Embracing Disruption

Financials – a revival amid rate normalisation

Shares of financial services companies have demonstrated remarkable performance in recent years, becoming the main beneficiaries of interest rate normalisation. In 2024, the MSCI Global Financials Index rose 34%, significantly outperforming the Dow Jones Global Index, which rose just 15%. In Europe, banks and insurers were the top two sectors, with high dividend yields coming on top of share price appreciation. After years of underperformance in the era of zero and negative interest rates, European banks have now outperformed the broader markets for four consecutive years. The apparent resurgence of financials and the expectation that interest rates will remain high enough to ensure decent profitability – despite impending cuts in base rates – is creating a sense of renewal and success. This reflects the positive outlook for financials and provides a suitable backdrop for expected growth and performance in the coming years.

Key takeaways

- In 2024, the MSCI Global Financials index surged by 34%, significantly outperforming the Dow Jones Global Index, which rose by only 15%

- In Europe, banks and insurance stocks were the top two sectors in 2024

- Valuation remains attractive with high cash returns to shareholders

- Regulation in US is expected to ease under a Trump administration

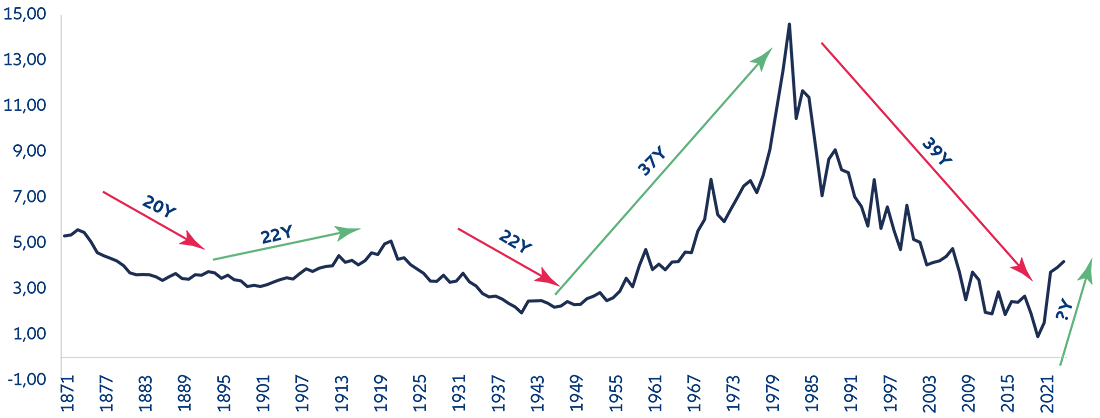

10Y US Government Bond Yield in % since 1871

Source: AllianzGI, 31.12.2024

The phase of zero or even negative interest rates in some regions was painful for most financial companies. Banks were unable to extract profits from their deposit base, which typically has enormous franchise value. Investment banks had subdued rates trading revenues, with industry estimates suggesting that rates normalization is adding 35 billion US-Dollar in trading revenue for global banks. Property & casualty insurers faced lower investment returns while life insurers struggled to meet guarantees to policyholders and had to radically change their product offerings. Furthermore, asset managers faced challenges in selling fixed-income products to the market. There was even a fee holiday on certain money market products as the fee would have otherwise eaten into the principal capital. After the interest rate cycle finally turned in 2022, all these problems began to disappear.

Profits soared, especially for banks. In 2024, central banks started to cut interest rates again, a trend that is likely to continue into 2025. However, no economic forecast predicts a return to the zero-interest rate environment. As long as interest rates remain sufficiently high, say above 2%, most financial services companies should do well. Indeed, lower interest rates could stimulate economic growth and business volumes, such as increased demand for loans or increased capital market activity. In addition, the current flat or even inverted yield curve in many regions could steepen, creating numerous earnings opportunities. Interest rates usually move in multiyear cycles and we have just entered a new one.

Capital markets boomed during the pandemic but came to a standstill in 2022. The number of IPOs and M&A transactions fell sharply, affecting the business of investment banks, alternative asset managers and wealth managers. There were many reasons for the sudden halt, including regulation, geopolitics, economic slowdown and a fall in the stock market, but there are clear signs that the market will rebound in 2025.

The stock market has already bounced, back from the dip in 2022, regulation will be rolled back under a Trump administration and the economy should pick up in most parts of the world. For much of the financial services sector, a more active capital markets environment would be excellent news, although to some extent this is already expected and discounted in share prices.

Regulation

In the aftermath of the Great Financial Crisis of 2008, regulators around the world tightened the rules for financial services providers. The introduction of stricter Basel capital rules for banks, Solvency II and IFRS17 for insurance companies, consumer protection laws and many other pieces of regulation have profoundly changed the business. Most of these rules are now in place and the financial services industry has adapted to them. With the arrival of the Trump administration, some of this regulation may now be rolled back, not only in the US but also in other countries, as governments are trying to create a level playing field for their companies. Most likely, the much tougher capital rules from the “Basel endgame” will not be implemented by the US, and this could be reflected in other parts of the world, particularly in Europe.

Conclusion

While a great deal of uncertainty remains regarding the shape of the global financial landscape over the coming months and years, the environment is likely to be increasingly favourable to financials. Indeed, even if rates prove stickier than anticipated, they remain very much on a downward trajectory. This, coupled with a potentially more advantageous regulatory environment, means investors should certainly keep an eye on this revived and rejuvenated sector.

4284516