Navigating Rates

Best of both worlds: how combining investment philosophies creates a resilient multi asset portfolio

Many multi asset funds rely on either fundamental or quantitative analysis to determine their investment process. But what if those approaches could be combined, complementing their strengths?

Key takeaways

- At a time of heightened market volatility, multi asset funds can provide a way to spread risk, offering diversification through the investment mix and the overall philosophy of the strategy.

- Many funds tend to favour one of two philosophies: a fundamental approach, which harnesses deep research that often cannot be codified, or quantitative, which uses computer power to process vast data sets.

- But combining both fundamental and quantitative philosophies in a single portfolio – as we do – may offer a more robust and diversified path to meeting investment goals.

Recent market choppiness has prompted some investors to contemplate a reshuffle of their portfolios.

Above all, the volatility has highlighted the value of spreading risk within and across asset classes and geographies.

But what if this kind of diversification could be “baked in” to the investment process?

Multi asset strategies offer an investment approach built around a broad spectrum of assets and thinking, where diversification is achieved not only through the investment mix but also the overall philosophy of the strategy. The philosophy will likely determine how portfolio managers use information when constructing a portfolio and dictate the timing of when these assets are bought and sold.

Many multi asset funds generally favour one of two philosophies. The first is a fundamental approach, which harnesses deep research into securities and other information that often cannot be codified. The second is a quantitative approach, which applies investment ideas in a systematic way and uses computer power to process vast data sets.

But combining both in a single portfolio – as we do (and have done for 20 years) – may offer a more robust and diversified path to meeting investment goals. Let’s look at how we employ both approaches.

Fundamental: broad expertise with conviction at the core

Our fundamental approach relies on the expertise of a broad team of investment professionals, both within the Multi Asset team and from the rest of the firm, to target undervalued opportunities in markets. This will include colleagues specialised in areas such as equities, fixed income and currencies – as well as our internal team of economists – to gain a deep understanding of individual asset classes and the broader economy.

Building a culture of well-founded analysis, debate and – sometimes – disagreement can shape an investment process that is rigorous but also creative and spontaneous, and able to pivot to well-considered convictions.

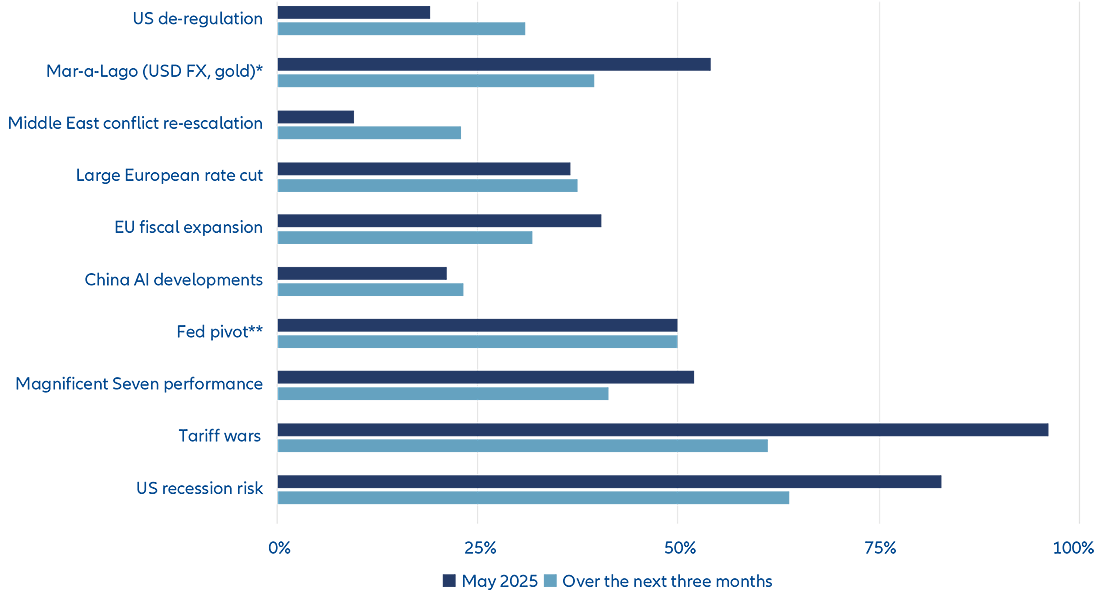

Convictions – having a high degree of confidence in the potential of a particular investment – is a key component of our approach, based on a sound understanding of what is driving markets now and what will likely drive markets in the months ahead (see Exhibit 1).

