Navigating Rates

Where are the new centres of gravity in markets?

Amid market volatility and uncertainty, our view is that investors should stay invested and look for new sources of diversification, including within UK and Japanese equities and European bonds.

Key takeaways

- Donald Trump’s approach has uprooted the perceived stability of the US and its financial assets, leaving many investors wondering where to invest.

- Uncertainty is high but so far equity market moves are in line with previous market corrections and even after the biggest market selloffs, the subsequent recovery has been strong.

- Within our multi asset portfolios, we have diversified more of our equity investments to outside the US and see openings in other asset classes: staying diversified may offer the best chance of positioning for further twists in market conditions.

More than 100 days into Donald Trump’s second term as US president, many investors will feel his actions have turned financial markets upside down.

From sky-high tariffs against China to criticism of the US Federal Reserve (Fed) Chairman, Mr Trump’s approach has uprooted the perceived stability of the US and its financial assets. US equities, the US dollar and US Treasuries have all been buffeted by volatility in recent weeks, and many investors are asking where to invest now.

Within our multi asset portfolios, we have diversified more of our equity investments from the US to the rest of the world. Recent volatility has demonstrated the risks inherent in the highly concentrated US stock market, where 10 companies account for around half of the large-cap stock market risk.

Four reasons to stay put

But we think it may be a mistake for investors to reduce exposure to markets altogether. We see four reasons why investors should remain invested:

- Market moves so far are not out of the ordinary: while it may take time for markets to become calmer, the encouraging news is that the current moves we’re seeing in equities are in line with previous market corrections.

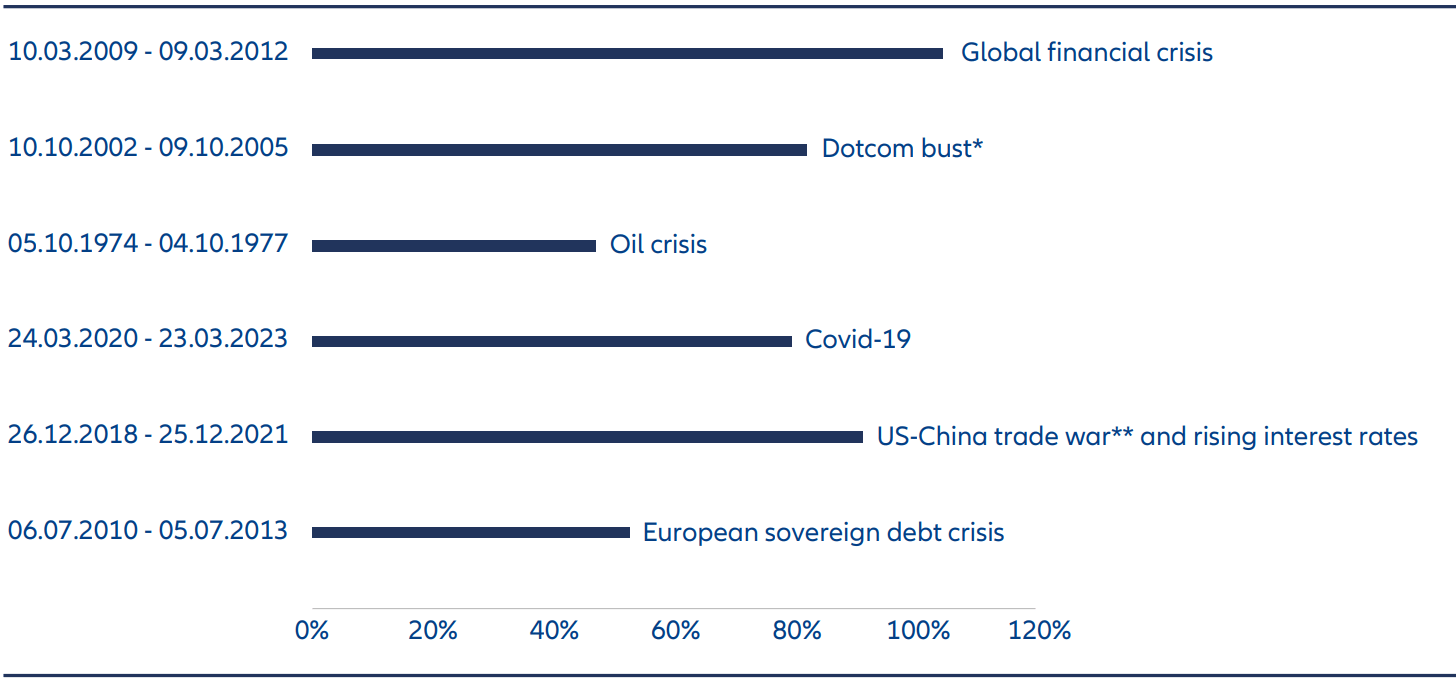

- A recovery may be in sight: it is worth remembering that even after the biggest selloffs in markets, the subsequent recovery has been strong (see Exhibit 1). For example, after the 2009 global financial crisis, global equity markets delivered a cumulative return over the following three years of more than 100%.

