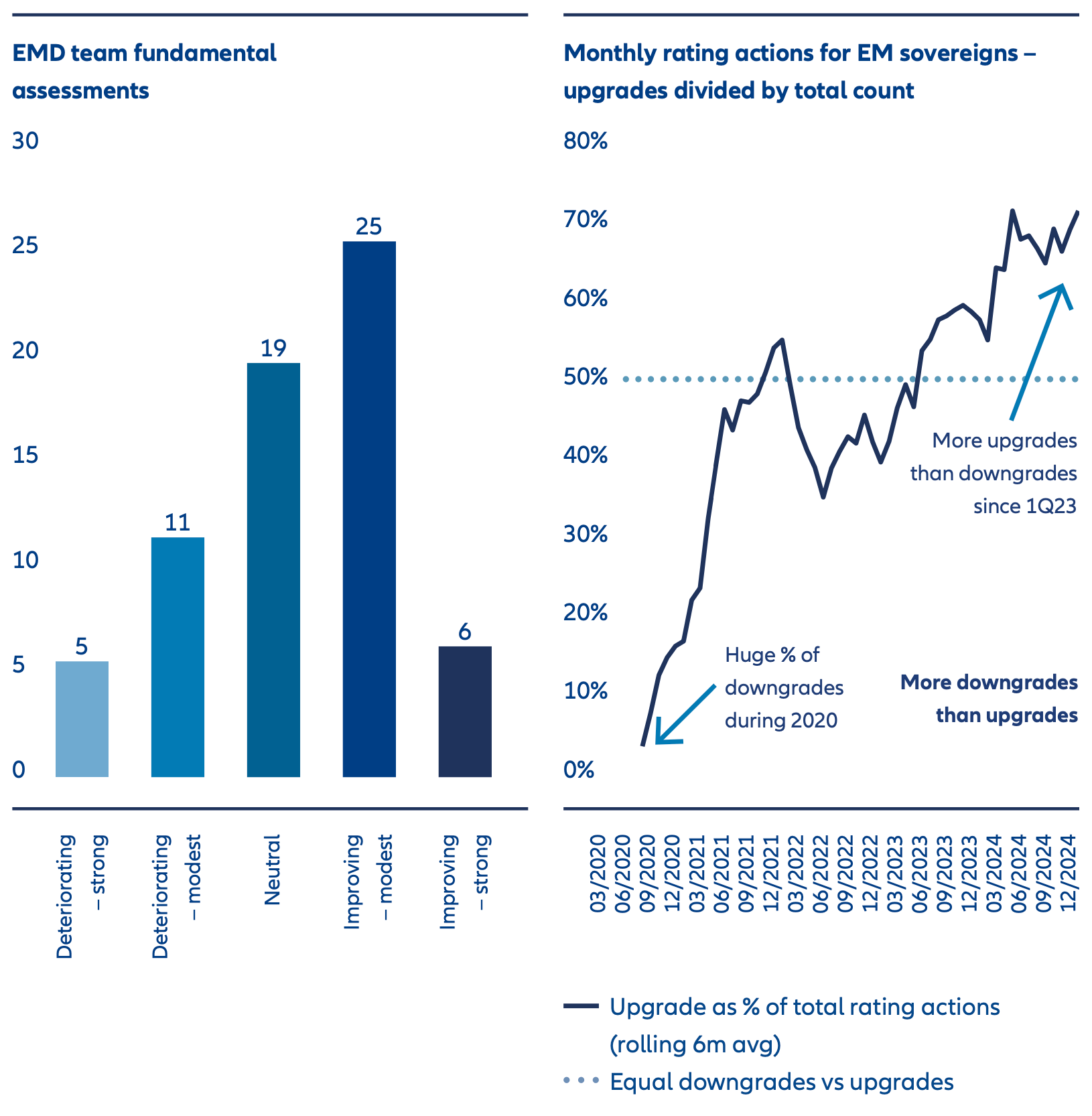

In our opinion, both our macroeconomic analysis and rating agencies’ credit assessments confirm an improvement in emerging market economic fundamentals. Since 2023, emerging markets are more likely to have had their credit ratings upgraded than downgraded (Exhibit 4). The asset class – as captured in the JP Morgan EMBIGD Index – is now, on average, rated investment grade, which provides another source of support.

We expect more investors will turn to this asset class, which we argue should be a strategic component of any asset allocation because of its potential to provide diversified alpha and compelling risk-adjusted returns.

Exhibit 4: Emerging markets’ credit profiles are improving

Source: Allianz Global Investors, Bank of America Research as of January 2025.

1Source: Allianz Global Investors, IMF World Economic Outlook, as at April 2025.

4795725