In our view, the market cycle is the ultimate conviction tool. By understanding where we are in the market cycle, it is possible to anticipate swings in asset prices and therefore know when to be bullish or bearish.

But it is not enough on its own to track the market in this way. Diversification away from the ups and downs of markets is critical, and so we’re also developing ways to develop conviction independent of the market cycle.

Exhibit 1: Market drivers can change over time

* The idea that the US could push countries to accept a weaker dollar and lower interest rates on their US Treasury investments to remain protected by US security.

** The prospect of the US Federal Reserve cutting interest rates.

Source: Allianz Global Investors. Based on a survey of our investment professionals about the impact of current market drivers and the likely impact of market drivers over the next three months. Data as at May 2025.

Going beyond the traditional indicators

Economic growth and inflation data provide valuable insights into where we are in the market cycle – and may offer clues about the future performance of asset classes. But traditional macro indicators may not give an up-to-the-minute picture of the health of the overall economy – and what that means for markets.

We source a wider array of indicators from specialist data providers to provide a more complete picture. These might include internet search data or satellite imagery of vehicles in car parks to gauge consumer behaviour. Such data can offer a snapshot of the economy in real time, in contrast to traditional macroeconomic indicators, which are generally released with a lag.

Similarly, current asset valuations can offer only a partial insight into the market environment. Data on investor sentiment, flows and positioning can give a more comprehensive overview and signal where markets may be headed – and where to invest.

Gathering forecasts from a diverse team

We have a team of portfolio managers who systematically analyse all such data to inform their forecasts on the key stock markets. Ensuring the group is large enough and with a wide range of specialisms – from technical to data analysis skills – helps to minimise bias and create conditions for the most effective forecasting.

Their votes on the expected future performance of 18 markets and indices ranging from the S&P 500 to MSCI China provide can further inform our fundamental team’s investment views.

Quantitative: harnessing data to deliver diversification and conviction

Quantitative analysis is the other pillar of our multi asset investment strategy. While our fundamental approach focuses on analysing companies and the broader economy to uncover value in markets, our quantitative approach leans more heavily on the power of data. Our quantitative team uses advanced mathematical and statistical methods, computer modelling and large data sets to identify profitable investment opportunities and risks.

The philosophy of our quantitative investing approach is:

- Taking conviction positions at scale: the modelling and data analysis at the heart of quantitative investing provide a solid foundation for making investment decisions that deviate from the benchmark, delivering convictions at scale.

- Making diversification easier: quantitative investing enables the analysis of dozens and dozens of markets in parallel – a huge advantage when targeting diversification and risk-adjusted outperformance.

- Keeping human nature in check: by drawing on data-led insights and objective decision-making, quantitative investing can avoid the behavioural biases driving markets and make investments that are sometimes contrary to the prevailing trend – a boon when, for example, markets have misread the macro environment.

A way to deliver diversification and active management at scale

To lock diversification into our multi asset funds, we have developed an allocation tool to ensure each portfolio has an active array of contributors, with no single position dominating.

We see the tool, called the “Optimiser”, as the ultimate expression of our quantitative approach, pooling all the insights from the global multi asset team, including both fundamental and quantitative considerations. Each asset within the Optimiser is given an attractiveness score. The higher the score, the higher the potential weighting in the portfolio.