- Exiting markets may pose inflation risks: staying on the sidelines may seem a wise approach when markets are choppy but beware the dangers of inflation. With inflation currently higher-than-average (with the risk of more to come), money left on the sidelines may lose its purchasing power.

- Rebuild and reposition: a more prudent long-term approach in the current environment may be to rebuild and reposition portfolio exposures. Fairervalued opportunities within equities and fixed income may emerge that investors might have overlooked in the past due to their cost.

Exhibit 1: Past periods of significant equity market selloffs have been followed by strong recoveries

*The dotcom bubble is generally considered to have started in 1995 and peaked in 2000, before internet stock prices fell, hitting the bottom in October 2002.

**Refers to the trade war started in 2018 during Donald Trump’s first term as US president.

1 MSCI World Total Return Index in USD. The cumulative performance of the three years following a setback (at least -10%) was taken into account for all completed three-year periods.

Source: Allianz Global Investors, Bank for International Settlements. As at 10 April 2025. Past performance does not predict future returns.

Where are the opportunities in a new equilibrium?

The biggest challenge for investors in the coming months may be negotiating a gradual shift in the centre of gravity of markets away from the US.

During the equity market slump in early April, US Treasury yields rose, meaning their price fell. The move spooked many market participants as it ran counter to the historical negative correlation of bonds and equities: when US stocks fall, US government bonds tend to gain, making the latter a potentially safe choice during market turbulence.

More recently, both have risen in tandem. Their recent correlation echoes 2022 when stocks and bonds fell simultaneously amid high inflation – and brings an added challenge to formulating a diversified portfolio.

Against this unpredictable backdrop, some investors are looking to diversify away from the US. So where are the opportunities?

- UK and Japanese equities: having reduced our exposure to the S&P 500 in multi asset portfolios, we are more positive on European markets, with a preference for the UK’s FTSE 100 and Japan’s Topix index. UK and Japanese equities have received a boost from the easing of US tariff plans. Across broader equities, we favour value versus growth stocks, with the former trading at an attractive discount to fair value.

- Japanese yen: with the US dollar under pressure, the Japanese yen has emerged as a strong diversifier in currency markets. With yields on Japanese 10-year government bonds steadily increasing, more of the country’s investors are starting to switch from US Treasuries to Japanese assets, strengthening the yen.

- European bonds: with the recent movement in US Treasury markets, we prefer European bonds. We see the asset class benefiting over the coming months as investors build positions in anticipation of increased government expenditure on defence from 2026 onwards.

- Gold: we also remain positive on gold but are taking a more tactical view. We still like the asset class in the longer term as we see as it as long-time source of value supported by central bank buying and retail demand.

In the months ahead market sentiment will remain guided by further US policy announcements and by data that may offer clues about the health of the economy.

Mr Trump’s ambition to achieve lower interest rates, a weaker dollar and a stronger economy is unrealistic, in our view. But we expect the Trump administration to continue to push for this unlikely trilogy, meaning more pressure may be heaped on Fed Chairman Jay Powell to cut rates.

Risk off – for now

With the prospect of renewed bouts of volatility, it may be prudent to consider a more conservative approach to risk. Difficulty in predicting the Trump administration’s next policy move makes for an unclear outlook, requiring investors to have one foot over the throttle – if the US economy proves more resilient than anticipated – and one foot over the brake – in case a recession materialises.

But as markets begin to settle, and we seek to add risk, we will likely opt for equities over high yield fixed income. In the high yield market, we are adopting a cautious approach because of worries about how easy it would be to exit positions in the event of a recession. We have reduced our exposure to emerging market debt due to liquidity risk and uncertainty over the US economy but are ready to add select positions as the outlook improves for individual countries.

Caution on US equities

A glimmer of light in the months ahead is that Mr Trump may feel the need to secure “wins” by unveiling trade deals, particularly with big trading partners such as China and the European Union. If the trade negotiations can be struck relatively quickly, we would expect a rally in US equities and possibly even fresh record highs for the S&P 500.

But it will take more to reassure us before re-entering US stocks on a selective basis. In addition to progress on trade policy, we would also look for signs of greater institutional stability.

With more volatility ahead, staying diversified may offer investors the best chance of positioning for further twists in market conditions.

4497575