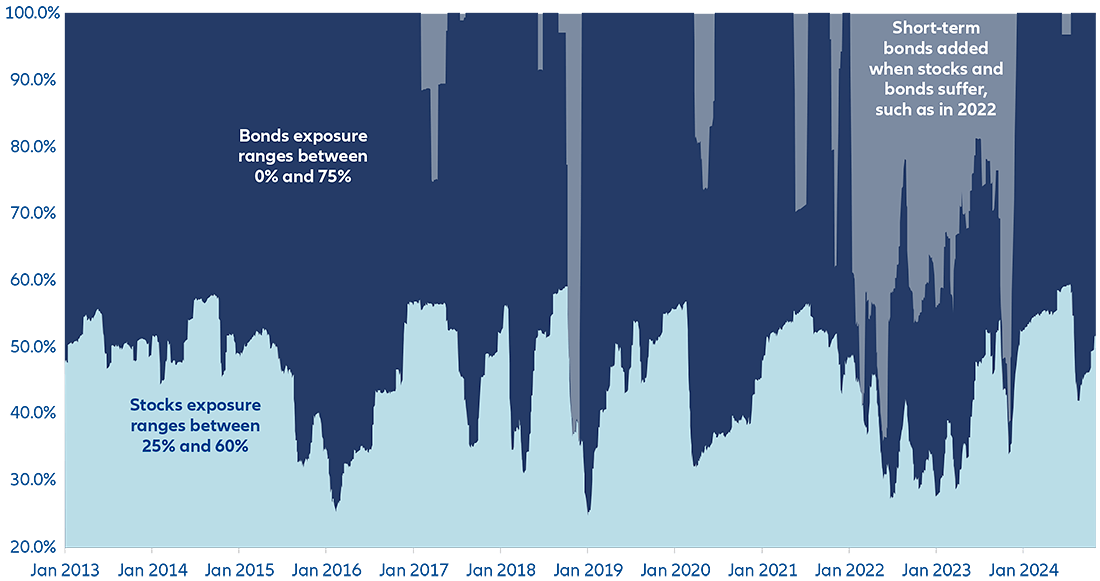

Portfolio managers can use the Optimiser to access all this information and get proposals for asset mix changes across hundreds of funds, making it easier and faster to change asset allocations. The Optimiser helps to ensure our portfolios have the right balance of asset classes as markets change (see Exhibit 2).

Exhibit 2: The balance of asset classes within our portfolios changes as markets shift

Source: Allianz Global Investors. This is for illustrative purposes only.

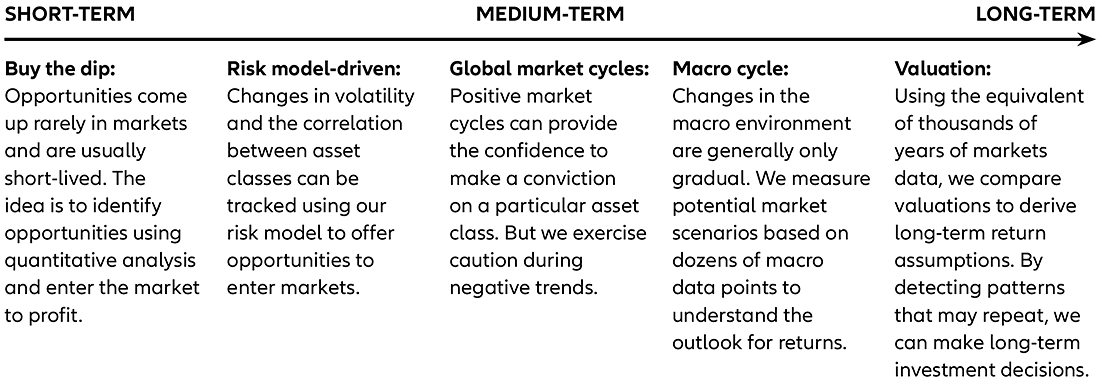

Combining different quantitative approaches – from short-term and opportunistic to long-term and patient

We run various quantitative approaches that complement each other due to their varying time horizons (see Exhibit 3).

Exhibit 3: Our quantitative approaches span different time horizons

Quantitative has delivered

The quantitative investing industry has faced tricky years. Most notably, 2020 proved challenging as the sharp rise in inflation without the commensurate rise in real rates created losses across the industry. But performance since has been strong, aided by a revival in volatility.

And we think it is important to focus on the long-term benefits quantitative investing can offer. Over the past two decades, quantitative investing has outperformed the benchmark each year more often than not.

Team and machine: a two-pronged approach to ride out volatility and thrive across the long-term

We consider fundamental and quantitative signals when constructing each portfolio’s asset allocation. Combined, we think they provide complementary approaches to active management and a powerful source of diversification to ride out periods of volatility and thrive in the long term.

In our view, they can provide the best of both worlds in investment processes: the deep research into securities and the economy of our fundamental team, and the data-driven analysis of investment trends and ideas of our quantitative team.

The divergence between the fundamental and quantitative teams’ processes – including their calls on when to buy and sell assets within portfolios – can also help to manage risk and maximise the potential for alpha generation.

4568099